Baxter International (BAX) is down approximately 5% in the past 6 months. However, the stock is positioned to deliver better share price performance going forward. Thus, I am bullish on this stock. (See Analysts’ Top Stocks on TipRanks).

Headquartered in Deerfield, Illinois, Baxter International is a healthcare company focusing on products for the treatment of hemophilia and kidney disease, in addition to various other disorders of the immune system.

Baxter’s products are sold and distributed across 100 countries worldwide.

Q3 Earnings

The recovery from the COVID-19 crisis took place in many markets worldwide, which allowed the company to record sales growth across different geographies and products in the third quarter of 2021. As a result, total revenues improved, increasing nearly 9% year-over-year to hit $3.23 billion in the quarter, which was in line with analysts’ projections.

The company posted a proforma EPS of $1.02 (up 23% year-over-year), while the average consensus expected $0.94 per share.

A Resilient Business

Baxter is committed to the fight against the COVID-19 infection, contributing to the development of the vaccine against the coronavirus.

Since the COVID-19 infection also seems to have a particular predilection for the kidneys of a sick person, Baxter’s therapies support the ongoing function of the renal system and other organs. In fact, the demand for these products is coming especially from intensive care units at the moment.

This segment of the company should strengthen across several markets globally following the purchase of Hillrom, a leading provider of medical technologies, with the deal expected to finalize in early 2022.

Regarding the other divisions of Baxter, the situation is as follows.

Intravenous therapies and infusion pumps continue to hold well even though many hospitalizations are being shortened or postponed due to COVID-19. The usage of drug administration sets and reconstitution devices also remained buoyant despite the pandemic.

Additionally, having a well-diversified portfolio of products and services from a geographical standpoint allows the company to counterbalance the negative effects of the restrictions. This is particularly true regarding the company’s premixed and oncology drug platforms, in addition to some of its pharmaceutical products such as inhaled anesthesia.

Looking to Fiscal Year 2021

Baxter forecasts that it will report a 7%-8% increase in total sales while analysts estimate a growth of 7.6%. The company also expects that proforma diluted EPS will be between $3.58 and $3.62 versus the average consensus estimate of $3.6.

Wall Street’s Take

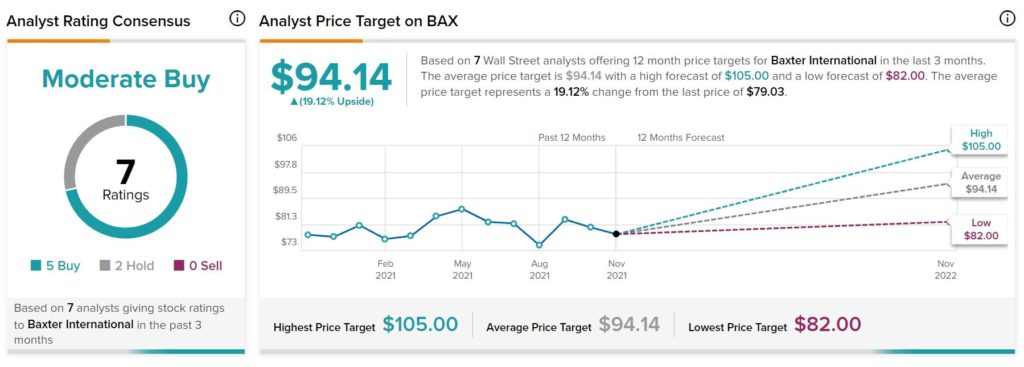

In the past three months, seven Wall Street analysts have issued a 12-month price target for BAX.

The average Baxter International price target is $94.14, implying 19.1% upside potential. The company has a Moderate Buy consensus rating, based on five Buys and two Holds assigned.

Summary

Shares have recently undergone a period of slight tarnish, but this was not due to Baxter’s business which, on the contrary, demonstrated good stamina during the pandemic.

The shares will likely resume a rally as soon as the market notices this aspect.

Disclosure: At the time of publication, Alberto Abaterusso did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.