With American households still facing a daunting environment of elevated inflation and high borrowing costs, targeting automotive retailer AutoNation (NYSE:AN) might not seem to be a particularly bright idea. Unsurprisingly, bearish traders in both the open and options market imply that long-side speculators could get smoked. However, the company may drive higher on an underappreciated catalyst. Combined with the potential for short-covering activities, AN stock could fly higher, making me bullish.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Aging Cars Have to be Replaced; Lower Rates Make That Easier

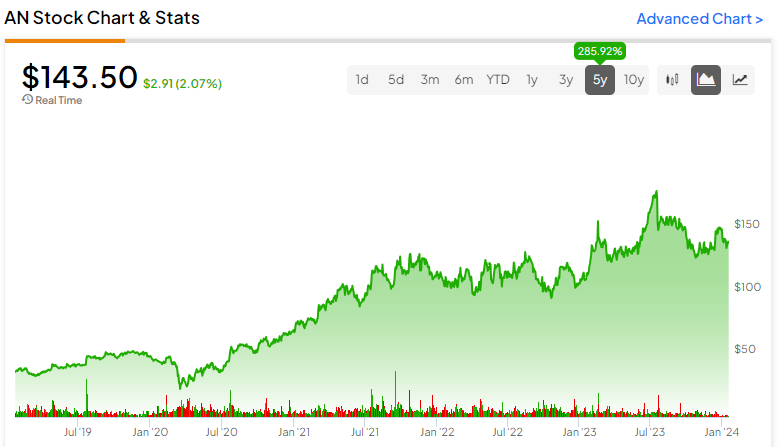

Although demand for certain high-ticket items fell last year, not every entity suffered the same magnitude of pain. Some investments, such as AN stock, actually saw positive returns — in this case, a lift of almost 22% in the past 52 weeks. That might seem odd, given the tough circumstances that consumers find themselves in. However, certain factors could eventually favor the auto retailer.

First, many market participants expect the Federal Reserve to reduce the interest rates later this year. To be fair, a hotter-than-expected December jobs report clouds this narrative. If the labor force remains robust, this dynamic would translate to more dollars chasing after fewer goods. That’s not exactly a great framework for lowering borrowing costs.

Still, it’s impossible to know with absolute certainty what might happen in the future. Should rates decline, as the Fed hinted at last month, buying expensive items will likely be far less onerous. According to data from the Board of Governors of the Federal Reserve System, the finance rate for 60-month loans for new vehicles shot up to 8.15% in November 2023.

In February 2022, that rate was at 4.52%. Unsurprisingly, total vehicle sales began conspicuously falling since June of last year. Potentially, reduced borrowing costs could reinvigorate sentiment, thus lifting AN stock.

Second and more importantly, consumers may have little choice in the matter. In 2023, the average age of vehicles on U.S. roadways hit 12.5 years, a fresh record. At some point, even the most reliable cars will incur mechanical issues. Financially, it just might make more sense to find a replacement vehicle rather than keep repairing a money pit.

If lower interest rates become the norm, consumers may view purchasing a vehicle as a no-brainer, benefiting AutoNation.

Options Market Transactions Tempt the Contrarian Trade

Nevertheless, the implied pessimism in the options market represents a warning shot to those considering buying AN stock. In particular, TipRanks’ screener for unusual options activity shows several transactions with bearish implications. Typically, these trades revolve around bought puts, which give holders the right (but not the obligation) to sell the underlying security at the listed strike price.

However, pessimists can also take a more daring approach with sold (written) calls. In particular, two bearish call option transactions – 400 contracts of the AN Feb 16 ’24 160.00 call and 410 contracts of the AN Feb 16 ’24 165.00 call – warrant close attention. Both transactions occurred on January 10.

In summary, these traders are betting that AN stock won’t rise materially above the $160 and $165 strike prices by the February 16 deadline. If AN fails to do so, the bearish trader can potentially collect the maximum premium, that is, the funds received for selling the aforementioned contracts.

Of course, the risk centers on AN stock possibly moving higher instead of lower. For example, if AutoNation drives up to $200, the bearish trader is contractually obligated to fulfill the underlying terms upon exercise: sell AN shares at $160 and $165. Therefore, the loss comes out as the difference between what the shares could have been sold for versus the strike price minus the premium.

In addition, if the written calls were uncovered, the bearish trader must buy AN stock at the open market price and sell it at the lower strike price. Therefore, uncovered short calls expose participating traders to uncapped loss potential, adding pressure to the situation.

Finally, the bears are also betting against AN stock directly. Currently, AutoNation’s short interest as a percentage of its float stands at 11.93%. Also, the short interest ratio comes in at 13.15 days to cover. If AutoNation jumps higher for any reason, a short-covering panic could erupt, leading to significant upside.

Solid Financials Imposes Risks on the Pessimists

Notably, Autonation stock’s financials are surprisingly resilient, as the company has been posting profits every year. Perhaps most conspicuously, even in the pandemic-disrupted year of 2020, the company posted operating income of $939 million and net income of $381.6 million. Surely, the business has undertones of discretionary sentiment. At the same time, many people need personal transportation, thus making the service a necessity.

It’s also hard to ignore the discount at play. At the moment, shares trade at a trailing-year earnings multiple of 6x. However, the sector average for the auto and truck dealership segment comes in at 9.71x. With many elements working in favor of the bullish thesis, the bears are probably feeling the heat.

Is AN Stock a Buy, According to Analysts?

Turning to Wall Street, AN stock has a Moderate Buy consensus rating based on four Buys, two Holds, and zero Sell ratings. The average AN price target is $181.83, implying 26.9% upside potential.

The Takeaway: AN Stock is Begging for Takers

At first glance, the tough challenges that American households face don’t make AutoNation an enticing bullish idea. However, with cars on roadways becoming increasingly older, consumers must start considering buying replacements. That’s a catalyst that bearish traders (both in the open market and the options market) could be ignoring, setting up a potentially lucrative showdown for optimists. On top of that, the stock’s low valuation provides extra support to the bulls.