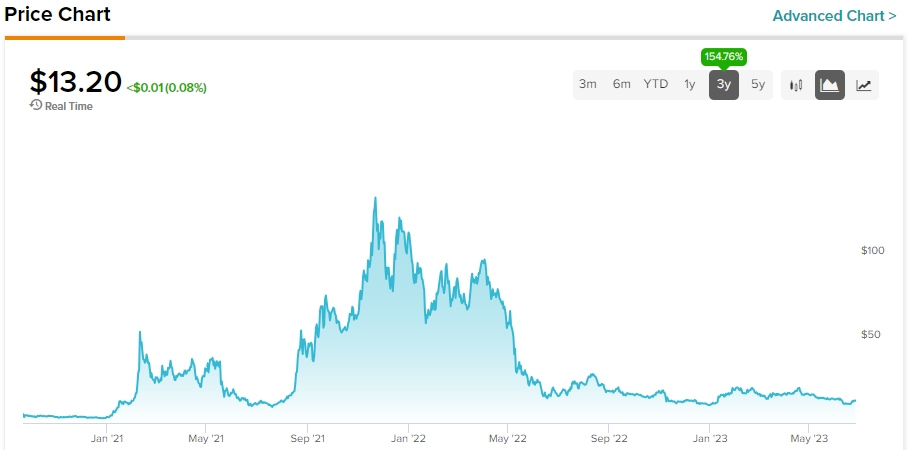

Avalanche (AVAX-USD), once the darling of the crypto community, has seen some tough times ever since the market had a drastic cooldown in 2022. Once hailed as a key part of the “Solunavax” trio — Solana (SOL-USD), LUNA, and AVAX — of scalable layer-1 blockchains, the hype isn’t quite there anymore. Despite continuing to secure partnerships and new launches, AVAX is still a long way off its previous highs.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Unlike its brethren, the AVAX community never had to deal with dramatic shocks. With LUNA imploding completely in 2022 and SOL suffering from the revelations of the FTX fraud, AVAX came off relatively unscathed. It did see the demise of one of its largest proponents, Three Arrows Capital, but the fund wasn’t nearly as impactful to the ecosystem as FTX was for Solana, for example.

From a peak of ~$151 in November 2021, AVAX is currently trading at $13.17, almost a 92% drawdown — quite close to SOL’s -93%. Ethereum (ETH-USD), in comparison, only went down by about 65% in the same time frame.

Avalanche’s value proposition comes primarily from its Subnet model, where the Avalanche network is actually a mesh of semi-independent blockchains called Subnets. Anyone can create and deploy a Subnet and enlist AVAX validators to secure it with a Proof-of-Stake model (a mechanism where validators stake their cryptocurrency to secure a network).

Avalanche also has multiple in-built chains, most notably the C-Chain. This is what most people associate with the AVAX network, as it’s the EVM (Ethereum Virtual Machine) smart contract-enabled platform where most of the user activity is concentrated. Custom subnets will also usually be independent EVM environments.

The C-Chain has been battered by the bear market, losing almost 95% of its total value locked, a measure of assets supplied to the chain’s various DeFi and NFT protocols.

Nonetheless, the market has slowed down everywhere, so Avalanche remains at a respectable 7th place among all networks at $650 million, easily triple Solana’s TVL.

Active Onboarding and Development Efforts

The Avalanche team hasn’t been idle and continues to secure key partnerships and integrations to bring the network forward.

For example, it has recently onboarded Loco Legends, an e-sports streaming platform in India that launched an NFT marketplace subnet.

Another announced integration is with SK Planet, a subsidiary of South Korean telecom conglomerate SK Telecom. The company is set to launch its own subnet called UPTN, which is expected to be integrated with the company’s consumer-facing products, such as OK Cashbag, an online cashback and loyalty platform.

Ava Labs also released AvaCloud, a no-code subnet deployment platform that makes it easy for anyone to bootstrap their own network backed by Avalanche’s blockchain validation process.

Finally, another partnership that made waves in early 2023 is with Amazon Web Services, which would simplify subnet deployment for users of the cloud platform. However, some critics maintain that this is little more than a paid service disguised as a partnership and that anyone can technically become an “AWS Partner” like Avalanche.

This event highlights some unpleasant facts about the Avalanche network, which might be the primary cause of its token’s current underperformance.

The Fundamentals Look Weaker Than the Marketing

When digging deeper into Avalanche’s subnets, there are discrepancies between how it’s supposed to work and how it actually works right now.

The core idea behind Avalanche is (or was) for Primary Network validators to be “rented” by subnet operators. This means that subnets borrow some of the security from the main network so that they don’t need to pay as much in staking yield.

In practice, though, the exact opposite is happening right now. As can be seen through Avalanche Subnet explorers, subnet teams are entirely responsible for their own chain. Defi Kingdoms, by far the most active subnet, is backed by 8 validators operated by its own team.

Subnet validators must also validate the main chain, which is the opposite of what you’d expect. Besides some additional staking yield, a dedicated subnet validator has little economic incentive to secure what is effectively an unrelated blockchain. There is little to no public information as to why this principle was adopted.

Finally, activity on these subnet networks is somewhat underwhelming. Outside of Defi Kingdoms, with its 18,000+ active addresses, other subnets have much smaller figures: Dexalot has less than 200 active addresses, Step Network has just shy of 600, and DOS has less than 25. All this is in comparison to C-Chain’s 150,000 addresses, a towering figure over the custom networks. As a further blow, Crabada recently migrated its subnet-based platform to the C-Chain.

With the bear market, people and investors become more conscious of the fundamentals and aren’t as easily swayed by marketing claims, which helps explain the current position of AVAX.

Nonetheless, the Avalanche network remains an impressive technological feat, and its performance and cost are vastly more attractive compared to competing networks like Ethereum. Also, the platform still has a number of innovative and active projects which might just make a key difference in the future. As of now, though, it’s unclear if the Avalanche team’s efforts will pay off.