We’re well into Q4, and investors are positioning their portfolios for the coming year. As always, the key is identifying stocks poised to deliver solid returns, and Bank of America has highlighted strong choices for those seeking high-growth opportunities.

BofA’s analysts aren’t limiting their focus to just one part of the market; they are looking across sectors at a diverse group of stocks – and they are looking ‘under the hood’ to find shares that are ready to jump.

With that in mind, we turned to the TipRanks database to review two of Bank of America’s latest stock picks, both of which present strong upside — including one with a potential gain of nearly 390%.

In fact, the banking giant isn’t the only one backing these names; both stocks are rated as ‘Strong Buys’ by the broader analyst consensus. Let’s take a closer look and find out what the optimism is all about.

Werewolf Therapeutics (HOWL)

We’ll begin in the world of biotherapeutics, where Werewolf Therapeutics is developing new immunotherapy drugs specifically designed to reduce the common and severe side effects often associated with cancer treatment. The company has created a proprietary development platform, known as PREDATOR, to engineer conditionally activated molecules that stimulate both the adaptive and innate functions of the immune system. With this approach, Werewolf has successfully advanced two drug candidates into clinical trials.

Both products are INDUKINE molecules, a proprietary development, and are designed to selectively activate in tumor tissues while remaining inactive in peripheral tissues, a feature intended to reduce the occurrence of unwanted off-target effects while maximizing the anti-tumor immune response. Werewolf’s goal is to create anti-cancer drugs with higher tolerability levels than existing treatments.

Werewolf’s lead drug candidate, WTX-124, is being developed to treat solid tumors and is under investigation as both a monotherapy and in combination with Keytruda. The company is enrolling patients in a Phase 1 open-label, multicenter study – a first-in-human trial of the drug. At the ASCO Annual Meeting in June 2024, the company shared new interim results from the monotherapy dose-escalation arm, along with early data from the combination arm. The latest data highlighted WTX-124’s clinical activity and its overall tolerability in patients. Dose escalation in the combination study section is ongoing, with updated data expected by year-end.

The company’s second candidate, WTX-330, is focused on treating advanced or metastatic solid tumors as a monotherapy. Early data from its Phase 1 trial, also presented at ASCO, showed promising outcomes in patients with advanced solid tumors or Non-Hodgkin Lymphoma. Werewolf plans to release further updates later in this quarter.

Despite a 47% drop in the stock price this year, could this present a prime buying opportunity? Bank of America’s 5-star analyst, Jason Zemansky, certainly thinks so.

“Despite an arguably positive conference, Werewolf Therapeutics shares have been pressured since ASCO. In our view, this has had less to do with concerns about the WTX-124 data, which arguably added support to an encouraging, albeit early, clinical profile. Rather, we believe the pullback has been driven more by competitive fears related to ‘124’s magnitude and duration of responses. We recognize the concerns but feel they are overdone; beyond the caveats of comparing (especially) early-stage efficacy data, we think investors are overlooking the more critical safety updates that not only set Werewolf’s IL-2 asset apart but which also further validate its platform – the main value driver of the story, in our view,” the analyst opined.

Looking ahead, Zemansky sees strong potential for investors, stating, “Ahead of a catalyst rich 12mos – several capable of driving a re-rating – we see compelling near-term upside potential and opportunity on weakness.”

