No matter what your preference in the stock market, the nature of the game is always going to revolve around returns. Without returns, there’s no point putting your money in the market. And few investment sectors can offer the high reward potential found in the healthcare segment, particularly biotech stocks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

These research-oriented pharmaceutical firms, despite their high overhead and long lead times, always have that ‘holy grail’ waiting: a new drug or medical treatment to get approval – and when that approval comes, so do the profits.

The potential in these names can often lead to powerful, triple-digit, upside for these stocks, and Bank of America analyst Jason Gerberry is pointing out 3 healthcare stocks with as much as ~160% upside potential for the coming year. By using the TipRanks database, we can also see whether the rest of the Street agrees these are stocks to own right now. Let’s take a close look.

Jazz Pharmaceuticals (JAZZ)

The first stock on our list, Jazz Pharmaceuticals, is one of the biotech firms that has reached that ‘holy grail.’ The company has both a portfolio of approved drugs on the market and an extensive pipeline of research projects, with drug candidates at various stages of the preclinical, clinical, and regulatory processes. Jazz, which has a market cap of $7.5 billion, focuses its work in the fields of neuroscience and oncology.

Those two medical/therapeutic areas frequently feature conditions that are both difficult to treat and lack effective treatments; Jazz is working to correct both issues. The company’s neuroscience segment addresses issues such as sleep disorders and epileptic seizure disorders, while the oncology side is working on therapeutic medicines for hematologic malignancies as well as solid tumors.

The company’s three strongest revenue-generating drugs are Xywav, Epidiolex, and Rylaze. Respectively, these are a treatment for excessive sleepiness during daytime; a cannabidiol used to treat seizures; and a treatment for acute lymphoblastic leukemia (ALL). Together, these were the key growth drivers in Jazz’s last reported quarter, 3Q23, and showed a combined year-over-year revenue increase of 24%.

On the pipeline side, Jazz’s leading drug candidate is zanidatamab. This oncology drug candidate is undergoing late-stage clinical studies for the treatment of gastroesophageal adenocarcinoma, a common cancer that is also the third-leading cause of cancer-related deaths globally. Data from this study is expected during 1H24. In addition, Jazz is on track to complete it rolling BLA submission for zanidatamab in the treatment of 2L BTC (biliary tract cancers) during the first quarter of this year.

This company’s combination of a research pipeline with approved drugs on the market makes Jazz unusual for a biotech firm in an important respect: the company is net-profitable. In the last reported quarter, 3Q23, Jazz showed a total top line revenue figure of $972 million. This was up 3.3% year-over-year and came in $2.8 million better than had been expected. The company’s non-GAAP bottom line, the EPS of $4.84, was down from the $5.17 reported in the prior-year quarter, and missed the forecast by 9 cents per share.

In covering this stock for Bank of America, Jason Gerberry notes that Jazz shares have been underperforming, giving investors and opportunity to buy in at a discount. He writes, “In 2023, JAZZ was an underperformer (-23% vs +5% DRG) largely due to the emergence of competition to Jazz’s oyxbate business and no offsetting pipeline updates. Heading into 2024, we believe it will be important for Jazz to demonstrate sustained growth of its longer-duration assets (Xywav-IH, Epidiolex, Rylaze), generate some pipeline success and consummate a high-quality business development transaction. At Jazz’s current ’24 P/E and EV/EBITDA multiples both <7x, we believe the stock trades at floor value and we see risk/reward meaningfully skewed to the upside.”

Gerberry complements his commentary with a Buy rating and a $184 price target that suggests a one-year upside potential of 56%. (To watch Gerberry’s track record, click here)

