Explore all about two auto sector-focused mutual funds with the potential to earn over 15% appreciation in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The auto sector in the U.S. is a highly regulated one, with safety concerns and vehicle recalls being a normal routine. Even then, the automotive and transportation sectors play a crucial part in economic growth. Hence, including such companies in your portfolio would give an apt diversification. The automobile sector is cyclical, and its performance is often hampered by broader macroeconomic factors. Picking stocks from such a diverse sector could be difficult. Hence, investing in auto sector-focused mutual funds could be a relatively easier task.

With this background in mind, let us explore two auto sector-focused mutual funds.

Fidelity Select Automotive Portfolio (FSAVX)

The FSAVX invests 94.2% of funds in companies engaged in the manufacture, marketing, or sale of automobiles, trucks, specialty vehicles, parts, tires, and related services. The FSAVX has a Smart Score of seven, meaning it has the potential to perform in line with market expectations. As of today’s date, the fund has 32 holdings with total assets of $150.84 million.

On TipRanks, FSAVX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 32 stocks held, 23 have a Buy rating, while nine stocks have a Hold rating. The average Fidelity Select Automotive Portfolio price target of $60.21 implies 18.6% upside potential from the current levels.

Year-to-date, FSAVX has gained 26.8%. Its top five major holdings include Tesla (TSLA), Toyota Motors (TM), O’Reilly Automotive (ORLY), General Motors (GM), and Aptiv PLC (APTV).

Rydex Series Fds, Transportation Fund Class A (RYTSX)

The RYTSX invests at least 80% of its funds in equity securities of Transportation Companies that are traded in the United States and its derivatives. Similar to FSAVX, RYTSX also has a Smart Score of seven, meaning it has the potential to perform in line with market expectations. RYTSX has 63 holdings and total assets worth $14.18 million.

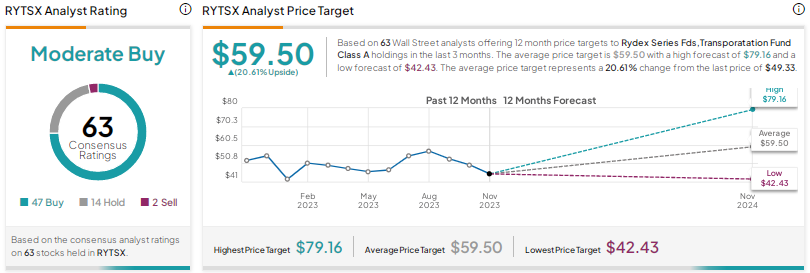

On TipRanks, RYTSX has a Moderate Buy consensus rating. This is based on its holdings of 47 stocks with a Buy rating, 14 stocks with a Hold rating, and two stocks with a Sell rating. The average Rydex Series Fds, Transportation Fund Class A price target of $59.50 implies 20.6% upside potential from the current levels.

RYTSX has gained 16.6% so far this year. Its top five holdings include Tesla, United Parcel Services (UPS), Union Pacific Corp. (UNP), Uber (UBER), and CSX Corp. (CSX).

Final Thoughts

Both FSAVX and RYTSX focus on the automobile sector, which is an important contributor to any economy. To make your stock-picking decisions easier, investors can choose from the wide variety of auto sector-focused mutual funds available in the market with the help of TipRanks tools.