Mid-cap banks took a beating in March of last year, when the failure of Silicon Valley Bank sparked a crisis in the sector. Depositors ran on their accounts, Silvergate Bank and Signature Bank also failed – and for a short time, it looked as though a full-fledged banking crisis was in the making. Supportive action from the Federal Reserve and other central banks helped stave off a larger contagion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Since then, the banking sector has staged a modest rebound. Reduced underwriting, as a response to last year’s crisis, along with the prospect of lower rates later this year, have helped keep the smaller banks standing – but investors remain cautious.

Accordingly, mid-cap bank stocks have been underperformers over the past year, still dealing with the hangover from the crisis. But has that produced a positive buying environment for investors?

A recent note from Barclays analyst Jared Shaw would suggest it has. Examining the banking sector, Shaw writes, “We have a generally positive outlook for the US Mid-Cap Banks from here. While our expectation is that growth will likely be slow, balance sheets look stable, with good credit trends. The names we believe are best positioned within our coverage include WAL, EWBC, and WBS, which each have ample capital, strong credit, and stable funding.”

Opening up the TipRanks databases, we’ve dipped into the recent statistics on Shaw’s picks – and found that his colleagues on the Street are also taking an upbeat stance. These three mid-cap bank stocks have ‘Strong Buy’ ratings and Shaw sees up to 50% upside potential here. Let’s take a closer look.

Webster Financial (WBS)

We’ll start with Webster Financial, the holding company behind the Webster Bank. The company is based in Connecticut, and operates through a network of full-service banking locations – more than 200 in all – across the Connecticut, Rhode Island, Massachusetts, and the Metropolitan New York City area, along with a network at 24-hour ATMs. Customers can access a wide range of banking services, including personal banking and wealth management, and commercial and business banking.

Webster made a large move to expand its network and services just two years ago, when it completed its acquisition of Sterling Bancorp. The combined entity continued operations under Webster’s name, and became one of the largest regional commercial banks in the Northeast. At the time the merger action was completed, the combined company had $65 billion in assets, $44 billion in loans, and $53 billion in customer deposits; today, Webster Financial boasts total assets of $75 billion, $50.4 billion in loans, and $60 billion in customer deposits.

Webster Financial reported its quarterly results for 4Q23 this past January, and missed the forecasts on both the top and bottom line. The company’s revenue came in at $634.8 million for the quarter, down 10% year-over-year and some $44.3 million below expectations. The bottom line, reported as an adjusted non-GAAP EPS of $1.46 was 2 cents less than the forecast.

Of note for return minded investors, Webster paid out its most recent common share dividend, at 40 cents per share (the rate it has held since 2019) on February 16. The annualized payment of $1.60 gives a forward yield of nearly 3.3%.

Checking in with Jared Shaw and the Barclays view, we find the analyst optimistic on the long-term potential for this regional bank, writing, “Our Overweight rating on WBS is based on our outlook for sustainable growth of both funding and loans, as well as the ability to maintain excellent asset quality. With the integration of Sterling behind it, WBS continues to extract efficiencies from its larger balance sheet and should benefit from competitor consolidation in the Northeast. WBS has expanded over the years through both bank and non-bank acquisitions to create a model of diversified growth and strong credit quality and is positioned with leading deposit market share in its primary markets.”

That Overweight (i.e. Buy) rating, is backed by a $70 price target that points toward a 44% gain in store for the stock this year. (To watch Shaw’s track record, click here)

