The growing U.S.-China tensions remain an overhang on U.S.-listed stocks of Chinese companies. Aside from geopolitical tensions, regulatory pressures and the unexpected decline in China’s manufacturing activity in April have also impacted investor sentiment. Nevertheless, Wall Street analysts remain bullish on the long-term prospects of many U.S.-listed Chinese stocks. We used TipRanks Stock Comparison Tool, to place Alibaba (NYSE:BABA), JD.com (NASDAQ:JD), and Li Auto (NASDAQ:LI) against each other to find the most compelling Chinese stock as per Wall Street analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Alibaba (NYSE:BABA)

In March, the news of e-commerce giant Alibaba’s plan to split into six business units was welcomed by investors. It intends to break up into six units, including cloud computing, media, and e-commerce, with the possibility of each business exploring fundraising and an initial public offering. The company believes that the restructuring will make its businesses more agile and enhance decision-making.

The move is also seen as a strategy to ease the scrutiny over the tech giant’s massive business, which has often invited regulators’ wrath due to alleged monopolistic practices and other issues.

The company is also taking various initiatives to boost its business. Alibaba Cloud is slashing the prices of its core products and services in China by up to 50% to boost demand and fight competition.

However, BABA American depositary receipt (ADR) has declined more than 15% over the past one month due to increasing U.S.-China friction. In late April, a group of nine Republican senators urged the Biden administration to impose sanctions on Huawei’s cloud unit, Alibaba Cloud, and other Chinese cloud service providers, as they could pose a threat to national security.

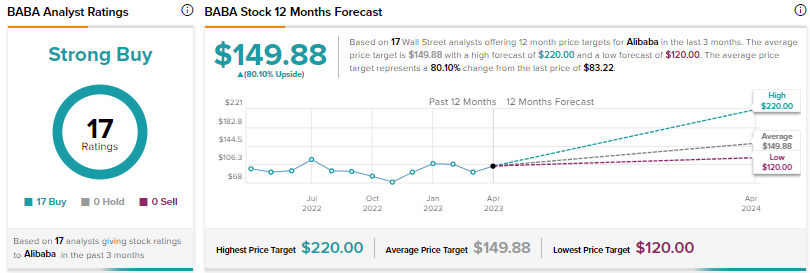

What is the Price Target for Alibaba Stock?

In April, Goldman Sachs analyst Ronald Keung reiterated a Buy rating on Alibaba with a price target of $136, as he continues to view the stock as “one of the best value stock proxies” that is poised to experience advertising recovery and fintech (through its 33% stake in Ant) as well as cloud structural growth.

The analyst sees a high possibility for the re-rating of the stock’s valuation multiple when its top-line growth resumes and calendar year 2023-2025 estimated earnings bounce back to teens growth.

Alibaba scores Wall Street’s Strong Buy consensus rating based on 17 unanimous Buys. The average price target of $149.88 suggests 80.1% upside. Shares are down 5% year-to-date.

JD.com (NASDAQ:JD)

Like rival Alibaba, JD.com also plans to restructure its business by spinning off its property and industry units and listing them in Hong Kong.

JD has been under pressure due to intense competition and macro challenges. Also, China’s stringent COVID restrictions impacted JD’s business last year. In March, JD reported mixed results for Q4 2022. The company swung to a profit in Q4 compared to a loss last year, fueled by a 7.1% rise in revenue and cost efficiency. However, Q4 revenue lagged expectations.

Additionally, the company cautioned that despite the government’s stimulus to boost the economy, it will take some time for consumption to recover. It expects recovery speed to be better in the second half of the year.

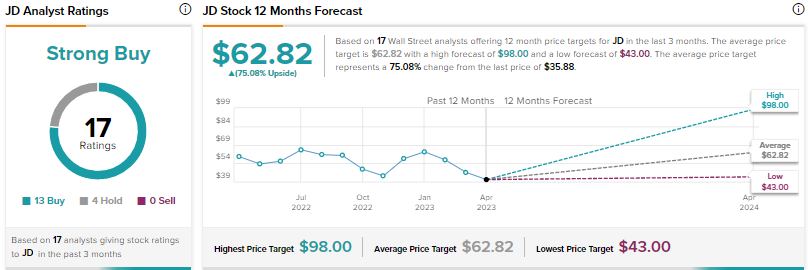

Is JD Stock a Buy, Sell, or Hold?

Last month, UBS analyst Jerry Liu downgraded JD.com stock to a Hold from Buy and lowered the price target to $43 from $60, citing competitive headwinds.

The analyst thinks that JD lacks exposure to the rapidly growing segments of e-commerce. He expects the company to take a longer period to enhance its product selection and user experience for customers looking for value deals to better compete in the long term with rivals like Alibaba, Pinduoduo [owned by PDD Holdings (PDD)], and Douyin.

Unlike Liu, most Wall Street analysts are bullish on JD. With 13 Buys and four Holds, JD scores a Strong Buy consensus rating. The average price target of $62.82 suggests 75.1% upside.

Li Auto (NASDAQ:LI)

Li Auto and other Chinese electric vehicle makers are recovering from the disruption caused by the COVID-19 resurgence last year. The company impressed investors with its April deliveries of 25,681 vehicles, reflecting growth of 23% month-over-month and 516% year-over-year.

The solid April deliveries were driven by robust demand for the Li L7 five-seat flagship SUV launched earlier this year. The company is on track to release a beta version of NOA (Navigation on ADAS – advanced driver-assistance system) in Li AD Max 3.0 this quarter. Management aims to roll out the feature in 100 cities by the end of this year.

Is Li Auto a Good Stock to Buy?

Earlier this week, Morgan Stanley analyst Tim Hsiao reiterated a Buy rating and a price target of $30 for Li Auto stock. The analyst noted that April marked the second straight month in which deliveries crossed 20,000 units.

Hsiao believes that while Li Auto’s previous target of 30,000 monthly sales in Q2 2023 appears to be a high bar to achieve, the company’s significant sales outperformance compared to its peers could drive near-term stock movement.

He thinks that better-than-expected L7 orders could drive the stock higher. Further, the successful launch of Li AD Max 3.0 could boost the top line.

Wall Street’s Strong Buy consensus rating for Li Auto is based on five unanimous Buys. The average price target of $37.30 implies nearly 56% upside potential. Shares have advanced over 17% year-to-date.

Conclusion

Wall Street is bullish on the three Chinese stocks discussed here. That said, analysts see more upside in Alibaba stock compared to JD and Li Auto. Nevertheless, investors should keep in mind the risks associated with Chinese stocks, given the growing U.S.-China issues.

As per TipRanks’ Smart Score System, Alibaba scores a “Perfect 10,” implying that the stock could outperform the broader market over the long term.