Are the US and China heading for a trade war again? Those were the questions on investors’ minds after last week’s market drop, triggered by renewed trade tensions between the world’s two largest economies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It started with China, which announced plans to impose export controls on rare earth elements and certain products containing them – a critical category of materials used in everything from smartphones and EVs to military systems. China currently dominates roughly 70% of the global supply of rare earths, giving it significant leverage in this space.

In response, President Trump initially announced sweeping new tariffs – in some cases up to 100% – on Chinese imports, raising fears of an all-out trade conflict and sending markets tumbling on Friday. The S&P 500 slid 2.71%, while the tech-heavy Nasdaq dropped 3.56%.

Over the weekend, however, Trump appeared to soften his tone, saying: “Don’t worry about China, it will all be fine!” The comment helped calm investors, with U.S. stocks moving higher ahead of the week’s trading.

Even though volatility has returned, that doesn’t mean investors should stay on the sidelines. Pullbacks like this can sometimes open the door to attractive entry points in quality names. Bank of America’s analysts share that view, highlighting two stocks they believe offer solid opportunities. We’ve opened up the TipRanks database to take a closer look at their picks.

Darling Ingredients (DAR)

The first company we’ll look at here is Darling Ingredients, a firm with its hands in several areas: recycling, food tech, and agribusiness. Darling has built its business by collecting waste materials from the animal husbandry, agriculture, and food industries and using those materials as the base to create new, useful products in feed, food, and fuels. Darling’s end products include animal feeds, human food products and additives, and renewable biofuels.

The company’s work is split among those three main segments. On the feed side, Darling produces a range of essential ingredients, including fats and proteins, that are used in animal nutrition, for both livestock and pets. The company’s feedstock fats are also an essential base ingredient for the biofuel industry. Darling is the largest rendering company in the global feed market.

Turning to human food, Darling has a reputation as a global leader in gelatin and collagen solutions. The company has 16 factories around the world and sells its products in more than 80 countries. The company’s gelatin products are used as stabilizers, clarifiers, and thickeners in a wide variety of food products, while the collagen products are used in the health and wellness sector. Darling is also known for producing natural protein ingredients for the meat industry and has its hands in the biopharmaceutical field, where it provides medical-grade gelatins. We should note here that Darling and Tessenderlo Group have entered into a joint venture, dubbed Nextida, that will combine the two companies’ collagen and gelatin segments. The venture will be 85% owned by Darling and is projected to generate $1.5 billion in revenue.

Finally, Darling’s fuel segment produces renewable biodiesel, sustainable aviation fuels, and biogas. The biodiesel is derived mainly from cooking oil and animal fats, and the company produces approximately 1.2 billion gallons per year. Darling’s aviation fuel is also produced from waste fats and oils, while the biogas is generated from food waste and pig manure.

Turning to Darling’s last financial report, which covered 2Q25, we find that Darling generated $1.5 billion in net sales for the quarter, representing a 1.4% year-over-year increase—but also just missing the forecast, coming up $804,000 short. At the bottom line, Darling’s 8-cent EPS represented a year-over-year decline of 41 cents and was 23 cents per share less than had been expected.

Despite the miss on the Q2 results, Bank of America’s Conor Fitzpatrick sees plenty of potential in Darling Ingredients. The shares are down approximately 10% this year, but Fitzpatrick writes of Darling, “We see a robust recovery in RD margin based on 2026 RINs demand growth. RD margins have been the main driver of total EBITDA revisions and stock performance over the last several years, so we rate Buy expecting RD margins to recover and for share prices to also rise. Long-term value is additionally supported by Feed volume growth due to policy-related demand targets. Assuming the Food Nextida gelatin & collagen JV is finalized, accretive monetization of that JV could be an additional catalyst.”

That Buy rating is accompanied by a $45 price objective that suggests a one-year upside potential of 49.5%. (To watch Fitzpatrick’s track record, click here)

