Most financial experts think that the market won’t be able to keep going up for long this year. Against a backdrop of a looming recession, most financial commentators are talking up the prospect of more uncertainty ahead.

But not everyone. In fact, the strategy team at Bank of America believes there are plenty of reasons for owning stocks right now. Market sentiment is resolutely bearish, and a recession is practically accepted by everyone – both offering a chance for a contrarian take. And there’s trillions in ‘dry powder’ waiting to enter the market, while there’s also the prospect of the Fed taking a step back from its rate-hiking activities.

BofA also has an idea where the best opportunities are right now. “In what feels like a conviction-less market, we have high conviction in upside risk cyclical sectors within the S&P 500 this quarter,” said team leader Savita Subramanian.

So, let’s take a look at a couple of names that fit such a description. We opened the TipRanks database and got the lowdown on two stocks that share a particular set of attributes: cyclical stocks by nature, part of the S&P 500, and both boasting a Strong Buy consensus rating. Here are the details.

Constellation Brands (STZ)

We’ll start with Constellation Brands, a giant of the consumer-packaged goods segment. The alcoholic beverage leader oversees a drinks portfolio with many household names amongst the 100+ brands. From Corona, Modelo Especial and Negra Modelo on the imported beers list to spirits including Svedka vodka, High West Whiskey and Casa Noble Tequila to a wine collection including Robert Mondavi, the Prisoner Wine Company and Ruffino. Aside from being the U.S.’s biggest beer importer by sales, Constellation also boasts of cannabis and healthcare investments.

Investors seemed sanguine about the company’s latest financial statement, for F4Q23, despite the report not hitting all the right notes. Revenue hit $2 billion, coming in $20 million below expectations although the company highlighted the beer business’s outperformance which showed depletion growth of over 6% with Modelo Especial and Corona Extra leading the way. At the other end of the scale, EPS of $1.98 fared better than the $1.84 forecast.

For the year ahead, the company sees EPS hitting the range between $11.70-$12.00, at the midpoint above consensus at $11.80. Constellation also announced that the quarterly dividend would rise by 11.3% to $0.89 from $0.80 per share. The payout currently yields 1.43%.

Assessing Constellation’s prospects, RBC analyst Nik Modi thinks the latest financial results should go some way toward assuaging prior worries.

“This quarter’s performance and guidance should ease some investor concerns regarding the underlying health of Constellation’s beer business,” the 5-star analyst writes. “Better-than-expected depletions (despite the poor weather in CA) and initial FY’24 guidance that was in line with management’s previous commentary should also give the bulls something to be encouraged by… Mgmt. called out STZ has been doing extremely well in shelf reset situations with their portfolio representing more than 80% of the growth in beer. Distribution gains (on and off premise) should support STZ growth in markets once weather trends normalize.”

Accordingly, Modi rates STZ shares an Outperform (i.e., Buy), while his $295 price target implies 29% upside potential from current levels. (To watch Modi’s track record, click here)

Most on the Street agree with Modi’s thesis. The stock garners a Strong Buy consensus rating based on 13 Buys vs. 3 Holds. (See STZ stock forecast)

PG&E Corporation (PCG)

Let’s continue with a big name in the utilities space. PCG is the holding company behind Pacific Gas & Electric Company, an electric and gas utility offering services to 16 million people across Northern California. Specializing in energy, utility, power, gas, electricity, solar and sustainability, Pacific Gas & Electric has 5.5 million electric customer accounts and 4.5 million gas customer accounts under its belt. With a workforce numbering roughly ~26,000 employees, it is one of the biggest utility names in the US.

That said, the company comes with a loaded history and was forced to go bankrupt in January 2019 following devastating wildfires caused by its equipment. Since then, the company has improved its safety measures, undergone leadership changes, and committed to investing in infrastructure to prevent future disasters.

Last month the company submitted to California’s Office of Energy Infrastructure Safety its new WildfireMitigation Plan, whereby it intends on spending $18 billion in wildfire prevention through 2025.

It’s the concerted efforts to avoid repeating the mistakes of the past which forms part of Ladenburg Thalmann analyst Paul Fremont’s thesis.

“Following the completion of the company’s plan to underground 10,000 miles of its distribution lines, we believe the company will have effectively eliminated its exposure to wildfires,” the analyst explained. “Meanwhile, California has set aside a $20 billion wildfire fund to pay for near term fire exposure. Additionally, the current level of rate base investment supports our forecast of 10% EPS growth through 2025 which is among the highest in the utility sector.”

To this end, Fremont rates PCG shares a Buy, while his $20.50 price target suggests the shares will climb 20% higher in the year ahead. (To watch Fremont’s track record, click here)

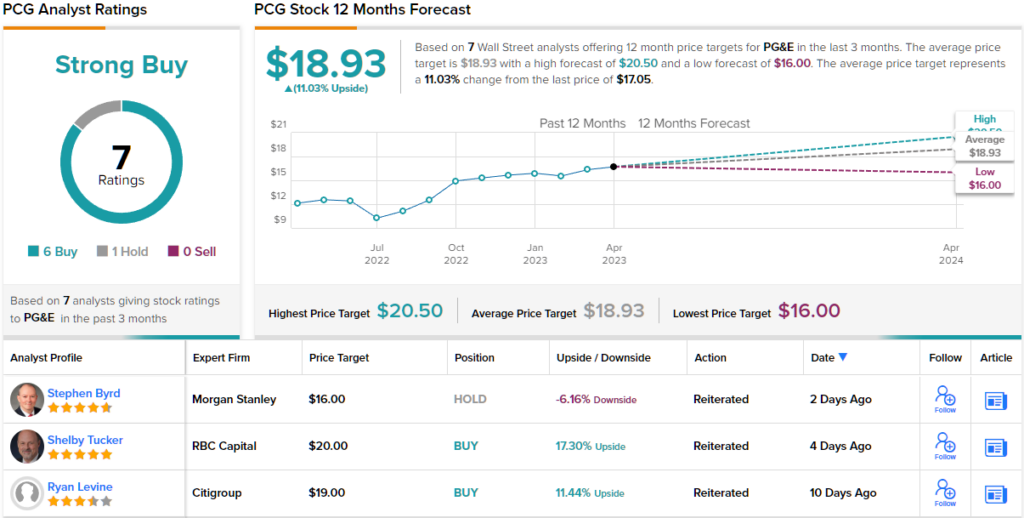

Elsewhere on the Street, the stock garners an additional 5 Buys and one Hold, all coalescing to a Strong Buy consensus rating. (See PCG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.