Discover all about two Consumer Discretionary-focused mutual funds with the potential to earn over 10% appreciation in the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investing in the consumer discretionary sector has a direct correlation with the economic cycle. Recently, the U.S. Federal Reserve hinted that its interest rate hiking campaign could be ending, and the possible reversal of the economy could be in sight. The consumer discretionary stocks have not performed that well in 2023, but there could be a potential growth soon. Keeping this in mind, it seems like a good time to explore this sector and see how the mutual funds that invest in these companies perform.

Vanguard Consumer Discretionary Index Fund Admiral Shs (VCDAX)

The VCDAX fund invests in companies that manufacture products and provide services that consumers consider nonessential, such as retailers, restaurants, and internet and direct marketing retail companies. The VCDAX has a Smart Score of seven, meaning it has the potential to perform in line with market expectations. As of today’s date, VCDAX has 308 holdings with total assets of $5.81 billion. Notably, VCDAX also carries a lucrative dividend yield of 5.17%.

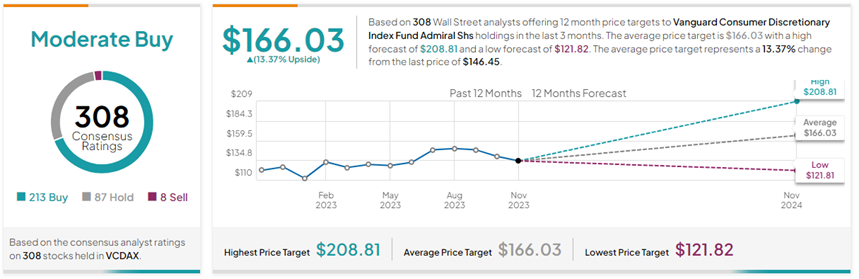

On TipRanks, VCDAX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 308 stocks held, 213 have a Buy rating, 87 stocks have a Hold, and eight stocks have a Sell rating. The average Vanguard Consumer Discretionary Index Fund Admiral Shs price target of $166.03 implies 13.4% upside potential from the current levels.

Year-to-date, VCDAX has already gained 30.9%. Its top five major holdings include Amazon.com (AMZN), Tesla (TSLA), Home Depot (HD), McDonald’s (MCD), and Lowe’s (LOW).

Fidelity Advisor Consumer Discretionary Fund: Class I (FCNIX)

The FCNIX invests 98.08% of the funds in companies engaged in the manufacture and distribution of consumer discretionary products and services. Similar to VCDAX, FCNIX also has a Smart Score of seven, meaning it has the potential to perform in line with market expectations. FCNIX is a comparatively smaller fund, having 56 holdings and total assets of $517.55 million.

On TipRanks, FCNIX has a Moderate Buy consensus rating. This is based on its holdings of 46 stocks with a Buy rating and ten stocks with a Hold rating. The average Fidelity Advisor Consumer Discretionary Fund: Class I price target of $45.82 implies 12.9% upside potential from the current levels.

FCNIX has gained 30.8% so far this year. Its top five holdings are similar to the prior fund, including Amazon.com, Tesla, Home Depot, Lowe’s, and TJX Companies (TJX).

Ending Thoughts

Both VCDAX and FCNIX focus on the consumer discretionary sector, which could perform brilliantly should the economy revive and consumer sentiment improve. To make your decisions easier, investors can choose from the wide variety of consumer discretionary-focused mutual funds available in the market with the help of TipRanks tools.