The Federal Open Market Committee’s March meeting minutes, which were published yesterday, stoked fears of a recession. A mild recession is anticipated later in 2023 as a result of the recent banking crisis, according to the officials. Investors may become perplexed about which stock to buy during these uncertain times, which is where the TipRanks Top Smart Score Stocks tool can help.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The tool helps identify stocks with the potential to generate returns higher than the market averages. It assigns each stock a unique score based on several factors. It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Using this tool, we’ve looked up two stocks sporting a perfect score – ArcelorMittal (NYSE:MT) and Telus (NYSE:TU). Year-to-date, both these stocks have outperformed the 6.6% rally in the S&P 500.

Let’s delve deeper into each stock.

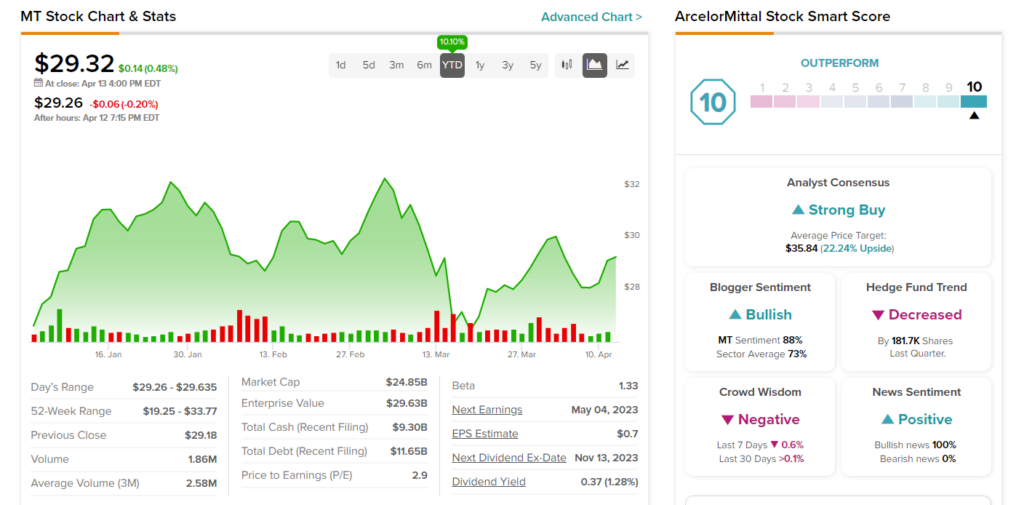

ArcelorMittal

MT stock was added to the Perfect 10 list two days ago. The stock enjoys bullish blogger sentiment and Positive News Sentiment on TipRanks. Lastly, an ROE of 18.4% is another positive factor.

The company engages in steelmaking and mining activities. ArcelorMittal expects shipments to grow by 5% in 2023 and generate positive free cash flow between $4 billion to $5 billion. Interestingly, the MT stock seems to be undervalued. Its current price/earnings ratio of 2.9x reflects a discount of 77.5% from its five-year average of 12.8. This presents an opportunity for investors to buy the stock.

Is MT a Buy or Sell?

Wall Street is optimistic about MT stock. It has a Strong Buy consensus rating based on four Buy and one Hold recommendations. The average price target of $35.84 implies 22.2% upside potential from current levels. The stock is up 10.1% so far in 2023.

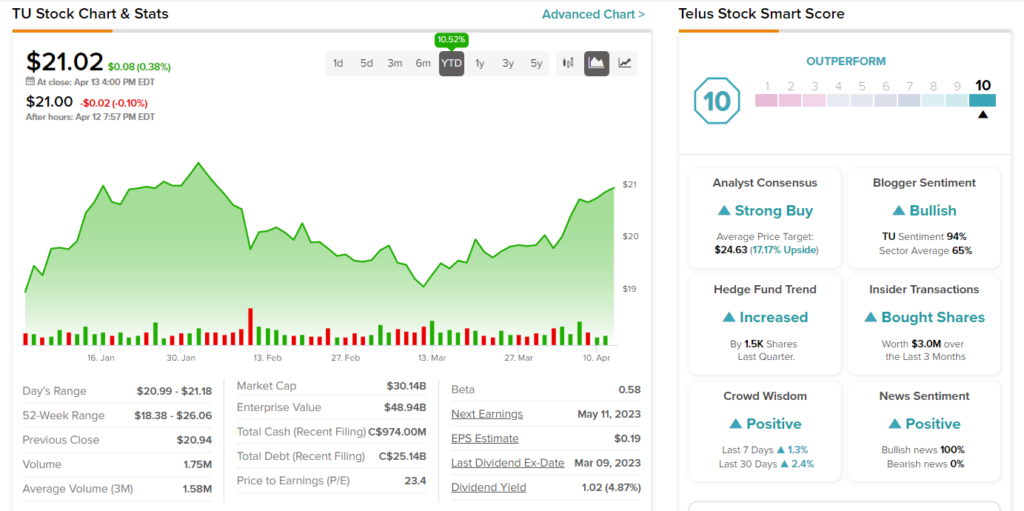

Telus Corporation

TU stock was added to the Perfect 10 list two days ago. The stock also has a Positive signal from insiders and hedge funds. Our data shows that hedge funds bought about 1.5K shares of the company in the last quarter while insiders purchased TU stock worth $3 million. The stock also enjoys bullish Blogger sentiment and Positive News Sentiment on TipRanks. The stock also has a Positive signal from retail investors.

The company provides a broad range of telecommunications products and services in Canada. Its ability to increase average revenue per user despite challenging macroeconomic conditions is encouraging. Additionally, TU stock looks undervalued. Its current price/sales ratio of 2.14x is currently at a 14.7% discount from the sector’s average of 2.51

Is TU Stock a Buy?

Telus has a Strong Buy consensus rating on TipRanks based on nine Buy and one Hold recommendations. The average price target of $24.63 implies 17.2% upside potential from current levels. TU stock is up 10.5% so far in 2023.

Concluding Thoughts

With a perfect Smart Score on TipRanks, bullish analysts’ sentiments, and robust fundamentals, ArcelorMittal and Telus make attractive picks for investors.