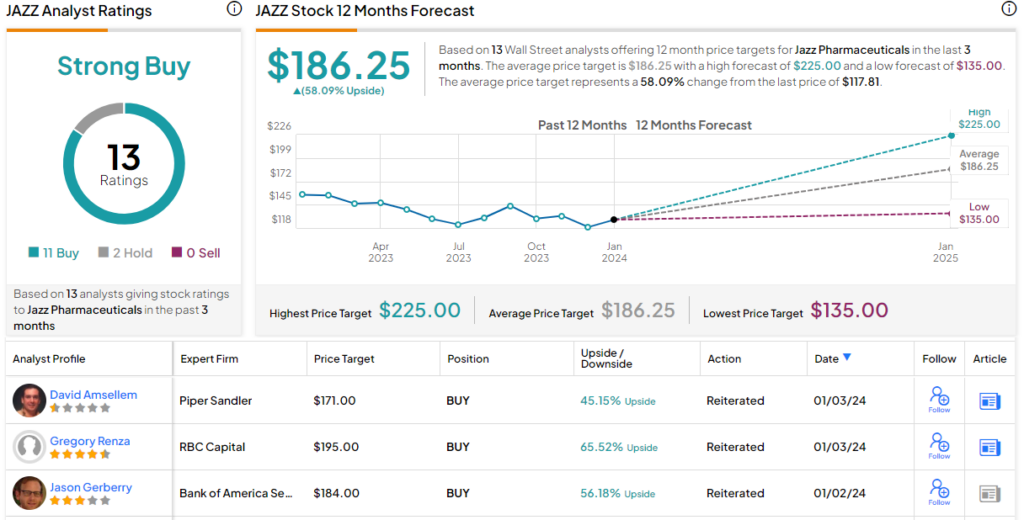

Overall, JAZZ has a Strong Buy consensus rating, based on 13 reviews with an 11 to 2 breakdown of Buy versus Hold. The shares are trading for $117.81 and their $186.25 average target price implies the stock will gain 58% this year. (See JAZZ stock forecast)

Relay Therapeutics (RLAY)

Next on our list of Bank of America health stock picks is Relay Therapeutics, a precision medicine firm with novel drug candidates at both the preclinical and clinical stages of the research process. The company is working on first-in-class therapeutic agents for the treatment of various intractable disease conditions, including cancers and genetic diseases.

The company is pursuing the development path using its Dynamo platform. This is a drug discovery platform using novel technology and techniques, including leading-edge computational approaches, to create new drug candidates to target conditions that had previously proven resistant to treatment. Using this platform, Relay has developed a pipeline of 6 drug candidates.

Amongst these, there is RLY-4008, which targets FGFR-2 altered solid tumors. Recently reported data, based on clinical studies through August 23 of last year, showed clinically significant positive responses to treatment in up to 40% of patients, with some therapeutic effects lasting as long as six months. The company has completed enrollment for a pivotal expansion cohort for continued studies.

The next drug candidate of note, RLY-2608, is the potential treatment for PIK3CA mutant breast cancer. The company is expanding its study of this drug candidate, to add combination studies and to target additional types of breast cancer, such as PI3Kα-mutant, HR+, HER2- locally advanced or metastatic breast cancers, and expects to complete its early-stage studies during 2025.

Maintaining a cutting edge research and development pipeline does not come cheap – but Relay has deep pockets. In its last quarterly update, the company extended its cash runway by up to 1 year, stating that it has cash and cash equivalents of $810.6 million, enough to fund its ‘current operating plan’ as far forward as 2H26.

When we turn to analyst Gerberry’s stance, we find him bullish on future studies of both leading programs. Gerberry writes of Relay, “In 2023, Relay (RLAY) underperformed biotech peers (-26% vs +8%) as initial clinical data of RLY-2608 (PIK3CAi; value driver) in 2L+ metastatic breast cancer (mBC) came in below Street’s expectation. Nonetheless, RLAY continues to progress two lead programs (PIK3CAi, FGFR2i) through dose expansion trials and expects to provide clinical data updates for both in 2024. Trading at $400-500m EV, we believe the Street is mainly giving RLAY credit on cash and FGFR2i while expectations for PIK3CAi (RLY-2608) are relatively low even though ‘2608 targets a much larger commercial opportunity. In 2024, we see ‘2608 updates as key to stock upside.”

These comments support the analyst’s Buy rating here, and his $27 price target indicates his confidence in a one-year upside of a hefty 159% for the stock.

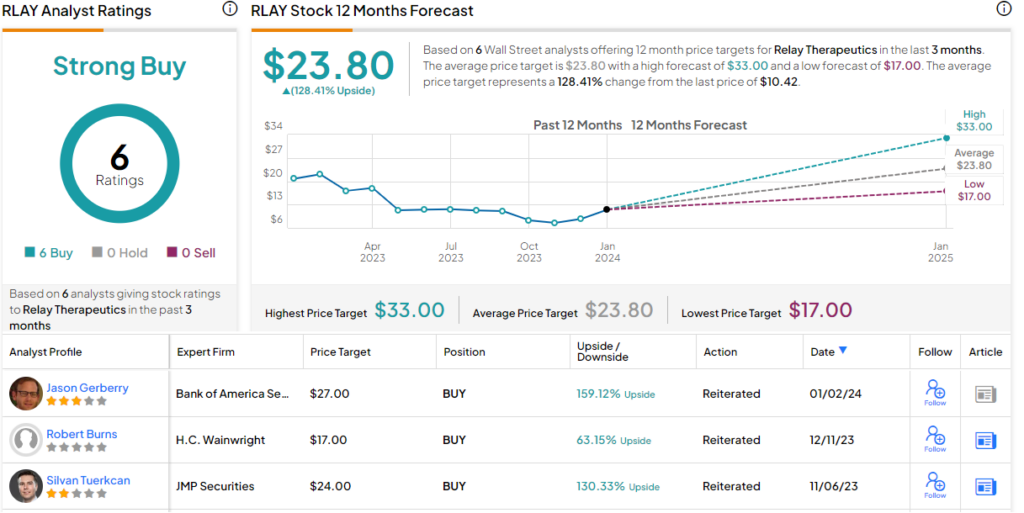

The Strong Buy consensus rating on RLAY is unanimous, based on 6 positive analyst reviews. The shares have a current trading price of $10.42 and an average target price of $23.80; together, these imply a 128% gain in the coming year. (See Relay stock forecast)

