Hedge funds are known for beating the average market returns. Thus, keeping a tab on which stocks hedge funds buy or sell becomes important. Let’s leverage TipRanks’ Hedge Fund Trading Activity tool (it uses data from Form 13-F to offer hedge fund signals) to look at the top five stocks that hedge fund managers sold the most in the last three months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What are the Most Sold Hedge Fund Stocks?

Shopify (NYSE:SHOP) (TSE:SHOP)

Rank: #5

Number of Shares Sold By Hedge Funds: 20.7M

Shopify provides internet infrastructure for commerce. A slowdown in its growth and macro headwinds weighed on Shopify stock, which is down about 76% year-to-date. Despite this significant correction in its price, hedge funds are skeptical about Shopify’s prospects.

TipRanks’ Hedge Fund Trading Activity tool shows that hedge funds sold 20.7M SHOP stock last quarter. Eight hedge fund managers, including Bridgewater Associates’ Ray Dalio and Joel Greenblatt of Gotham Asset Management, closed their positions in SHOP stock. Meanwhile, eight hedge fund managers reduced their holdings.

SHOP stock has 12 Buy and 14 Hold recommendations for a Moderate Buy rating consensus. Moreover, the average price target of $43.50 implies 33.97% upside potential. SHOP stock has an Underperform Smart Score of 1 out of 10.

Snap (NYSE:SNAP)

Rank: #4

Number of Shares Sold By Hedge Funds: 21.0M

Snap is a social media company. Its Snapchat camera application helps users communicate visually through short videos and images. SNAP stock has plunged over 77% this year as corporations are spending less on adverting due to a weak macro environment, which is directly impacting Snap’s performance. As Snap faces headwinds, hedge funds reduced their holdings in the stock.

Per TipRanks’ Hedge Fund Trading Activity tool, hedge funds sold 21.0M SNAP stock last quarter. Greg Poole of Echo Street Capital Management and seven other hedge fund managers sold their holdings in SNAP stock. Further, Theofanis Kolokotrones of PRIMECAP Management reduced exposure to SNAP stock.

SNAP stock sports a Hold rating consensus on TipRanks based on 10 Buy, 22 Hold, and four Sell recommendations. Meanwhile, the analysts’ average price target of $14.70 implies 38.7% upside potential. SNAP stock has an Underperform Smart Score of 1 out of 10.

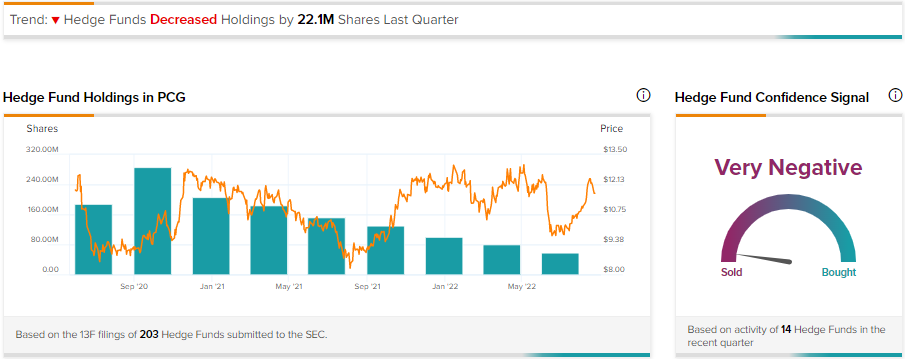

PG&E Corporation (NYSE:PCG)

Rank: #3

Number of Shares Sold By Hedge Funds: 22.1M

PG&E Corporation operates as a natural gas and utility business. Given its conservative utility business, PCG stock is mostly stable. However, TipRanks’ data shows that PCG stock has a negative signal from hedge fund managers.

According to TipRanks’ Hedge Fund Trading Activity tool, hedge funds sold 22.1M PCG stock last quarter. Five hedge fund managers reduced their holdings in PCG stock. Meanwhile, Brigade Capital Management’s Donald Ellis Morgan closed his position.

While hedge fund managers have lowered their exposure to PCG stock, analysts are cautiously optimistic about its prospects. It has received five Buy and two Hold recommendations for a Moderate Buy rating consensus. Further, the analysts’ average price target of $16.14 implies 37.7% upside potential. PCG stock has an Underperform Smart Score of 3 out of 10 on TipRanks.

Farfetch Limited (NYSE:FTCH)

Rank: #2

Number of Shares Sold By Hedge Funds: 23.7M

Farfetch is a leading platform for luxury fashion. Macro weakness in China, closure of operations in Russia, and uncertainty weighed on FTCH stock, which is down about 77% year-to-date. Due to these challenges, hedge funds have reduced their exposure to FTCH stock.

Per TipRanks’ Hedge Fund Trading Activity tool, hedge funds sold 23.7M FTCH stock last quarter. Kenneth Tropin of Graham Capital Management, Ricky Sandler of Eminence Capital, and Steve Mandel of Lone Pine Capital sold out their positions in FTCH stock. Meanwhile, three hedge fund managers, including Catherine Wood of ARK Investment Management, lowered their holdings in the last quarter.

FTCH stock sports a Moderate Buy rating consensus on TipRanks based on seven Buy and four Hold recommendations. Meanwhile, the analysts’ average price target of $15.36 implies 95.9% upside potential. FTCH stock has an Underperform Smart Score of 1 out of 10.

Nu Holdings (NYSE:NU)

Rank: #1

Number of Shares Sold By Hedge Funds: 38.3M

Nu Holdings is a leading digital banking platform with the most significant operations in Brazil. A weak macro environment and the fear of a deterioration in asset quality dragged NU stock lower. It is down about 51% year-to-date.

TipRanks’ Hedge Fund Trading Activity tool shows that NU stock has a negative signal from hedge fund managers. Hedge funds sold 38.3M NU stock last quarter. Malcolm Levine of Dendur Capital closed the position in NU stock. Meanwhile, Chase Coleman of Tiger Global Management reduced the holdings in NU stock.

Though hedge funds are bearish on NU stock, Wall Street analysts are highly bullish. NU stock has received five buy recommendations for a Strong Buy rating consensus. Moreover, their average price target of $7.30 implies 60.1% upside potential. NU stock has an Outperform Smart Score of 8 out of 10 on TipRanks.

Bottom Line

Hedge fund managers selling stocks is a negative sign. However, investors should never judge a stock based on one specific parameter. They can leverage TipRanks’ other valuable tools to know about analysts’ recommendations, investor sentiment, and insider signals to make an informed investment decision.

Built with the help of TipRanks’ Stock Comparison tool, here is the summary of how these stocks stack up on TipRanks’ valuable datasets.

Also, discover the performance and ranking of hedge funds using TipRanks’ Top Hedge Fund Managers tool.

Continue to watch this space to keep a tab on hedge fund trading activities.