The stock markets have been ripping this year, with investors buying into the bullish trend. However, some savvy investors are turning their attention to the other side of the tape – oversold stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sure, beaten-down stocks are often beaten down for a reason. Still, analysts argue that some of these names have been punished too harshly, creating compelling entry points at discounted levels.

With that backdrop in mind, we’ve used the TipRanks platform to pinpoint stocks that have taken steep hits in 2025 yet still carry upbeat analyst sentiment. Two tickers jump out – each down more than 35% year-to-date but supported by Strong Buy consensus ratings and plenty of upside on the Street. Let’s take a closer look.

Xencor (XNCR)

First up is Xencor, a biopharmaceutical company that focuses on protein engineering as the base technology for its drug development platform. The company’s proprietary platform, dubbed XmAb, allows for the development of new monoclonal antibodies, aimed at treating patients who suffer from autoimmune diseases or cancer. Xencor is using its XmAb technology to implement small structural changes in its monoclonal antibody drug candidates – but those small changes can lead to novel modes of therapeutic action.

Xencor has used its platform to put together a broad pipeline, featuring over a dozen drug candidates at various stages of development. The company’s pipeline includes both proprietary clinical and preclinical programs that have been developed solely by Xencor, as well as drug candidates that have been developed in conjunction with partner companies.

While Xencor does not have any approved drugs in its portfolio that it directly markets, it does have several that are sold under license by partner firms. Xencor collects royalty payments on these drugs, and in its 2Q25 report, the company listed $43.6 million at the top line – and attributed that revenue to milestone payments from Incyte and non-cash royalties from both Incyte and Alexion. The company’s Q2 revenue was up 82% compared to the second quarter of 2024.

Among the company’s clinical trial programs are two first-in-class, tumor-targeted, T-cell engaging 2+1 bispecific antibodies; XmAb819 is designed to target clear cell renal cell carcinoma (ccRCC), while XmAb541 is under development to treat patients with advanced solid tumors expressing CLDN6. Initial data from the Phase 1 dose escalation study of XmAb819 showed that the drug was well tolerated in heavily pretreated patients, and that it demonstrated a 25% overall response rate within the target dose range. The company has selected the first cohort for dose escalation, and is working to identify the dose for the second expansion cohort. Xencor expects to recommend a Phase 3 dose next year, and to initiate the first pivotal study of XmAb819 sometime during 2027.

On the XmAb541 track, Xencor has a Phase 1 dose escalation study ongoing, evaluating the drug as a treatment for patients with CLDN6-expressing tumor types, including ovarian cancer and germ cell tumors. The company’s goal in this study is to characterize the target dose levels.

Despite the scientific momentum, the stock has been under pressure, down 39% year-to-date. Yet some on Wall Street see the disconnect as an opportunity. Barclays’s Etzer Darout, an analyst ranked among the top 4% on Wall Street, recently upgraded the stock to Overweight (i.e., Buy), citing increasing conviction in the company’s long-term prospects.

“Our Overweight rating for XNCR is driven primarily by two factors: 1. our WACC [Weighted Average Cost of Capital] assumptions for XNCR now fall in line with the rest of our biotech coverage; and 2. a more positive outlook on the company’s pipeline following updates at the AACR-NCI-EORTC Conference on Molecular Targets and Cancer Therapeutics. While XNCR’s platform has delivered value through commercial royalties and external validation, our [prior] bearish view had been primarily on the internal pipeline, for which we ascribed no value. XNCR’s recent updates for XmAb819, a first-in-class ENPP3 x CD3 bispecific T-cell engager in development for advanced clear cell renal cell carcinoma (ccRCC), and XmAb541 (CLDN6 x CD3) in CLDN6+ tumors were positive, in our view, and exceeded our expectations,” the 5-star analyst noted.

Along with his Overweight rating, Darout puts a $23 price target on Xencor to suggest a one-year gain of 65%. (To watch Darout’s track record, click here)

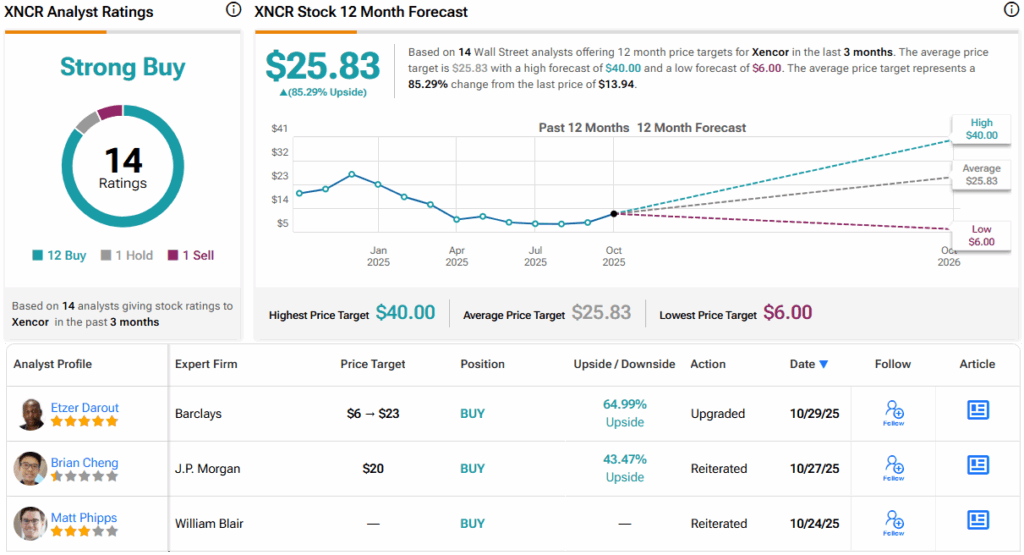

The Strong Buy consensus rating on XNCR stock is based on 14 recent analyst reviews that break down to 12 Buys, and 1 Hold and Sell, each. The stock is currently trading for $13.94 and its $25.83 average target price implies that it will gain 85% over the next 12 months. (See XNCR stock forecast)

