Car dealership company AutoCanada Inc. (TSE:ACQ) has been continuously making acquisitions to expand its domestic footprint. The company has recently acquired two collision centers and has plans to take over more in the coming quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On August 10, the Alberta-headquartered company reported record results for the second quarter of 2022, driven by strong performance across all its business segments.

Q2 Results at a Glance

Revenue rose 31.6% year-over-year to a record C$1.686 billion on the back of excellent performance of its parts, service, and collision repair (PS&CR) and finance and insurance (F&I) operations. It was the highest second-quarter revenue figure in the history of the company.

Revenue from Canadian operations grew 32% to C$1.438 billion, and sales of its U.S. operations jumped 29.5% to $248.1.

Total vehicle sales climbed 17.4% year-over-year to 28,115 units, and used vehicle sales went up 33.7% to 4,469 units.

Gross profit rose 28.2% to C$279.3 million, while gross margin fell to 16.6% from 17% in the year-ago quarter. The decline was the result of a used vehicle inventory write-down of C$10 million.

Adjusted EBITDA grew 7.2% year-over-year to C$75.6 million, whereas the adjusted EBITDA margin fell 100 basis points to 4.5%.

Earnings jumped 10 cents, or 8.1%, to C$1.33 per share, exceeding the consensus estimate of C$1.29 a share.

Paul Antony, the Executive Chairman of AutoCanada, said, “Strong results in Q2 reflect the ongoing sustainability of our business model, as well as our ability to continue navigating a range of industry challenges, including OEM production delays and inventory constraints.”

“Looking forward to the remainder of 2022, we will continue to build on our strong momentum and focus on our strategic growth pillars to deliver best-in-class performance and enhance shareholder returns. We also expect to see continued realization of synergies from our acquisitions which will further drive our Adjusted EBITDA performance,” Antony added.

Is AutoCanada a Good Stock to Buy?

AutoCanada’s shares have lost almost 30% so far this year. However, the stock is on the upswing and has gained 11.7% in the last three months, indicating a recovery in demand for the company’s services following two years of lull.

Additionally, it has reported better-than-expected results in most quarters in the last couple of years. If the trend continues in the upcoming quarters, ACQ stock will likely get a boost.

On TipRanks, AutoCanada has a Moderate Buy consensus rating based on two Buys. ACQ’s average stock forecast of C$40 implies nearly 36% upside potential to current levels.

Maggie Macdougall of Stifel Nicolaus and Michael Doumet of Scotiabank are the two analysts that have reiterated a Buy rating on the stock in the last 30 days. Both have provided a price target of C$40 on AutoCanada.

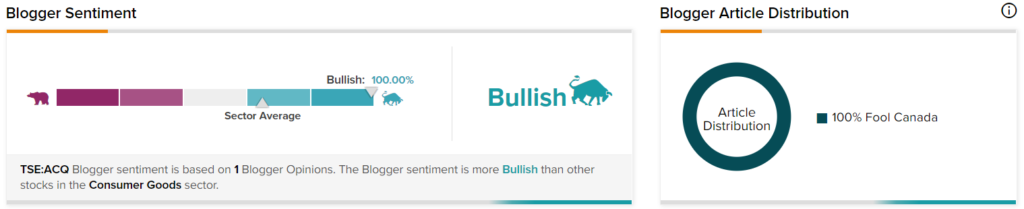

Just like these two analysts, bloggers are also optimistic about the stock. Data from TipRanks shows that financial bloggers are 100% Bullish on ACQ, compared to the sector average of 65%.

Read full Disclosure