With rising recession fears, investors might be searching for tools that can help identify stocks with a chance of outperforming the market. This is where TipRanks’ Top Smart Score Stocks tool comes into play. The tool considers eight different factors, including analyst ratings, technical analysis, and insider activity, among others, and assigns a score to stocks between 1 and 10, with 10 being the best.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Texas Instruments (NASDAQ:TXN) and Advanced Micro Devices (NASDAQ:AMD) are two such stocks that recently landed a “Perfect 10” Smart Score.

Let’s discuss these stocks in detail.

Texas Instruments Incorporated

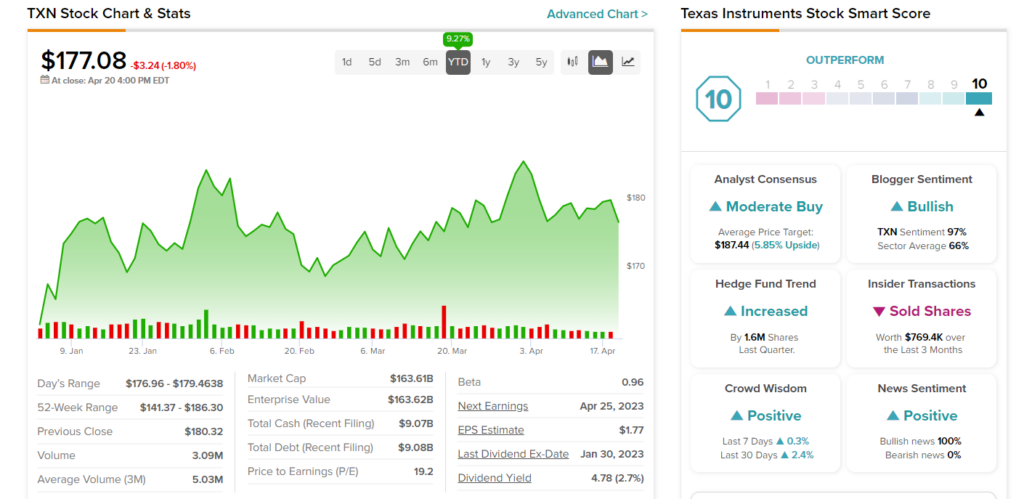

TXN made it to the Perfect 10 list yesterday. TXN stock is up 9.3% so far in 2023.

The stock also has a positive signal from hedge funds. Our data shows that hedge funds bought about 1.6 million shares of the company in the last quarter. The stock also enjoys bullish Blogger sentiment and a Positive News Sentiment on TipRanks. Lastly, an ROE of 62.4% is another positive factor.

The global chip giant benefits from high free cash flow and a low net debt position that support higher distributions. Additionally, it is encouraging to see Texas’ investments in the development of manufacturing capabilities. Also, the rising demand for 300-mm wafers in the automotive and industrial markets should aid in the company’s growth.

Is TXN a Good Stock to Buy?

Texas has a Moderate Buy consensus rating on TipRanks. This is based on seven Buy, eleven Hold, and one Sell recommendations. The average price target of $187.44 implies 5.9% upside potential from current levels.

Advanced Micro Devices

Chip giant Advanced Micro Devices has a top-notch Smart Score of “Perfect 10” on TipRanks. Shares of the company have gained 40.5% year-to-date.

Hedge funds have maintained a positive outlook on AMD stock. Our data shows that hedge funds bought 17.9 million shares of the company in the last quarter. Bloggers are bullish on the stock, while News Sentiment is positive.

AMD is well-positioned to benefit from the improving trends in the artificial intelligence (AI) space. At the same time, the company’s efforts to diversify its business through strategic acquisitions bode well for long-term growth.

What is the Future of AMD?

Analysts are optimistic about the stock. It has a Strong Buy consensus rating based on 19 Buy and six Hold recommendations. Further, the average price target of $98.72 implies 9.8% upside potential.

Ending Thoughts

Investment decisions in these uncertain times can be a daunting task for investors. But one may consider stocks with more upside expected by top Wall Street analysts. AMD and TXN are attractive picks for investors looking for stocks with more room for growth.

Stay abreast of the best that TipRanks’ Smart Score has to offer.