American States Water (NYSE:AWR) and SJW Group (NYSE:SJW) proudly bear the esteemed title of Dividend Kings, a prestigious tag for companies that have achieved the remarkable feat of increasing dividends annually for over 50 years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With impressive track records of 66 years and 55 years, respectively, American States Water and SJW Group lead the industry in sustained dividend growth. Side note: California Water Service Group (NYSE:CWT) has also increased its dividend for 55 consecutive years. Nonetheless, in this article, I will review how AWR and SJW maintain impressive dividend and earnings growth records. I will also assess which of the two Dividend Kings presents more promising future dividend growth.

How Can AWR & SJW Sustain Their Dividend Growth?

With an extensive history of sustained dividend growth, both AWR and SJW have demonstrated a remarkable ability to consistently expand their earnings over decades. This achievement is particularly noteworthy, given the various economic downturns, including recessions, that have transpired over the past 50+ years.

The resilience of these companies can be attributed to the recession-resistant nature of water utilities, coupled with the advantages of organic growth trends the industry enjoys. These trends encompass base rate increases authorized by regulators and population growth, contributing to the success of water utilities.

The resilience of water utilities in the face of economic challenges is rather clear. This stability stems from the essential nature of water for survival and its diverse applications, which together ensure consistent demand. Consequently, water utilities’ revenue streams are less susceptible to the volatile dynamics that can affect the broader economy.

Notably, both companies have demonstrated sustained revenue growth throughout downturns, such as the Great Financial Crisis and the COVID-19 pandemic, supporting this argument.

Regarding the underlying organic tailwinds that both companies enjoy, population growth in areas served and, most significantly, rate increases allow for consistent revenue growth. For example, AWR’s adopted average water rate base is expected to grow by a compound annual growth rate of 10.3% between 2018 and the end of this year. SJW tends to achieve similar rates, given their strong CapEx commitments.

This results in a remarkable level of revenue growth visibility for both AWR and SJW. Such visibility empowers them to prudently increase dividends in alignment with their projections for net income growth. For context, AWR & SJT feature 10-year LTM (last-12-month) income CAGRs of 7.2% and 15.5%, respectively — not bad given their incredibly mature operations and “boring” business models.

Consequently, both companies have achieved a noteworthy pace of dividend growth, each featuring an equally compelling CAGR of 8.2% and 7.5% over the same period, respectively. Again, these growth rates gain added significance when considering the sustained, compelling growth exhibited by AWR and SJW over successive decades despite their mature status.

Which Stock Offers Better Dividend Prospects?

Undoubtedly, both AWR and SJW have demonstrated their prowess in consistently and sustainably increasing dividends over numerous decades. However, when evaluating the two for their future dividend growth potential, which stands out as the more promising choice?

Well, starting by examining their payout ratios, AWR is anticipated to achieve EPS of $2.91 for Fiscal 2023, implying a payout ratio of about 59%, while SJW is expected to post EPS of $2.68, implying a payout ratio of around 57%, based on their current quarterly dividend run rates.

Despite their similar payout ratios, looking at AWR’s and SJW’s forward-looking EPS growth estimates reveals a notable contrast. AWR is projected to achieve an impressive 14% CAGR in the next five years, dwarfing SJW’s figure of 7%. The stark contrast in expected growth, however, prompts the consideration that these estimates have already been factored into the market valuation. Indeed, AWR’s forward P/E stands at 27.0, notably higher than SJW’s forward P/E of 23.2.

In terms of their dividend yields, AWR and SJW are trading at levels close to 2.2% and 2.4%, respectively, indicating a relative parity.

In essence, I believe that both companies present comparable opportunities for dividend growth. The close alignment of their payout ratios and yields indicates a parallel investment scenario. Although AWR is positioned to experience an upswing in earnings, potentially leading to superior dividend growth versus SJW, it’s worth noting that the market has already factored in this anticipated growth. Consequently, any dividend prospect upside between the two appears limited or non-existent.

What are the Price Targets for AWR and SJW Shares?

Regarding Wall Street’s view on AWR, the stock has a Moderate Sell rating based on a single Hold rating assigned in the past three months. Based on this single rating, AWR’s stock price prediction of $79.00 implies 1.3% upside potential.

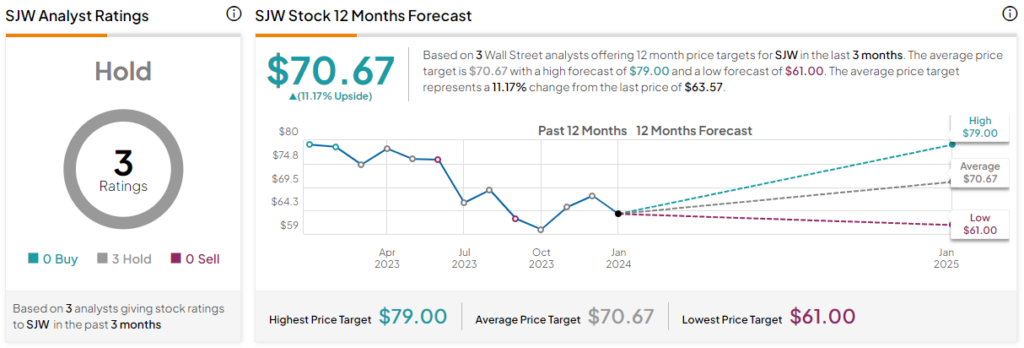

Moving to SJW, the stock features a Hold rating based on three unanimous Hold ratings assigned in the past three months. The average SJW stock forecast of $70.67 implies 11.2% upside potential.

The Takeaway

In conclusion, American States Water and SJW Group’s impressive track records as Dividend Kings underscore their resilience and sustained success in navigating economic challenges. The recession-resistant nature of water utilities, coupled with organic growth trends, has been instrumental in their decades-long dividend growth.

While both companies exhibit comparable opportunities for dividend growth, AWR’s higher projected earnings CAGR suggests potential superiority. However, the market may have already factored in this advantage, limiting significant upside. Thus, both companies are likely to serve dividend growth investors equally sufficiently, moving forward.