AT&T (NYSE:T) is scheduled to release its first-quarter results before the market opens on April 20. The company might have benefited from its initiatives to extend the reach of the 5G and fiber networks to other regions in the yet-to-be-reported quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ahead of the Q1 results, Citigroup analyst Michael Rollins is upbeat about the performance of the telecom behemoth and anticipates that its current operational strategy will boost the share price.

Regarding the clientele of the business, Rollins predicts that AT&T saw a rise in wireless postpaid and fiber broadband net additions during the quarter. The analyst kept his Buy rating and had a $22 price target for the stock.

Overall, the Street expects AT&T to post earnings of $0.58 in Q1, lower than the prior-year quarter figure of $0.77. Meanwhile, analysts expect the company to report net revenue of $30.24 billion, down 20.7% from the same quarter last year.

What is AT&T’s Price Target?

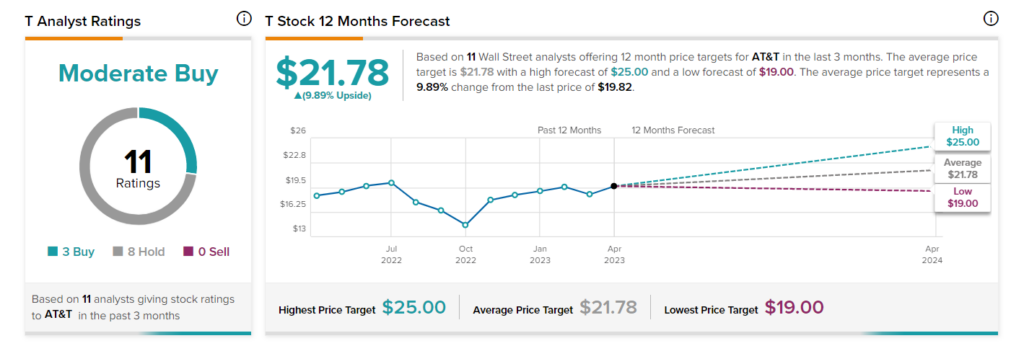

Overall, Wall Street is cautiously optimistic about T stock. The stock has a Moderate Buy consensus rating based on three Buys and eight Holds. The average price target of $21.78 implies 9.9% upside potential from current levels. Shares of the company have gained 8.8% so far in 2023.

Ending Thoughts

AT&T has been making efforts to focus on its core businesses. The company appears to be succeeding after selling its stake in the Warner Media business last year. Additionally, AT&T has been able to improve its position on the balance sheet by steadily reducing the net debt balance. Investors received reassurance from the company that it is on track to achieve cost savings of $6 billion or more by the end of 2023.