Investors looking for stocks with the potential to beat the market averages may consider taking a look at the TipRanks Top Smart Score Stocks tool. The tool considers eight different factors, including analyst ratings, technical analysis, and insider activity, among others, and assigns a score to stocks between 1 and 10, with 10 being the best.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Using this tool, we’ve looked up two stocks that are currently displaying the “Perfect 10” score – Accenture(NYSE:ACN) and Krispy Kreme (NASDAQ:DNUT). Let’s take a closer look at these two companies.

Accenture Plc

ACN stock was added to the Perfect 10 list two days ago. The stock also has a Positive signal from retail investors and hedge funds. Our data shows that hedge funds bought about 344.9K shares of the company in the last quarter. The stock also enjoys bullish Blogger sentiment and a Positive News Sentiment on TipRanks. Lastly, an ROE of 32.6% is another positive factor.

Accenture provides management consulting, technology, and outsourcing services. The company is likely to benefit from the strong momentum in the cloud business. Further, its efforts to control expenses in 2024 are encouraging. The company aims to lower its headcount by 19,000 over the next 18 months.

Is ACN Stock a Buy?

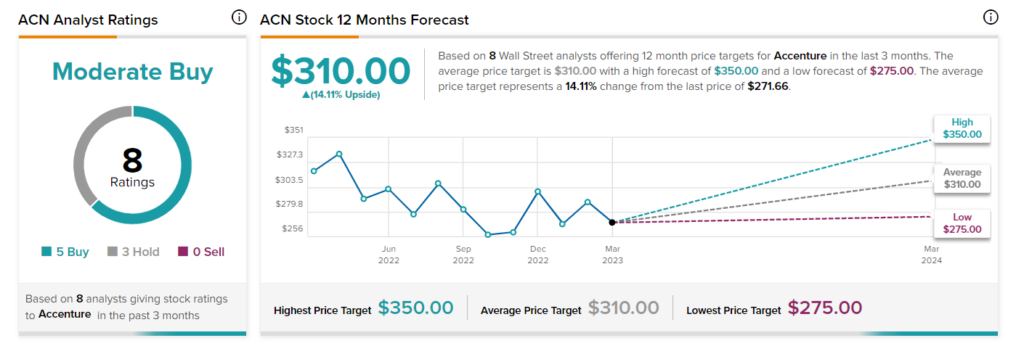

Wall Street is cautiously optimistic about ACN stock. It has a Moderate Buy consensus rating based on five Buy and three Hold recommendations. The average price target of $310 implies 14.1% upside potential from current levels. The stock is up 1% so far in 2023.

Krispy Kreme Inc.

DNUT stock boasts a top-notch Smart Score. The stock also has positive signals from bloggers and hedge funds. Our data shows that hedge funds bought 427.6K shares of the company in the last three months. The stock also enjoys a Positive News Sentiment on TipRanks.

Krispy Kreme is a multinational doughnut company and coffeehouse chain. The company continues to control costs with the rollout of automation initiatives and lower G&A expenses through the consolidation of offices.

Is DNUT Stock a Good Buy?

Krispy Kreme has a Moderate Buy consensus rating on TipRanks. This is based on two Buy and four Hold recommendations. The average price target of $15.67 implies about 1% upside potential from current levels. DNUT stock is up 48.9% so far in 2023.

Concluding Thoughts

Investors looking for stocks with strong potential for growth may want to take a look at Accenture and Krispy Kreme. The ability of both companies to improve the bottom line by controlling costs appears to be encouraging.