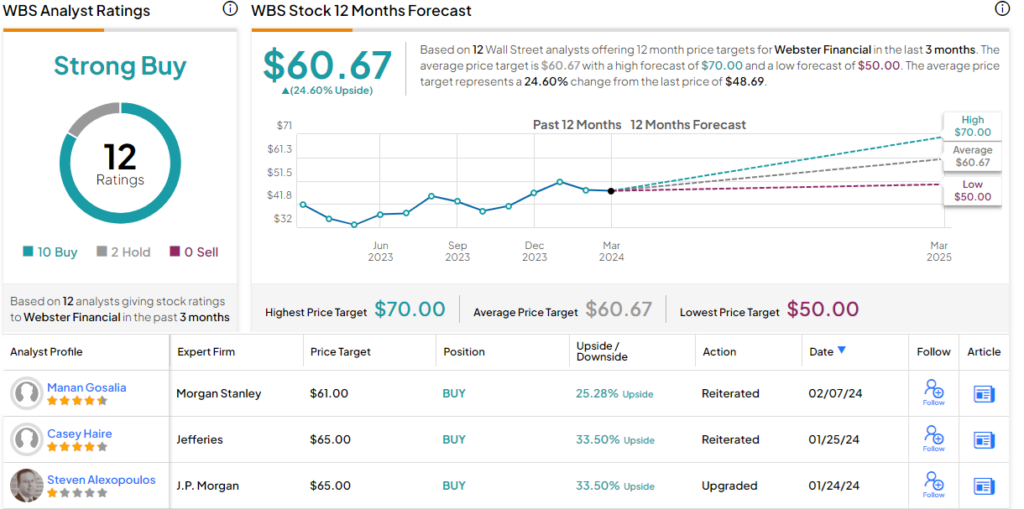

The Strong Buy consensus rating on Webster is based on 12 recent analyst reviews, and those include 10 Buys to 2 Holds. The shares are priced at $48.69 and their $60.67 average target price implies a one-year upside potential of 24.5%. (See WBS stock forecast)

Western Alliance (WAL)

Let’s shift our gaze to the Southwest, where Phoenix-based Western Alliance operates as a Bancorp with multiple subsidiaries across the region. The company’s bank subsidiaries focus mainly on the commercial side of the industry, offering a wide range of commercial, business, and small business banking services. These can include, but are not limited to, asset-based lending, commercial credit cards, equipment financing, business checking and savings, escrow services, fraud protection, and small business loans. The company finished 2023 with $70.9 billion in total assets on the books, and a market cap of $6.64 billion.

Western Alliance lives up to its name, providing its services mainly in the states of Arizona, Nevada, and California. The company had on its books at the end of 4Q23, the last reported, a total of $50.3 billion in loans and $55.3 billion in customer depots. These figures were up year-over-year by 1.7% and 1.9% respectively.

Loans and deposits are the bread and butter of the banking business, and Western Alliance generated $682.2 million in revenue during Q4. This was down 2.7% from the prior-year quarter, and missed the forecast by $28.5 million. The company’s bottom line, reported as a non-GAAP earnings per share of $1.91, was in-line with pre-report expectations. The company had a tangible book value, at the end of 2023, of $46.72 per share, up 16% year-over-year.

Jared Shaw, in his coverage of WAL, is impressed by the company’s capital, and its ability to grow its book value. He says of the firm, “Due to strong capital, a disciplined focus on profitability and demonstrated success handling a challenging operating environment in 2023, we have an Overweight rating on WAL. We expect the bank to continue increase risk-adjusted returns, as well as see sustained higher levels of growth compared to peers… Management has always been focused on maximizing profitability and optimizing capital, with historically group-leading ROTCE and ROAA. Additionally, over the past 10 years, the bank has seen nearly 500% growth in TBV, which is 8.5x peers.”

This Overweight (i.e. Buy) rating is complemented by a $91 price target that shows Shaw’s confidence in a 51% upside for the coming year.

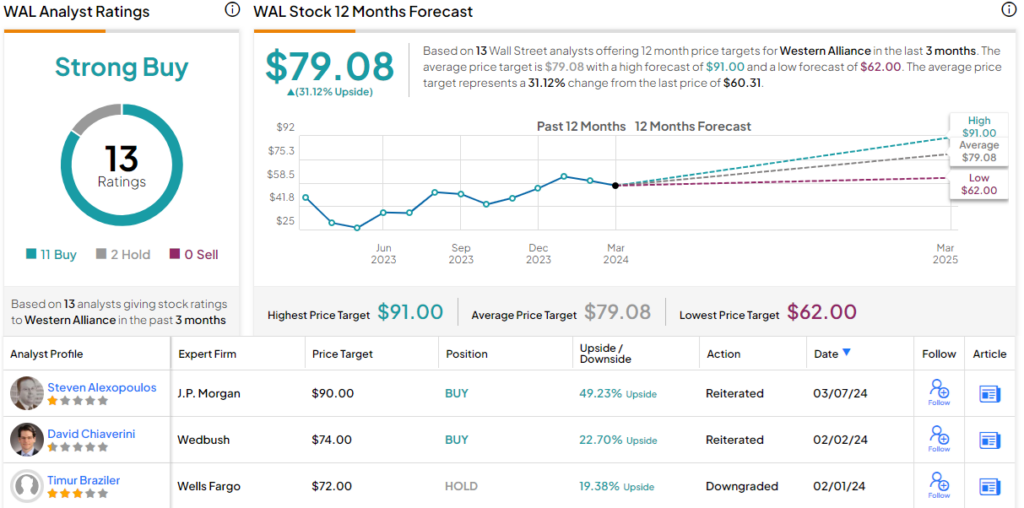

Overall, the Strong Buy consensus rating on WAL is derived from 13 recent analyst recommendations, which break down to 11 Buys and 2 Holds. The shares are currently priced at $60.31 and their average target, of $79.08, implies that the stock will gain 31% over the course of the year. It should also be noted that WAL pays a dividend. The last quarterly payment went out on March 1, and at $0.37/share, it offers a yield of 2.45%. (See WAL stock forecast)

