Based on recent positive price action in the equities sector, investors apparently no longer fear a wider banking sector contagion. Nevertheless, seeing as precious metal miners like B2Gold (NYSE MKT:BTG) keep rising suggests that the fear trade – or the seeking of safe havens amid troubling economic circumstances – may still be a catalyst. Therefore, I am bullish on BTG stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Earlier in March, many investors rightfully became alarmed at the failures of two major regional U.S. banks. To be fair, bank failures are not uncommon. In 2009, during the throes of the Great Recession, 140 banks failed. One year later, 157 financial firms ended up closing their doors. However, in 2021 and 2022, zero banking enterprises failed. Therefore, the fact that two collapsed this year represents a significant event.

Still, the last few weeks on Wall Street suggest that the intensity of contagion concerns faded, with equity indices moving in the northbound direction. On paper, all seems well, but the rise of BTG stock – along with accelerated interest in the derivatives market – gives observers pause.

Perhaps most noticeably, BTG stock represented a highlight for unusual stock options volume following the March 31 session. Specifically, the quotient between the Friday session volume (which hit 37,861 contracts) and the trailing one-month average volume came out to 1,578.24%. Breaking it down, bullish call options hit 35,604 contracts versus bearish put options numbering 2,257 contracts.

Frankly, gold is a “dumb” commodity. Therefore, the apparent targeting of BTG stock by the bulls presents an interesting backdrop.

Read Between the Lines for BTG Stock

Based on the broader context of the rise of BTG stock, it may be time for investors to read between the lines. Yes, most investors may believe that the worst of the banking crisis sits in the rearview mirror. At the same time, that so much action favoring B2Gold materialized in the options arena seems odd if, indeed, no major concerns exist.

In other words, many astute retail investors look to rumblings in the options market as a possible indicator of what the “smart money” is doing. Under this framework, there may be more to the banking sector fallout than meets the eye.

Consider the basic takeaway here. As everyone knows, as valuable as gold is, it’s just a commodity. It hires no people, generates no sales, and offers no dividends. Kingdoms and administrations come and go, but gold remains the same. Granted, if investors seek safe havens, gold is arguably unparalleled. However, as a means to drive progress for humanity, gold doesn’t offer the most compelling opportunity.

For that, investors should consider the space economy or artificial intelligence and machine learning, not BTG stock. Yet, data from barchart.com reveals that for the March 31 session, BTG ranked as the fifth-most unusual options volume trade.

Stated differently, smart-money investors may still be concerned about the banking sector, and that may cynically bolster BTG stock in future sessions.

Intriguing Financials Lift the Case for B2Gold

While the narrative for BTG stock presents an enticing profile, prospective investors shouldn’t ignore the underlying financials. Debatably, they’re just as attractive as the storyline.

First and foremost, B2Gold enjoys a relatively stout balance sheet. Its Altman Z-Score – a measure of bankruptcy risk – hits 5.87, well into the safe zone. Therefore, it probably won’t fail anytime soon. As well, the company benefits from a debt-to-equity ratio of 0.02 times, sitting favorably lower than the sector median value of 0.15 times.

Operationally, B2Gold’s three-year revenue growth rate hits 13.9%, which comes in above the metals and mining industry’s sector value of 7.5%. Also, BTG stock ranks better than 66.15% of the competition regarding this statistic. As well, its book growth rate during the aforementioned period is 14.3%, above 69.3% of rivals.

Finally, on the profitability front, the company posted a trailing-year net margin of 14.63%. This stat ranks above 79.3% of sector peers, making BTG stock quite formidable.

Is BTG Stock a Buy, According to Analysts?

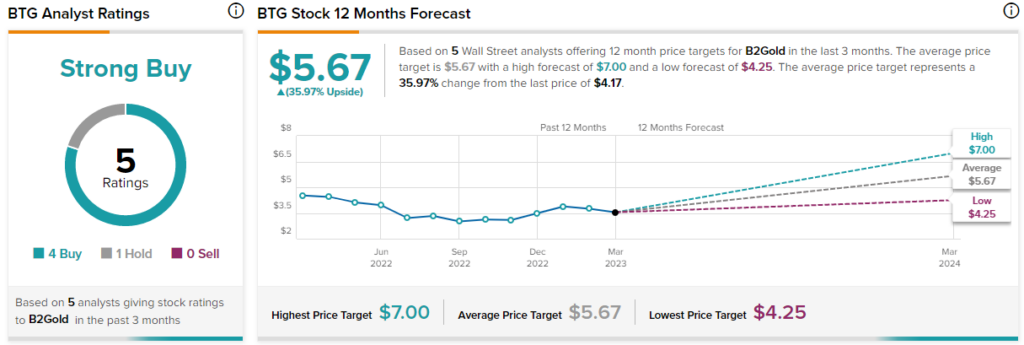

Turning to Wall Street, BTG stock has a Strong Buy consensus rating based on four Buys, one Hold, and zero Sell ratings. The average BTG stock price target is $5.67, implying 36% upside potential.

Conclusion: BTG Stock Worryingly Draws Attention from the Bulls

Regarding BTG stock, investors may want to do what the market does, not what it says. Sure, it seems that Wall Street believes everything that just materialized in the banking sector is A-okay. However, the robust interest in gold seems to suggest otherwise.