In this piece, I evaluated two aerospace and defense stocks, Boeing (NYSE:BA) and Northrop Grumman (NYSE:NOC), using TipRanks’ comparison tool to determine which stock can fly higher. A deeper analysis suggests a clear winner — Boeing over Northrop Grumman.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing designs, manufactures, and sells rockets, missiles, airplanes, satellites, and telecommunications equipment and provides product support and leasing services. Northrop Grumman is one of the largest weapons manufacturers and providers of military technology in the world.

Shares of Boeing are down about 8% year-to-date after plummeting 23% over the last three months, although they’re up 33% over the last year. Meanwhile, Northrop Grumman stock is off around 9.4% year-to-date following its three-month gain of 5%, although it’s up 8% over the last 12 months.

With such a dramatic difference in stock-price performance over the last three months, a closer look is needed to determine whether it’s warranted, especially considering that both stocks are down roughly the same amount year to date.

Boeing is unprofitable, so we’ll compare both companies’ price-to-sales (P/S) ratios to gauge their valuations against each other and against their industry’s valuation. Since Northrop Grumman is profitable, we’ll also consider its price-to-earnings (P/E) ratio compared to that of its industry.

For comparison, the U.S. aerospace and defense industry is trading around its three-year average P/S of 1.9. It’s also trading at a P/E of 23.8 versus its three-year average of 28.

Boeing (NYSE:BA)

At a P/S of 1.4, Boeing is trading at a significant discount to its industry. However, the many problems the company is experiencing, plus its lack of profitability, suggest a bearish view may be appropriate.

Boeing released its latest earnings report on Wednesday, posting an adjusted loss of $3.26 per share versus the consensus of $3.18 per share in losses. Revenue came in at $18.1 billion, edging out the consensus of $18.01 billion.

Unfortunately, the wider-than-expected loss continues to be a symptom of much bigger problems. On Wednesday, Boeing management said that they expect to deliver fewer 737 Max aircraft this year than they had previously expected.

The company continues repair efforts on the fuselages of some of the 737s it had manufactured, so it expects to deliver only 375 to 400 of the aircraft, down from the previous estimate of 400 to 450. The fuselage problems have been a blight on the popularity of the 737. As a result, airline customers have been left hanging at a time when new, more fuel-efficient passenger aircraft are desperately needed as air travel picks back up after the pandemic.

Unfortunately, Boeing also continues to take a hit from its Air Force One program, which lost $482 million in the third quarter due to higher manufacturing costs related to labor instability and engineering changes. The company also lost $315 million on one of its satellite contracts.

Finally, at a Relative Strength Index of 33, Boeing stock is nearing oversold levels, but with everything that’s going on with the company, it’s hard to imagine a significant rebound.

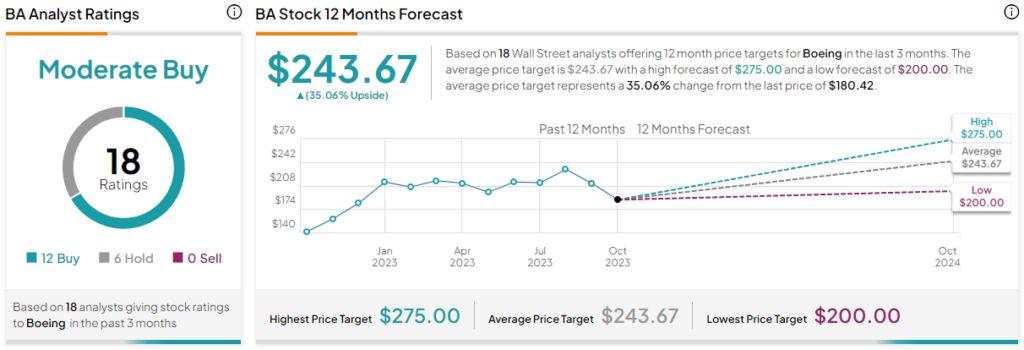

What is the Price Target for BA Stock?

Boeing has a Moderate Buy consensus rating based on 12 Buys, six Holds, and zero Sell ratings assigned over the last three months. At $243.67, the average Boeing stock price target implies upside potential of 35.1%.

Northrop Grumman (NYSE:NOC)

At a P/S of 1.9 and a P/E of 16, Northrop Grumman is in line with its industry on sales but is trading at a steep discount based on earnings. However, the company’s robust earnings results and increased weapons demand, combined with its long-term stock-price gains, suggest a bullish view may be appropriate.

Today, before market open, Northrop Grumman reported earnings of $6.18 per share on $9.8 billion in revenue, versus the expectations of $5.81 per share and $9.56 billion in revenue. The company also boosted its sales guidance for this year to about $39 billion, an increase of $400 million due to increased weapons demand, likely in connection with the conflicts in Ukraine and Israel.

In addition to the company’s strong fundamentals and growing demand, Northrop Grumman stock has marched steadily higher over the long term, suggesting it may be an attractive buy-and-hold position. The shares are up 68% over the last three years and have more than doubled over the last five years.

Finally, Northrop Grumman pays a solid dividend yield of 1.5%. While that’s slightly below the sector average of 1.6%, the company has boosted its dividend annually for the last 19 years. Thus, Northrop Grumman has displayed long-term dividend stability, suggesting it may also be a decent addition to a dividend portfolio, especially considering its long-term stock price appreciation.

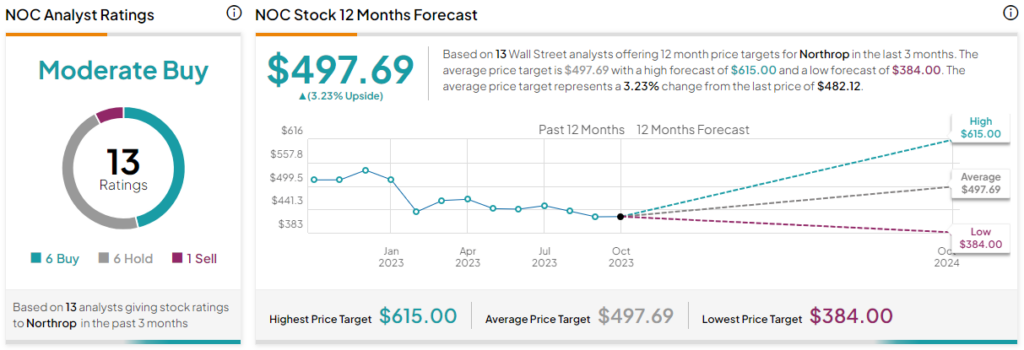

What is the Price Target for NOC Stock?

Northrop Grumman has a Moderate Buy consensus rating based on six Buys, six Holds, and one Sell rating assigned over the last three months. At $497.69, the average Northrop Grumman stock price target implies upside potential of 3.2%.

Conclusion: Bearish on BA, Long-Term Bullish on NOC

While both companies are in the same industry, the multitude of problems with Boeing’s passenger aircraft are weighing it down so much that its losses far outweigh any potential gains in its Defense business. Meanwhile, Northrop Grumman’s defense business is soaring, and the sky’s the limit. With its robust fundamentals, long-term stock-price appreciation, and solid dividend history, Northrop Grumman looks too good for long-term investors to pass up, in my opinion.