The markets have mostly been in a downtrend since midway through the summer, with a pensive mood driving the narrative. Concerns include higher oil prices, the prospect of interest rates remaining elevated for the time being, while worries about a recession are yet to abate.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, a new note from Bank of America’s head of US equity & quantitative strategy, Savita Subramanian, sets out the bullish case for the final quarter of 2023.

“I see far more bullish indicators for mid and large-cap stocks than I do bearish,” Subramanian noted. “What I find interesting is that every day a new bearish narrative emerges.”

Those ‘bullish indicators’ include the opportunities remaining for those yet to reap the benefits of AI, a ‘renaissance’ for US manufacturing, and the fact that everyone is now getting bearish, which is usually a good sign that the markets are about to take off.

In fact, Subramanian thinks a recession has already been averted, and she recently raised her end-of-year target for the S&P 500 from 4,300 to 4,600, suggesting the index will add another 7.5% by the end of 2023.

So, which stocks should investors be loading up on in anticipation of the bull market’s resumption? The analysts at Bank of America have an idea about that too and have been pointing investors toward the names they think stand to gain against this backdrop. We decided to get the lowdown on a couple of their recent picks and ran them through the TipRanks database for a fuller view of their prospects. Here’s what we found.

Nutanix, Inc. (NTNX)

First up is Nutanix, a tech firm in the cloud software world. Nutanix works to solve the unique challenges of cloud software and has developed a platform to bring together public cloud simplicity and agility with private cloud performance and security, based on several sound pillars: unified management, one-click ops, and automated AI. At bottom, the company makes hybrid multi-cloud operations both simple and cost-effective for users.

Those users include an array of well-known names, including Vodafone, AAA, and Home Depot. Nutanix’s platform lets them – and all of its customers – conduct cloud operations smoothly, adding apps, deploying and managing new features, and improving storage, visualization, and networking.

Cloud computing is an expanding niche, and Nutanix has leveraged it for a turn to net profits in recent quarters. The last three quarterly reports all showed non-GAAP EPS coming in at a net profit, a switch from regular net losses, supported by rising revenues.

In the last quarter reported, for fiscal 4Q23, Nutanix had a top line of $494.2 million, up 28% year-over-year and 18% better than the forecasts. The company’s bottom line came in at 24 cents per share by non-GAAP measures, or 8 cents ahead of the forecast. In a metric that bodes well for Nutanix going forward, the company’s annual contract value (ACV) billings jumped 44% year-over-year in fiscal Q4, from $193.2 million to $278.7 million. Annual recurring revenue, or ARR, was up 30% year-over-year, rising from $1.2 billion to $1.56 billion.

Bank of America analyst Wamsi Mohan is impressed with Nutanix’s execution in recent months, writing, “We see fundamentals improving over the next few years including ACV billings, revenue, and operating margin. We see renewals driving a higher portion of ACV billings growth post F24, which can lead to more stable revenues, and expect operating leverage through lower cost of renewals. The new ‘GPT-in-a-Box’ offering, Cisco partnership and potential share gains are upside levers. We move to a Buy, from Neutral, as NTNX drives higher growth and profitability and more stable FCF.”

Mohan complements his upgraded Buy rating with a $50 price target that implies a one-year upside potential of 38%. (To watch Mohan’s track record, click here)

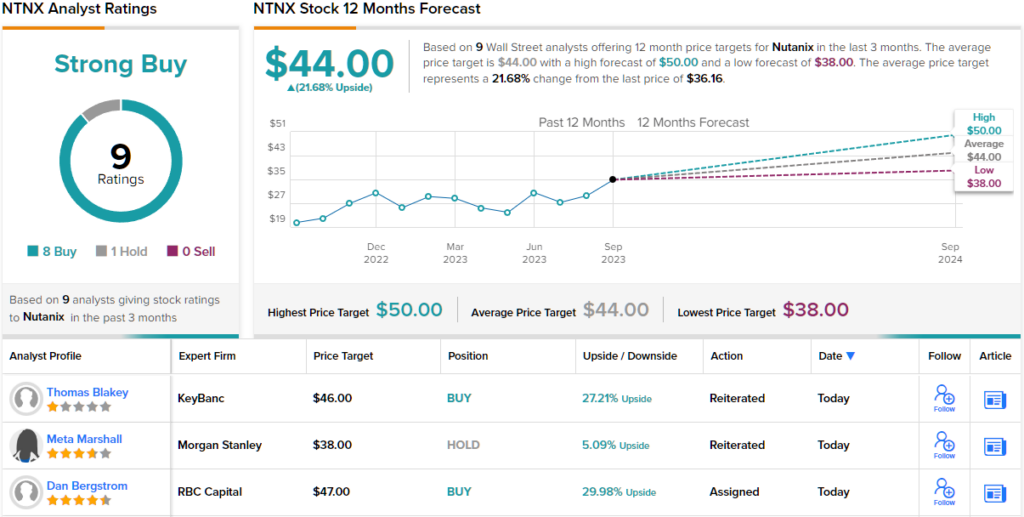

Overall, Nutanix has picked up a Strong Buy consensus rating from the Street’s analysts, based on 9 recent reviews that include 8 Buys and 1 Hold. The stock has a current trading price of $36.24 and an average price target of $44, suggesting ~22% gain on the one-year horizon. (See Nutanix stock forecast)

Fisker, Inc. (FSR)

The second stock we’ll look at is the brainchild of Henrik Fisker, the automotive design expert behind many of BMW’s luxury vehicles. Fisker started his eponymous car company in 2016, based in Los Angeles, to cash in on the coming electric vehicle (EV) boom. His company is designing and building the Fisker Ocean, a high-performance, all-electric SUV that entered full production earlier this year.

In its last production update, dated September 26, the Fisker company reported having made 900 customer deliveries this year and expects to deliver ‘several hundred’ more vehicles this week. These deliveries come from a total of 5,000 Fisker Oceans that have been built so far. The company expects to reach a milestone delivery pace of 300 vehicles per day to customers in the US and Europe later this year.

The switch to regular vehicle production and the jump in vehicle deliveries gave Fisker its first quarter of net positive automotive sales revenue. In the company’s 2Q23, it reported total revenue of $825,000, compared to just $10,000 one year earlier.

Realizing a positive revenue total, however modest, had an effect on Fisker’s earnings, and the company’s net loss, reported at 25 cents per share, was a noticeable improvement over the 2Q22 net loss of 36 cents per share. The 2Q23 figure came in 1 cent better than the estimates.

For Bank of America’s John Babcock, the key point here is that Fisker has started regular production and deliveries, which should lead to steadily increasing volume, revenue, and earnings heading into next year.

“FSR should see a sharp inflection in revenue, earnings and volume in 2024 with the ramp in production of the Ocean CUV. While this shouldn’t be a surprise to investors, the milestone on its own could serve as a key catalyst for the stock and particularly as the company has pushed back production targets due to supply chain issues. Ultimately, the ramp in volumes should get FSR to EBITDA breakeven in 2024 on revenues that we project will approach $3bn, up sharply from $1.2bn in 2023E and only $342k in 2022,” Babcock opined.

For Babcock, all of this points toward a Buy rating on the stock, and his price target, of $8, indicates his confidence in a 33% upside over the next few months. (To watch Babcock’s track record, click here)

All in all, Fisker’s 6 recent analyst reviews break down to 5 Buys and 1 Sell, giving this EV maker a Moderate Buy consensus rating. The stock’s average price target, now set at $10.20, implies a robust 70% gain by this time next year, from the current share price of $6. (See FSKR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.