East West Bancorp (EWBC)

Last on our list is East West Bancorp, a bank holding company that kicked off its operations in 1973, primarily to serve Chinese immigrant communities on the West Coast of the US. The company operates through its subsidiary, the East West Bank, and as of last year was the largest state-chartered bank in California. The company has a market cap of $10.75 billion, edging just over the top of the mid-cap stock category, has been in operation for just over 50 years, and works through a network of more than 120 branch locations in the US and China. That last makes East West one of the few US banking companies with a Chinese operating license.

Like its peers, East West offers its customers the full range of personal and commercial banking services, including checking and savings accounts, home and business loans, credit lines, business checking, CDs, SBA loans, and more. The bank’s services are available to customers at the branch locations, as well as through mobile and online banking options. For individuals with high net worth, the bank offers wealth management services, and international banking is also available, for both individuals and businesses, with a focus on international trade issues.

The bank company finished 2023 with $69.6 billion in total assets on the books, an increase of 8.6% from the end of 2022. As of this past December 31, East West reported $52.2 billion in total loans, along with $56.1 billion in total customer deposits. Looking at the financial results, we find that East West generated $654.7 million in total revenue for 4Q23, the last quarter reported. This was down more than 2% year-over-year – but it beat the forecast by more than $12.8 million. East West Bancorp’s bottom line, the non-GAAP EPS, came to $2.02 for the quarter, 7 cents per share better than had been anticipated.

Once again, we turn to Barclays analyst Jared Shaw, who is impressed by this mid-cap bank’s ability to execute on strategic plans, saying of the company, “Our Overweight rating on EWBC is based on the strength of management being able to continue to execute on the strategy of sustained higher growth in both deposits and loans combined with excellent credit underwriting while holding significant capital while also returning profitability to shareholders… EWBC is one of our key Overweights in the US Mid-Cap Banks space, given its balanced and sustainable growth, strong asset quality and peer-leading capital levels.”

The Overweight (i.e. Buy) rating that Shaw puts here is accompanied by a $106 price target, implying a 38% one-year upside potential for the stock.

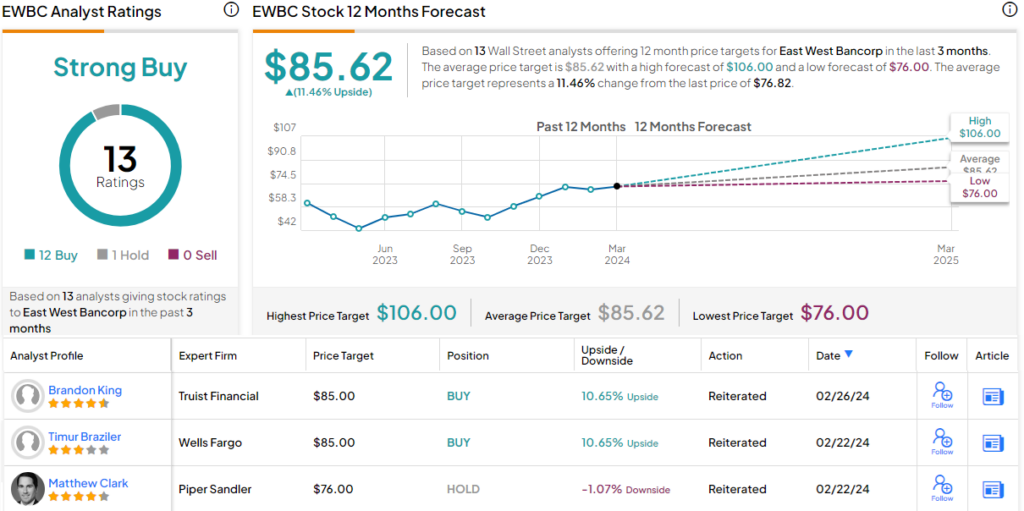

This third bank on our list of Barclays picks is another with a Strong Buy consensus rating from the analysts – this one based on 12 Buys against a single Hold. The shares are trading for $76.82 and their average target price, currently standing at $85.62, suggests a potential one-year share appreciation of 11.5%. EWBC also offers a dividend, the current quarterly payout stands at $0.48 and yields 2.5%. (See EWBC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.