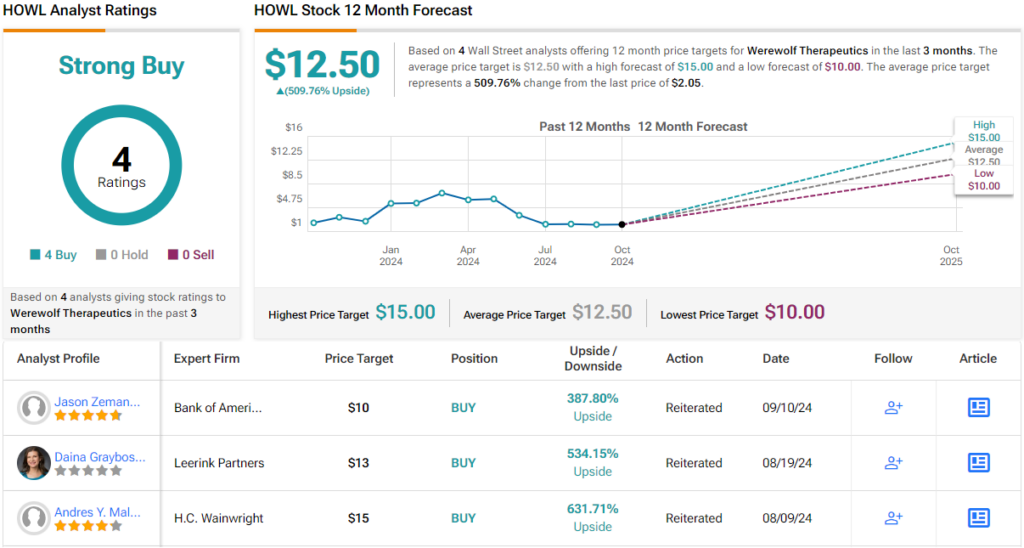

Taken together, these comments back up Zemansky’s Buy rating on HOWL, while his $10 price target points toward an impressive ~390% upside potential for the next 12 months. (To watch Zemansky’s track record, click here)

Overall, there are 4 recent analyst reviews on record for Werewolf, all of which are positive, resulting in a unanimous Strong Buy consensus rating. The shares are priced at $2.05, with an average price target of $12.50, even higher than Bank of America’s call, suggesting a potential ~510% gain over the next 12 months. (See HOWL stock forecast)

Ibotta, Inc. (IBTA)

From biotech we’ll move over to consumer tech with a look at Ibotta, a shopping rewards company. Based in Denver, Colorado, Ibotta provides and manages a direct-to-consumer app that allows shoppers to claim cash-back rewards on a wide variety of online and in-person purchases. The app makes it easy for users to claim rewards virtually anywhere. A long list of retailers, primarily grocers, participate, including major names such as Publix, Dollar General, Costco, Jewel-Osco, Kroger, Meijer, Walmart, and Whole Foods. Beyond the grocery sector, chains like Home Depot, Lowes, and Kohl’s also participate, as does Amazon.

Ibotta was founded in 2011, and earlier this year, after 13 years in business, the company entered the public markets through an IPO. The public offering saw 6.56 million shares go on the market by both the company and several private shareholders, with an initial price of $88 per share. This price was well above the estimated IPO range of $76 to $84. In total, the event raised $577 million. Ibotta directly sold 2.5 million shares, realizing proceeds of $220 million.

Since going public, Ibotta’s stock has dipped by nearly 32%. In response, the company initiated a $100 million share repurchase program in August to help support the share price.

On the financial side, Ibotta has released two sets of earnings results since the IPO. The most recent, released in August and covering 2Q24, showed a top line of $87.9 million, up ~14% year-over-year and beating the forecast by $2.15 million. At the bottom line, the company’s non-GAAP EPS of 68 cents per share was 5 cents per share below expectations.

In his coverage of this stock for Bank of America, analyst Curtis Nagle sees this stock as a potential growth opportunity for investors. He discusses the company’s wide-ranging footprint in its niche, noting: “As CPG brands focus on ways to efficiently deliver value to consumers and increase vols, we see Ibotta as a prime beneficiary. Ibotta works with ~2,400 brands and is the only digital promotions co. that offers full bottom of the funnel attribution (ties purchase to person, place, time, etc.) and is paid only when a promotion leads to a purchase. We see Ibotta as a highly attractive alternative to other forms of marketing and promotions where ROAS is much more difficult to measure.”

Nagle goes on to rate IBTA as a Buy, and complements that with a $110 price target suggesting a ~64% share appreciation on the one-year horizon. (To watch Nagle’s track record, click here)

All in all, this newly public stock has earned its Strong Buy analyst consensus rating by picking up 6 positive reviews from the Street. The stock is priced at $67.19 and its $101.17 average target price implies a one-year upside potential of ~51%. (See IBTA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.