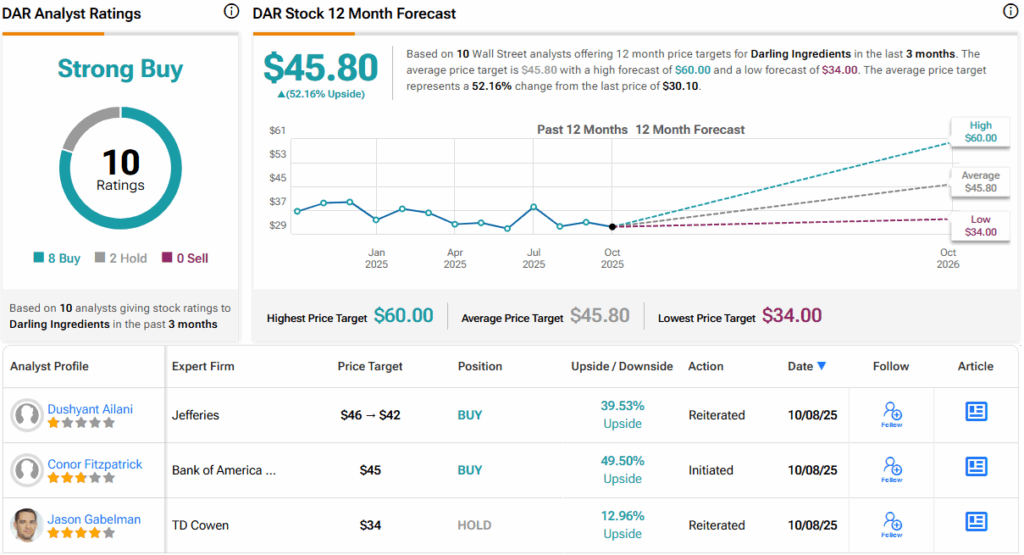

Overall, Darling’s stock has a Strong Buy consensus rating on the Street, based on 10 reviews that include 8 to Buy and 2 to Sell. The stock is priced at $30.10, and its $45.80 average target price implies a gain of 52% in the next 12 months. (See DAR stock forecast)

Karat Packaging (KRT)

Next on our list, Karat Packaging, is a $460 million company listed on the NASDAQ – and living, as its name suggests, in the packaging industry. Karat produces a wide range of products, from single-use cups to cleaning chemicals for the janitorial sector. The company is best known as a packaging supplier for the food and beverage industry, where it supplies professional-grade disposable food packaging, compostable food packaging, a diverse line of beverage supplies, and janitorial supplies.

On the food packaging side, Karat produces a wide range of traditional food packaging products, from single-use cups to paper bags and foldable boxes fit for custom printing. Customers can find paper, plastic, and cardboard food packages, cups, and delivery boxes, along with supplies such as aluminum pans and foil. The company also provides restaurant supplies, such as paper napkins, plastic cutlery, and sealing tapes. Karat Earth offers many of these same products, but derived from compostable materials and entirely environmentally safe.

Karat’s smaller product lines involve janitorial supplies and tea. The company’s newest brand is Total Clean, a line of janitorial cleaning supplies designed to remove tough stains and leave clean rooms – everywhere, from the office to the break room to the bathroom. Finally, Karat’s Tea Zone is a line of tea-based beverage products, including tea leaves, syrups, drink powders, and even the popular boba teas.

The company has built a large customer base, firmly set on major enterprise clients. These include such well-known food industry names as Sonic and In-n-Out, Chipotle Mexican Grill, Cinnabon, and Dave & Busters. Karat’s products are also available online, through Amazon and Walmart, and the company’s own subsidiary brand, Lollicup.

Karat also pays out a dividend. The most recent was declared on August 5 and paid out on August 27. At its 45-cent rate, the dividend annualizes to $1.80 per common share and gives an impressive forward yield of 7.8%.

Turning to the financial results, in its last reported quarter, 2Q25, Karat showed a top line of $124 million, up 10% year-over-year and a hair over the forecast, beating by $486,000. The company’s bottom line in the quarter came to a net loss of 57 cents per share, which missed the estimates by 3 cents.

This stock has caught the attention of George Staphos, who likes the way that the company has rolled with the tariff punches. In his write-up for Bank of America, Staphos says, “We rate KRT at Buy as we see positive trends in bags boosting the stock in the near term. KRT has been able to modify its supply chain to adapt to the current tariff environment, and we see incremental demand for bags (due to regulatory and other sustainability trends) as positive for the stock.”

Staphos complements his Buy rating with a $31 price objective that points toward a gain of 35% on the one-year horizon. (To watch Staphos’ track record, click here)

There are only three recent analyst reviews on file for Karat’s stock, and the 2-to-1 split, favoring Buy over Hold, gives the shares a Moderate Buy consensus rating. The stock is currently trading for $23.02, and its $33 average target price implies a 43% gain by this time next year. (See KRT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.