I have held a bearish outlook on iQIYI (NYSE:IQ) for years, initially betting against the stock in the summer of 2020 when shares were trading over $19. The leading online entertainment video services provider in China, or “Netflix of China,” as many like to call it, has faced significant profitability issues in recent years. Today, with shares trading at $4.61, it seems my initial assessment was accurate. However, recent quarters have shown signs of iQIYI finding its footing, prompting me to take a bullish view of the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue Growth Reacceleration Reverses Loss-Making Trend

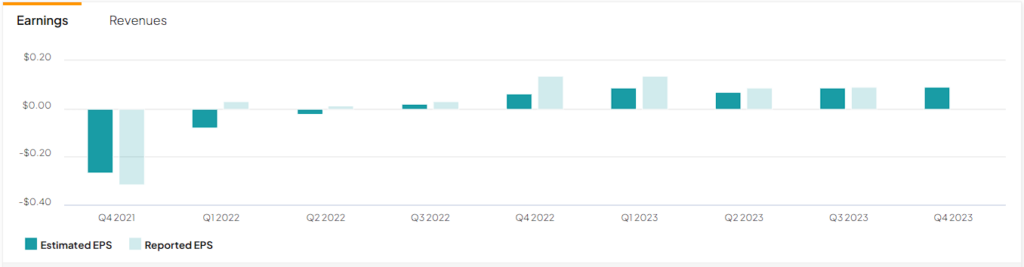

My bullish stance has been primarily fueled by the notable resurgence in iQIYI’s revenue growth, effectively signaling a reversal of the company’s prolonged trend of posting losses. To provide some context, iQIYI consistently recorded losses in each quarter from Q4 2016 (as far back as its publicly available data extends) through Q3 2022, barring only two quarters. Even then, one of those exceptions was attributed to a singular, non-recurring benefit in Q4 2017 resulting from IPO-related gains.

During this challenging period, iQIYI faced a significant slowdown in revenue growth, witnessing a decline in its last-12-month (LTM) revenue growth from an exciting 111% in Q4 2016 to a concerning -6% in Q3 2022. Clearly, the company was navigating a difficult terrain, with its performance steadily eroding quarter after quarter.

However, iQIYI has successfully reversed this trend, posting four consecutive quarters of revenue growth. In fact, as of Q3 2023, the company’s LTM revenue growth stood at 10.3%, a noteworthy improvement from the previous year’s -6%, as mentioned earlier. Recent results indicate that revenue growth is now driven by growing memberships, along with a positive trend in revenues per membership.

Specifically, in Q3 2023, iQIYI achieved a 7% increase in revenue, reaching $1.1 billion. This growth was propelled by a 6.4% rise in the average daily subscribers to 107.5 million and an 11.8% increase in the monthly average revenue per membership to RMB15.54 ($2.19).

Its top line was further boosted by Online Advertising Services revenues, totaling $229.5 million, a 34% year-over-year increase attributed to growth in both performance-based advertising and brand advertising businesses. However, this growth was partially offset by a 28% decrease in content distribution revenue to $72.1 million. The decline here was primarily due to a decline in the average unit price of barter transactions. This explains why total revenue stayed in the single digits.

Along with achieving revenue growth, iQIYI effectively managed its expenses, which increased by just 1.5% year-over-year. This enabled the company to elevate its margins from the red zone, achieving a net income of $65.2 million—marking the fourth consecutive quarter of positive earnings. With a seemingly enduring trend taking shape, it appears that iQIYI is on a path toward sustained profitability.

Positive Earnings Support Current Valuation Despite Recent Repricing

With iQIYI sustaining positive earnings in recent quarters, the market has started to reprice the stock due to its improved prospects. Remarkably, shares have rebounded from their low of $2.00 in October 2022, a period marked by declining revenues, to $4.61, as mentioned earlier.

Despite the stock’s notable gains from its October 2022 low, I believe that iQIYI remains reasonably valued. Based on the company’s performance during the first nine months of 2023 and ongoing momentum, Wall Street expects the company to achieve EPS of $0.40 for Fiscal 2023. This implies that the stock is currently trading at a forward P/E of 11.60. This valuation seems quite attractive for a streaming giant poised for further earnings growth.

One might argue that, as a Chinese stock, iQIYI warrants a below-average valuation due to associated additional risks—and I agree. However, it’s worth mentioning that iQIYI holds a distinct advantage in its operating landscape. Unlike its Western counterparts grappling with an oversaturated streaming industry, iQIYI operates in a market where it doesn’t directly compete with numerous streaming giants. Besides, the current multiple already implies undervaluation, assuming further earnings growth ahead.

Is IQ Stock a Buy, According to Analysts?

Taking a look at Wall Street’s sentiment on the stock, iQIYI currently features a Moderate Buy consensus rating based on five Buys and two Holds assigned in the past three months. At $6.95, the average iQIYI stock forecast implies 50.8% upside potential.

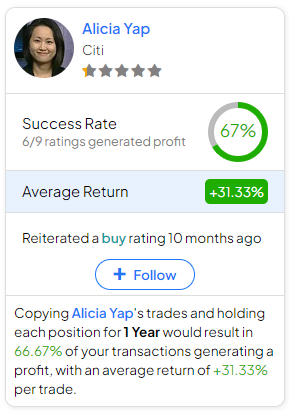

If you’re wondering which analyst you should listen to if you want to buy and sell IQ stock, the most accurate analyst covering the stock (on a one-year timeframe) is Alicia Yap, representing Citi. Her track record is robust, with an average return of 31.33% per rating and a 67% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, iQIYI’s recent turnaround, marked by consecutive quarters of revenue growth and sustained positive earnings, reflects a promising shift in its investment case. The company is currently growing its number of memberships and revenue per membership while prudently managing its costs. This marks a stark difference from its money-losing days, which would result in constant dilutive fundraising.

Despite a recent repricing in the market, the stock’s current valuation appears to remain attractive, given iQIYI’s market-leading position and prospects for further earnings growth. Thus, my sentiment on the stock has now turned from a bearish to a bullish one.