No matter how the economy turns, today’s digital world will always put a premium on effective cybersecurity.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This past year has been a good example. Markets rose despite serious macroeconomic headwinds in the form of persistent inflation and rising interest rates, and companies’ IT budgets proved to be particularly resilient. Firms simply couldn’t cut back on the cybersecurity spend when they were moved to trim the fat. The result was a set of sound gains in the cybersecurity sector.

These companies have already proven their worth, and their performance in recent years justifies investors’ confidence. A recent note from Bank of America’s 5-star analyst Tal Liani lays out a strong case for staying invested in these stocks:

“Cybersecurity is a highly defensible area of IT spend and should remain a top secular theme for technology and software investors in 2024, especially as enterprise security budgets should increase over the next twelve months,” Liani opined.

Liani has backed this stance with several specific recommendations, including two that he describes as ‘top picks.’ Are other analysts on Wall Street displaying confidence in these equities too? We used the TipRanks database to find out.

Fortinet (FTNT)

The first Bank of America pick is California-based Fortinet, a driving force in the combination of networking and cybersecurity. The company offers customers an integrated portfolio featuring more than 50 high-end, enterprise-grade cybersecurity software products, including firewalls, endpoint security, intrusion prevention, anti-virus systems, and zero-trust access platforms. Fortinet’s customers use the products to protect online security in a range of digital arenas, including data, networks, and system users.

Leveraging both the essential nature of cybersecurity and the known quality of its products, Fortinet has seen a steady trend over the past few years of year-over-year increases in both revenues and earnings. However, the company’s stock, which was rising steadily through July of last year, saw two heavy hits in 2023. These came in early August and early November, after the company reported its results for Q2 and Q3 of 2023.

Zoom out, and those results looked good – Fortinet had sound year-over-year gains at both the top and bottom lines. But look into the drop-downs, and we find that the company’s forward bookings are not keeping pace with the increases in revenue or earnings, and management has pared back predictions for growth going forward. Mind you, they are not predicting a downturn for the company, only that the pace of growth will slow down.

So let’s look into this company’s last earnings release, from 3Q23. Fortinet reported $1.33 billion at its top line; while this missed the forecast by $20 million, it was up 16% year-over-year. The company reported the bottom line as a non-GAAP diluted EPS of 41 cents; this was 5 cents per share better than had been anticipated. The company also reported $1.49 billion in billings for 3Q23, a total that was up 5.7% compared to the prior-year quarter. This is the figure that had investors worried, as it indicates a potential slow-down in the rate of future growth.

Despite that, Fortinet saw its cash flow from operations increase year-over-year, from $483 million to just over $551 million. Looking ahead, the company’s management is predicting 4Q23 revenue between $1.38 billion and $1.44 billion, below the $1.49 billion consensus, and billings between $1.56 billion and $1.7 billion. We’ll see on February 6 how this guidance matches up to reality when the company releases its 4Q23 results.

For Bank of America’s Tal Liani, current slowdown is less important here than Fortinet’s longer-term potential. The analyst, who is rated by TipRanks in the top 5% of Wall Street’s analysts, writes of this cybersecurity firm, “Fortinet continues to offer a unique investment opportunity in our view. The company significantly underperformed peers in 2023, up 15% compared to cybersecurity average of 75%+ and is in the midst of a firewall market downcycle. Despite two weak quarters ahead, we focus on our expectations for growth recovery in 2H24. Investor concerns have centered around a prolonged downcycle, yet our analysis suggests that once we exclude non-Firewall revenues and price hikes, the required absorption of excess historical demand represents less than one month of shipments, suggesting that demand should begin to show signs of recovery in 2H24.”

For Liani, this adds up to a Buy rating, and his price target, increased to $75, implies a one-year gain of 13.5% for the shares. (To watch Liani’s track record, click here)

Other analysts are more cautious here, treating this as a ‘show-me’ stock. The 32 recent analyst reviews break down to 7 Buys and 25 Holds, for a Hold consensus rating. (See Fortinet stock forecast)

CyberArk Software (CYBR)

Next on the list is CyberArk, a software company and a global leader in the fields of identity security and access management. These are vital areas, at the root of all effective cybersecurity – controlling who can access an online site, database, or platform, and how those people or entities must confirm just who and what they are. CyberArk’s Identity Security Platform is the firm’s flagship product, a platform that secures access to any resource or environment, from any location or device, by both humans and machines.

