Consumer electronics retailer Best Buy (NYSE:BBY) is scheduled to announce its results for the first quarter of fiscal 2024 on May 25. Analysts expect a steep fall in earnings, as BBY’s top line is anticipated to be hit by subdued consumer spending on discretionary items like electronics due to macro pressures.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q1 Expectations

When Best Buy reported its fiscal fourth quarter results in March, it warned investors about continued macro pressures in FY24. The company stated that it projects FY24 comparable sales to decline in the range of 3% to 6%, with Q1 FY24 expected to face the maximum sales pressure.

Analysts expect Best Buy’s Q1 FY24 revenue to decline about 11% year-over-year to $9.53 billion. Adjusted earnings per share (EPS) is forecast to plunge 30% to $1.10 due to lower revenue and higher costs.

As per TipRanks’ Website Traffic Tool, visits on bestbuy.com declined 27.2% year-over-year and nearly 8% on a sequential basis in the fiscal first quarter. Given the importance of online sales for retailers like Best Buy, these numbers reflect weakness in Q1 FY24.

Meanwhile, heading into Q1 results, Citigroup analyst Steven Zaccone cautioned that Best Buy and home furnishings retailer Williams-Sonoma (WSM) could deliver disappointing comparable sales and lower their outlook.

Zaccone noted that demand for electronics and home furnishings has softened over the past six weeks, as reflecting in the commentary from retail peers and weaker spending trends in the Citi credit card data.

“Both Williams-Sonoma and Best Buy have back-half weighted full year guidance for same-store sales and margins to improve – this seems increasingly risky given weakening near-term demand,” said Zaccone.

However, the analyst thinks that these two retailers have a history of controlling costs, which could protect their bottom line from a major hit. Zaccone lowered his price target for BBY stock to $62 from $72 and maintained a Sell rating. Further, he cut his price target for Williams-Sonoma to $123 from $127 and reiterated a Hold rating.

Technical Indicators

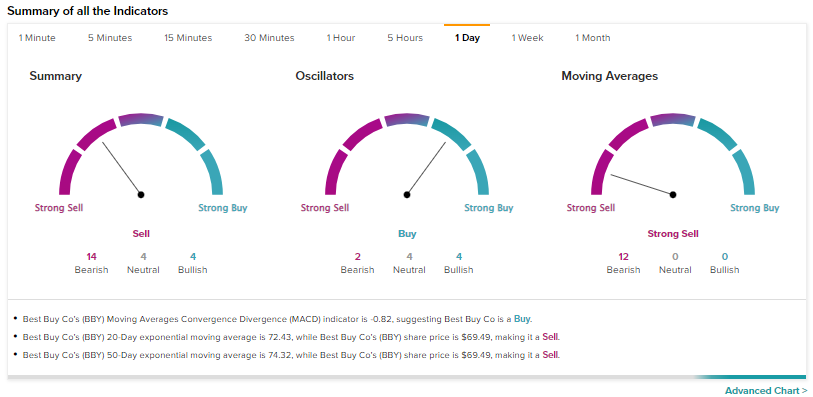

Ahead of the Q1 earnings release, technical indicators reveal that Best Buy is a Sell. According to TipRanks’s easy-to-understand technical tool, BBY’s 50-Day EMA (exponential moving average) is $74.32, while its price is $69.49, making it a Sell. Further, BBY’s shorter duration EMA (20-day) also signals a Sell.

Is BBY a Good Stock to Buy?

Wall Street’s Hold consensus rating on Best Buy is based on three Buys, 12 Holds, and three Sells. The average price target of $81.37 suggests 17% upside from current levels. Shares have declined 13% year-to-date.

Conclusion

The decline in consumer spending on discretionary goods like consumer electronics and higher costs are expected to weigh on Best Buy’s fiscal first-quarter results. While technical indicators reveal that Best Buy is a Sell, Wall Street analysts are currently sidelined on the stock.