Investors can easily identify stocks that have a greater chance of outperforming the market with the help of TipRanks’ Top Smart Score Stocks tool. This tool assigns a score to stocks based on eight different factors, including analyst ratings, technical analysis, and insider activity, among others. It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

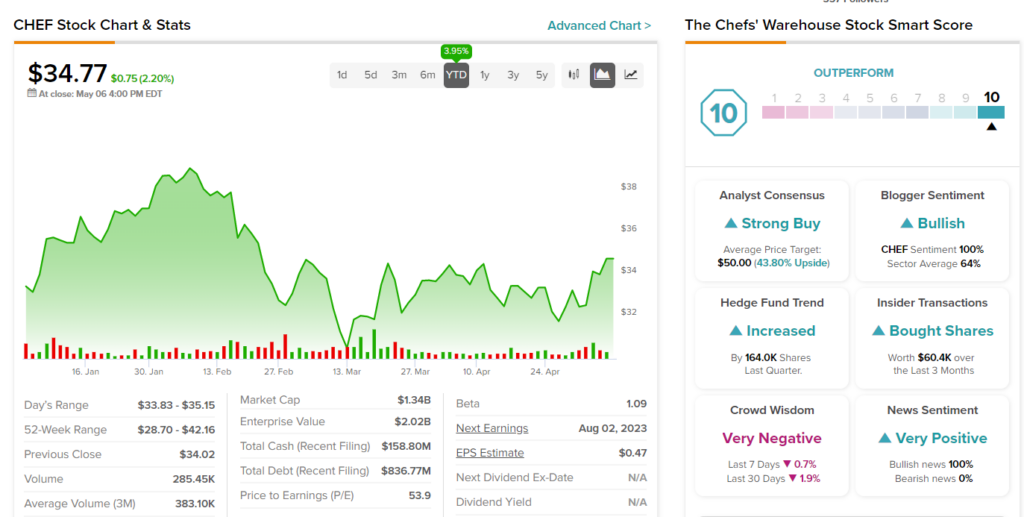

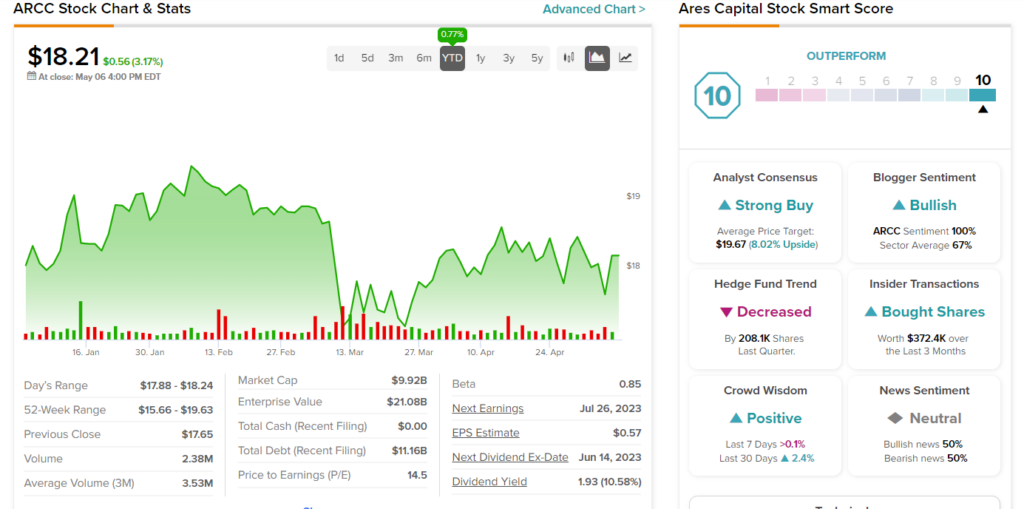

Using this tool, we’ve chosen two stocks that are currently displaying the “Perfect 10” score: The Chefs’ Warehouse (NASDAQ:CHEF) and Ares Capital (NASDAQ:ARCC). Let’s take a closer look at these two companies.

The Chefs’ Warehouse, Inc.

CHEF stock has been added to the Perfect 10 list today. The stock also has a Positive signal from corporate insiders and hedge funds. Our data shows that hedge funds bought about 164K shares of the company in the last quarter. The stock also enjoys Bullish Blogger sentiment and a Positive News Sentiment on TipRanks.

The specialty food products distributor has been growing successfully through acquisitions. On May 1, it announced plans to acquire Hardie’s Fresh Foods and Greenleaf Produce & Specialty Foods, which should boost its product offerings and expand its customer base.

Earlier this month, on May 3, Chefs’ reported better-than-expected first-quarter results. Moreover, based on current business trends, the company guided full-year 2023 revenue in the range of $3.20 billion to $3.30 billion, compared with the consensus estimate of $2.95 billion.

Following the results, five analysts on TipRanks rated CHEF stock a Buy. Among them, BTIG analyst Peter Saleh believes that CHEF is well-positioned to raise its guidance in the upcoming quarter given the company’s solid topline growth. Furthermore, the five-star analyst is of the opinion that the most recent acquisition offers the company opportunities for “operating efficiency, cross-selling, and category (produce) expansion.”

Is CHEF a Good Stock to Buy?

Chefs’ has a Strong Buy consensus rating on TipRanks, based on five unanimous Buy recommendations. The average CHEF stock’s price target of $50 implies 43.8% upside potential from current levels.

Ares Capital Corp.

ARCC made it to the Perfect 10 list today. The stock also has a positive signal from retail investors and insiders. Our data shows that insiders bought ARCC shares worth about $372.4K in the last quarter. The stock also enjoys bullish Blogger sentiment and Neutral News Sentiment on TipRanks.

The business development company’s investment-grade credit rating and strong market presence help instill confidence in the stock. Furthermore, its rock-solid dividend yield of 10.4% is encouraging.

It is worth highlighting that following the company’s Q1 results on April 25, five analysts assigned ARCC stock a Buy rating. Citigroup analyst Arren Cyganovich lowered the price target on Ares Capital to $20 from $22, citing recent market volatility and rising recession fears as key reasons.

Is Ares Capital a Good Buy?

ARCC stock has a Strong Buy consensus rating on TipRanks. This is based on five Buy and one Hold recommendations. The average stock price target of $19.67 implies 8% upside potential.

Ending Thoughts

Investment decisions in these uncertain times can be a daunting task for investors. The highest Smart Score on TipRanks, however, suggests that these stocks could outperform the broad market averages. Additionally, investors can leverage TipRanks’ Experts Center tool to identify top stocks.