The company also offers a range of privileged access management solutions, for managing privileged accounts, to monitoring secured areas, to securing cloud access. In all of these areas, users can set limits on individuals’ access, improve security on particular parts of sites, and define the secured credential requirements for site entry. CyberArk’s security protocols can be used for both physical on-site and remote access systems.

CyberArk and its products have proven particularly popular with energy, retail, financial services, healthcare, and government entities, all of which have varying levels of exposure to confidential or personal data from customers or service users. CyberArk’s platforms, with their particular strength in controlling both workforce and customer access to company networks and databases, have proven themselves expert at securing data while also protecting user identities and credentials.

This company has reaped strong benefits from the expansion, over the past several years, of remote work. As more office workers shifted to a work-from-home situation, the need for securing remote access has also grown. One result can be seen in the upward trend of CyberArk’s revenues post-COVID, and another in the company’s share gains last year. CYBR stock outpaced the NASDAQ, appreciating by more than 75% in the last 12 months. This is compared to the index’s nearly 35% gain in the same period.

A look at CyberArk’s last financial release, from 3Q23, shows that the company had solid results, beating the forecasts across the board. The firm’s quarterly revenues came to $191.2 million, up 25% y/y and some $6.6 million ahead of the estimates. The bottom line figure, the non-GAAP diluted EPS of 42 cents, was 19 cents per share over the forecast. Better, for the company’s future bottom line, total annual recurring revenue came to $705 million, up 38% year-over-year.

Turning again to the views of top analyst Tal Liani, we find that he taps CyberArk’s ‘access’ niche as a specific strength of the company, one that opens up plenty of vistas for the next few years.

“We believe CyberArk’s product and positioning is unique. The TAM of the Privileged Access Management market continues to expand, as does the definition of who is considered a privileged user, supported by digitalization and the transition to Cloud. The current TAM for PAM is $20bn, up from $9bn in 2020, and we highlight that the overall market penetration is less than 5%, leaving plenty of room for growth. Additionally, the company is a market leader in a critical area of cybersecurity spend, and secular tailwinds should support continued acceleration of growth through CY26,” Liani opined.

Based on these comments, Liani rates CYBR shares as a Buy, while his $255 price target suggests a one-year upside potential for the stock of 10%. (To watch Liani’s track record, click here)

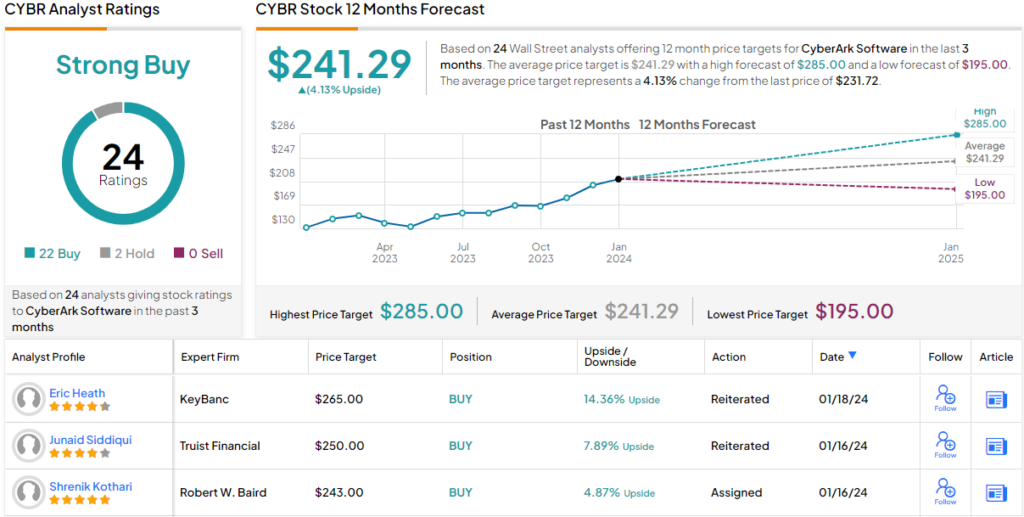

It’s clear, overall, that Wall Street is also bullish here; the stock has 24 recent reviews that include 22 Buys and 2 Holds for a Strong Buy consensus rating. (See CYBR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.