Arrowhead Pharmaceuticals (ARWR)

We’ll wrap up this list with Arrowhead Pharmaceuticals, a biotech that is working with the RNAi mechanism, or RNA interference, to develop treatments for diseases that are rare and/or intractable and have resisted treatment. Arrowhead has created various therapeutic agents suitable for delivery through the RNAi-based mode that will target specific genes involved in the disease expression.

The company’s approach is based on the ubiquity of the RNAi mechanism. The process is part of all living cells, and naturally inhibits the expression of specific genes, resulting in alteration or prevention of protein production. RNAi is a highly specific mechanism, which makes it uniquely suited for use in the treatment of genetic diseases; the delivery mechanism is precisely targeted, and takes the therapeutic agent to the exact location where it is needed.

Arrowhead is another biopharma with a proprietary platform. The company uses its TRiM platform (Targeted RNAi Molecule) to create a ligand-mediated delivery with precise, tissue-specific targeting carrying a structurally simple therapeutic agent. Building on this platform, Arrowhead has set up a pipeline that features multiple drug candidates, and has targeted a wide range of conditions, including various liver diseases, gout, hepatitis, myotonic dystrophy; in all, the company has 16 active research tracks.

The company’s more advanced research tracks include two drug candidates with recent updates, plozasiran and zodasiran. These new therapeutic agents are under investigation as treatments for hypertriglyceridemia and dyslipidemia. These are both conditions related to cholesterol levels in the blood, and can lead to cardiovascular complications. In recent data releases, the company showed significant progress for each drug candidate. To support an NDA (new drug application), the company expects to report Phase 3 FCS topline data for plozasiran in Q2.

In his coverage of this stock, BoA’s Gerberry outlines a path forward, and explains why he believes investors should buy in now: “In 2023, ARWR was an underperformer (-24% vs +8% XBI) due to cash runway concerns and lack of meaningful (step-up) de-risking catalysts. However, in ’23, we believe Arrowhead took key steps to advance its extra-hepatic siRNA platform with ARO-RAGE pulmonary program hitting chronic safety tox and target knockdown milestones. We are buy-rated on ARWR as we believe the company has favorable risk/reward into 2024 that includes catalysts for cardiovascular and respiratory programs…”

Gerberry goes on to rate the shares as a Buy, and he gives the stock a price target of $51 to imply a one-year upside of 50%.

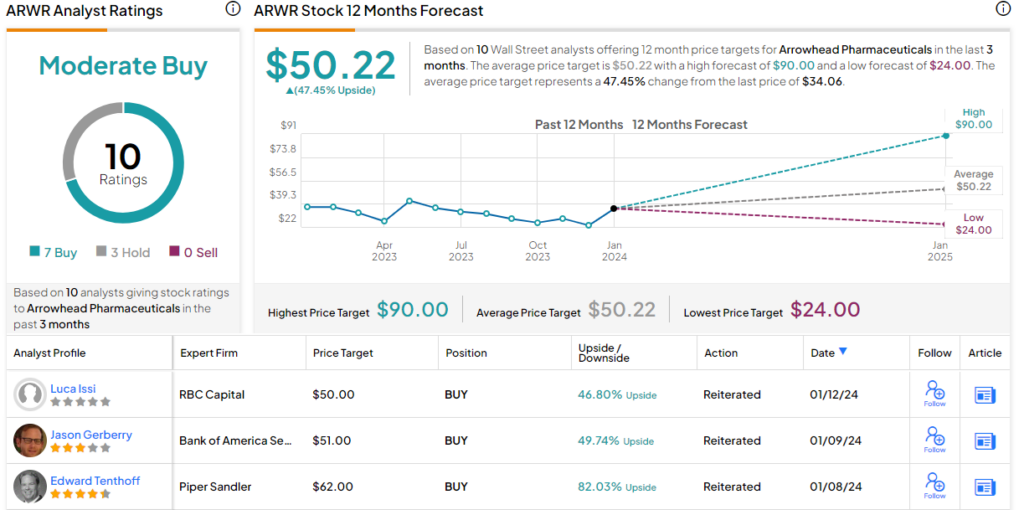

Arrowhead gets a Moderate Buy consensus rating, based on 10 Wall Street reviews that favor the Buys over Holds by 7 to 3. The shares are priced at $34.06 and the $50.22 average price target suggests the stock will appreciate by 47% by the end of the year. (See Arrowhead stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.