The majority of large and regional U.S. banks reported their second-quarter earnings, and so far, the operating trends have been better than feared. Most banks, excluding Goldman Sachs (NYSE:GS), exceeded Wall Street’s earnings forecast. While higher rates and modest loan growth drove NIIs (Net Interest Incomes), challenges still persist. The rapidly rising deposit costs and weak investment banking activity remained a drag in the quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The image below shows the Q2 EPS performance of banks and how their stocks behaved (rose or fell) soon after the earnings report.

Key Trends to Look Out For in 2H

The higher average rates and a slight improvement in loan balances will support the NIIs of banks. However, the increase in funding costs (higher deposit costs) and continued deposit drain will likely act as headwinds.

During the Q2 earnings conference call, Bank of America (NYSE:BAC) highlighted that it faced competitive pressure in the second quarter as some of its peers pushed prices higher to attract deposits. Meanwhile, Ally Financial (NYSE:ALLY) witnessed an increase in deposit costs due to the continued rise in short-term rates and heightened competition for deposits.

On the deposits front, banks could witness lower balances, reflecting noninterest-bearing deposit outflows as customers continue reallocating their cash into higher-yielding alternatives. Further, the mix shift towards interest-bearing deposits will likely remain a drag on NIIs.

As for banks with increased exposure to investment banking, like Goldman Sachs and Morgan Stanley (NYSE:MS), lower activity levels will likely remain a drag. However, the strength in the wealth management segment could continue to drive MS’ financials.

Here’s What This Analyst Thinks About Banks’ NII

On July 10, Wedbush analyst David Chiaverini said that “peak cycle net interest margins are behind us and weaker NIMs combined with slowing average earning asset growth should lead to continued net interest income pressure.” This implies that the analyst is predicting a slowdown in industry loan growth. Nonetheless, the credit quality could continue to stay strong, despite a slight reserve buildup (an amount kept aside to absorb losses on loans).

Which Bank Stock is Best to Buy Now?

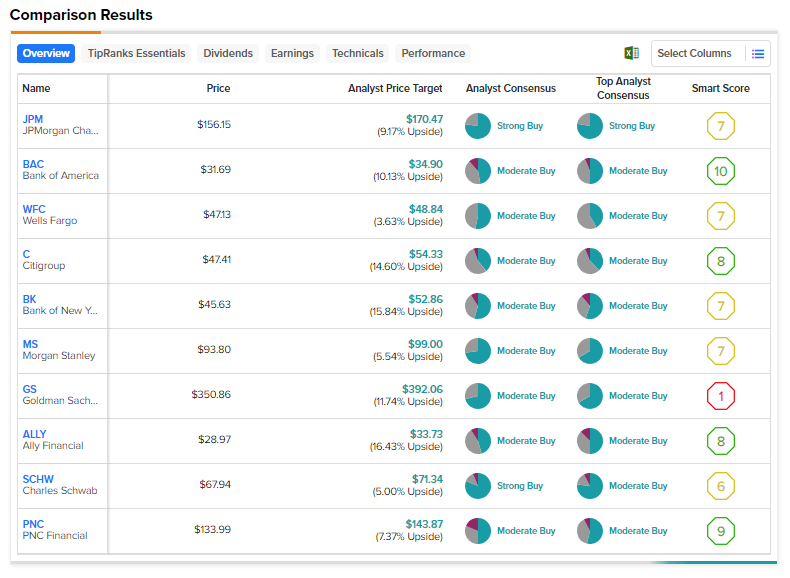

TipRanks’ Stock Comparison tool shows that JPMorgan Chase (NYSE:JPM) and Charles Schwab (NYSE:SCHW) sport a Strong Buy consensus rating. However, JPM is the only stock with a Strong Buy consensus rating from the Top Wall Street analysts.

For those who don’t know, TipRanks identifies the Top Wall Street analysts per sector, per timeframe, and against different benchmarks. The ranking shows an analyst’s ability to deliver higher returns through recommendations.

JPM emerges as a top bank stock due to its large scale and ability to offset higher funding costs with other products.

Jefferies analyst Ken Usdin reiterated a Buy recommendation on JPM stock on July 19. The analyst expects the bank to benefit from low-single-digit loan growth, modest increases in fee income, and higher rates.

The stock has received 14 Buy and four Hold recommendations from top Wall Street analysts. Their average price target of $170.33 implies 9.08% upside potential from current levels.

While Wall Street is most bullish about JPM stock, Ally Financial offers higher upside potential.

How High Will ALLY Stock Go?

Based on analysts’ consensus price target of $33.73, Ally stock offers an upside potential of 16.43%. Meanwhile, the stock has received five Buy, six Hold, and one Sell recommendations for a Moderate Buy consensus rating.

Goldman Sachs analyst Ryan Nash reiterated a Buy recommendation on ALLY stock on July 20. The analyst expects ALLY to benefit from improvements in net interest margin, tight cost control, and new loan originations.

Bottom Line

The banking industry will likely face headwinds from higher deposit costs, a continued decline in deposits, and increased competition. However, higher rates and modest loan balances could support NIIs. Also, banks with diversified revenue bases, strong balance sheets, and the ability to offset higher funding costs will be able to navigate the macro challenges well.