The easing of restrictions following stringent lockdowns sparked improved sentiment about Chinese stocks in 2023. However, Chinese stocks could get adversely impacted by rising political tensions between the U.S. and China, with both countries accusing each other of flying spy balloons. Keeping in mind these dynamics, using TipRanks’ Stock Comparison Tool, we placed Alibaba (NYSE:BABA), XPeng (NYSE:XPEV), and JD.com (NASDAQ:JD) against each other to pick Wall Street’s favorite Chinese stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Alibaba (NYSE:BABA)

A regulatory crackdown, the resurgence of COVID-19 in China, delisting concerns, and growing competition in the e-commerce space weighed on Alibaba shares last year. In Q2 FY23 (September 2022 quarter), cloud segment revenue growth slowed down to 4% compared to 10% in Q1 FY23, adding to investors’ concerns.

Nonetheless, Wall Street is optimistic about Alibaba’s long-term potential in the e-commerce and cloud computing markets as well as growth prospects in the artificial intelligence (AI) space. Several analysts expect the company’s financials to improve in the upcoming quarters as macro pressure eases.

Is BABA a Good Stock to Buy?

Recently, Benchmark analyst Fawne Jiang reiterated a Buy rating on Alibaba with a price target of $180. Alibaba is scheduled to report its December quarter results later this month. The analyst expects retail and e-commerce growth to remain subdued in the December (Q3 FY23) quarter.

Jiang slightly raised Q3 FY23 revenue estimates to RMB 244.9 billion from RMB 244.6 billion. He also increased his Q3 FY23 adjusted EBITDA forecast to RMB 52.5 billion from RMB 51.5 billion to indicate better-than-anticipated cost controls. Jiang expects inflection in the June quarter (Q1 FY24), with reaccelerated growth projected in FY24.

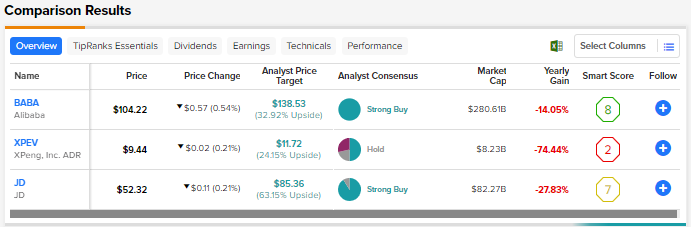

Overall, Alibaba earns the Street’s Strong Buy consensus rating based on 16 unanimous Buys. The average BABA stock price target of $138.53 suggests about 33% upside potential. BABA shares have moved up by over 18% in 2023.

XPeng (NYSE:XPEV)

Like many other electric vehicle (EV) makers, XPeng was also hit by production and supply chain issues due to China’s strict COVID-19 restrictions. Moreover, competition in the Chinese EV market is growing rapidly. XPeng delivered 120,757 vehicles in 2022, marking a 23% increase year-over-year but significantly lagging the initial target of 250,000 deliveries.

Moreover, XPeng disappointed investors by starting the year on a weak note. Its January deliveries came in at 5,218 vehicles, reflecting a decline of nearly 60% year-over-year and 53.8% month-over-month. The company blamed the seasonal slowdown during the Chinese New Year holiday period, which began in mid-January, for the weak numbers.

Last month, CEO He Xiaopeng told Bloomberg News that the company has pushed back its profitability goal and now expects to deliver an operating profit in 2025 compared to its price target to break even by late 2023 or early 2024. The company is focusing on full self-driving technology to achieve its profitability goal. XPeng is also streamlining its manufacturing to improve efficiency and control costs.

XPeng’s profitability over the near term is expected to be impacted by the ongoing price wars triggered by Tesla (NASDAQ:TSLA). Following Tesla, XPeng also announced price cuts on some of its models to boost volumes and stay competitive. XPeng’s performance might improve in the quarters ahead due to its upcoming launches and expansion into Europe.

What is the Target Price for XPeng Stock?

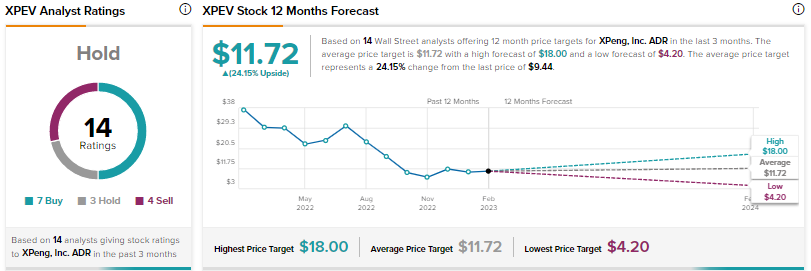

Several analysts have downgraded XPeng over recent months. This week, Macquarie analyst Erica Chen downgraded XPeng to Sell from Hold.

Wall Street’s Hold consensus rating for XPeng is based on seven Buys, three Holds, and four Sells. The average XPeng stock price target of $11.72 suggests 24.2% upside potential. Shares are down 5% year-to-date.

JD.com (NASDAQ:JD)

JD.com is one of the leading online retailers in China and also has a presence in logistics, fintech, and healthcare markets. Despite COVID-led headwinds and macro pressures, JD.com’s Q3 2022 revenue growth accelerated to 11.4% from 5.4% in Q2 2022. Higher sales and a focus on efficiency helped the company in generating better-than-expected earnings.

Looking ahead, JD is seeking growth in new AI-based applications and recently announced that it plans to launch a ChatGPT-like product.

What is the Forecast for JD Stock?

Mizuho Securities analyst James Lee expects December 2022 quarter to be “soft” for the Chinese internet space, given the impact of COVID-19 on business activity and consumer sentiment. Nonetheless, Lee pointed out that his firm’s early checks from late December through the Chinese New Year holidays “have been increasingly positive,” as indicated by solid consumer discretionary spending.

Lee expects JD’s Q4 2022 revenue to rise 7.5% year-over-year. He projects the net margin to improve by 60 basis points to 1.9%, driven by higher efficiency in core e-commerce and cost controls on new investments. The analyst expects revenue to resume double-digit growth starting Q2 2023.

Lee called JD and Baidu his top picks and expects both companies to gain market share from regulatory policies and a competitive environment. The analyst reiterated a Buy rating and raised the price target for JD stock from $82 to $85.

All in all, JD scores Wall Street’s Strong Buy consensus rating based on 10 Buys and one Hold. The average JD stock price target of $85.36 suggests 63.2% upside potential. Shares have declined 7% since the start of this year.

Conclusion

A rebound in business following the reopening of the Chinese economy is expected to improve the prospects for Chinese companies. However, U.S.-China tensions and macro pressures could impact the pace of recovery. Currently, Wall Street is more bullish on JD.com and sees higher upside potential in the stock compared to Alibaba and XPeng.