Glaukos (GKOS)

Next on our list is another medical research firm, Glaukos. This company focuses on developing new treatments for ophthalmic diseases – that is, diseases of the eye – including such conditions as glaucoma, corneal disorders, and retinal diseases. All of these bring a strong negative impact to the patient’s quality of life; Glaukos is working to create treatment alternatives for patients, to improve the standard of care.

Pursuing this goal, Glaukos has developed, and brought to market, several ophthalmic products and treatments. The company’s leading products are the series of micro-invasive glaucoma surgery devices – MIGS – under the iStent line. Stents are well-known in medical tech, and are used to divert fluid flows and open vascular systems, especially around the heart and brain. Glaukos’s iStents are tiny versions of the devices that can be implanted during cataract surgical procedures to help drain fluid from the eyeball and reduce the pressure that is the chief cause of glaucoma damage.

The company’s other marketable product is its iLink system, a line of ophthalmic devices used in corneal cross-linking as a treatment for keratoconus. This condition causes thinning and weakening of the cornea; Glaukos’s treatment, using a combination of medicinal drops and UV light, prevents further loss of vision by strengthening the cornea.

Looking forward, Glaukos is developing a line of treatments for retinal diseases. This development pipeline features micro-invasive, bioerodible, sustained-release drug delivery platforms. The company aims to apply this approach to the treatment of such conditions as diabetic macular edema and age-related macular degeneration (AMD).

We should note that revenue from the iStent product line is Glaukos’s chief source of income.

Shares in GKOS are down 42% for the year so far – but the lion’s share of that loss came back in February, when the company’s 4Q24 results showed a deeper-than-expected earnings loss. Since then, the company has faced headwinds over concerns about local coverage determinations (LCD) under the Medicare Administrative Contractor (MAC).

Glaukos released its results for 3Q25 earlier this week, however, and beat the forecasts. Revenue, at $133.5 million, was up 38% year-over-year and beat the estimates by almost $11 million. At the bottom line, the company’s non-GAAP EPS came in at ($0.16); while a loss, this was 10 cents per share better than expected and was an improvement over the ($0.28) EPS figure reported in the prior-year quarter.

Looking ahead, Wells Fargo analyst Larry Biegelsen sees better days for Glaukos. Explaining his outlook, Biegelsen writes: “We believe GKOS has a number of potential catalysts in 2026+, that should support the shares, including an underappreciated tailwind in Epioxa [part of the iLink product line] that could add meaningful upside to our model. In addition, we believe concerns around the potential iDose LCD (local coverage determination) may be somewhat premature, as we believe an LCD could unlock faster and broader coverage.”

These comments back up the analyst’s Overweight (i.e., Buy) stance on the shares, and his price target of $122 implies that GKOS will gain 40% by this time next year. (To watch Biegelsen’s track record, click here)

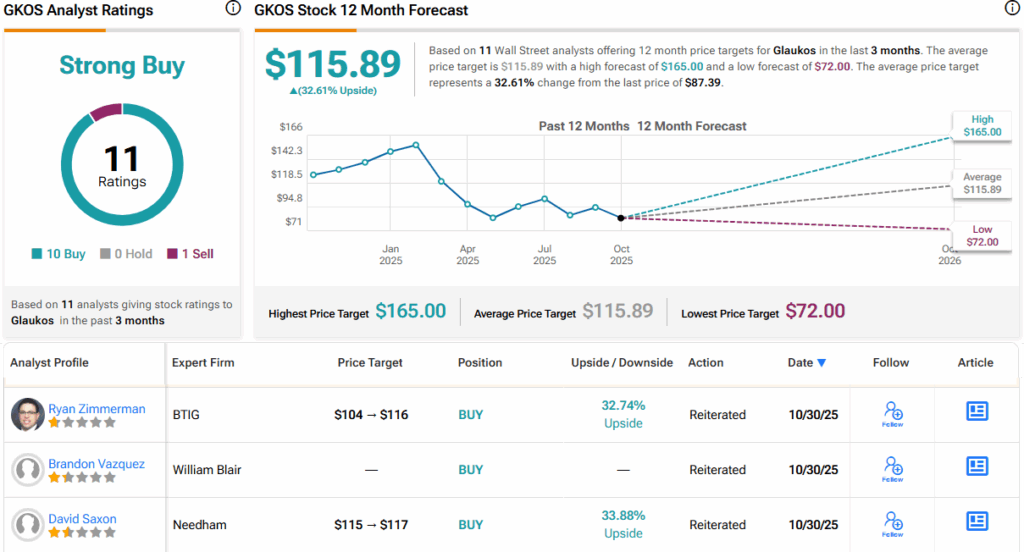

The Street is generally bullish on this stock, as is clear from the Strong Buy consensus rating based on 10 Buys and 1 Sell. The shares are priced at $87.39, and their $115.89 average price target points to a 33% one-year gain. (See GKOS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.