Atlantica Sustainable Infrastructure (NASDAQ:AY) could present a remarkable opportunity for income investors looking for green energy stocks that promise consistent payouts and sustainability. What truly makes Atlantica a compelling investment opportunity, however, extends beyond its enticing 7.5% dividend yield.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company boasts a unique blend of qualities that ensure an exceptional level of predictability when it comes to its future performance. Furthermore, the recent market correction has opened up a wider margin of safety, providing an even more enticing proposition for potential investors.

Specifically, shares are trading at the same levels they did back in the summer of 2015, even though Atlantica has made notable financial progress and achieved strong dividend growth since. Hence, I am bullish on the stock.

Why Have Shares of Atlantica Declined in Recent Years?

Shares of Atlantica had experienced a significant decline since their peak in early 2021 when they briefly surpassed $48. Currently priced at around $23, the stock has halved in a span of over two-and-a-half years.

This decline can be primarily attributed to investor behavior during the pandemic-induced excitement in 2021, where they pursued the stock for its yield. However, as soon as interest rates began to rise, investors started selling off Atlantica to account for the increased risk associated with equities.

Specifically, at its peak in 2021, Atlantica’s dividend yield had been pushed to just 3.6%. With the Federal Funds Rate gradually increasing, currently standing at 5.00% to 5.25%, it is understandable that investors have gradually demanded a higher yield from Atlantica to be compensated for the additional risk attached to a stock. This explains the stock’s gradual decline during the ongoing period of rate hikes and why investors have now pushed its yield to 7.5%.

Atlantica is Shielded by Macroeconomic Headwinds

While Atlantica’s share price decline can be attributed to the prevailing macroeconomic headwinds, such as the rise in interest rates, it is important to highlight Atlantica’s resilience against these challenges. It stems from Atlantica’s well-diversified asset base, supported by its extensive portfolio of multi-year, inflation-protected power purchase agreements (PPAs). Additionally, Atlantica enjoys the substantial advantage of a strong and reliable customer base, providing a solid foundation for its operations.

Let’s start with a quick overview of its asset base.

Atlantica’s Asset Base Update

Atlantica boasts a robust portfolio that includes 44 renewable energy projects spanning various categories and collectively boasting an impressive capacity to generate 2,161 MW of clean energy. Within this portfolio, 31 projects consist of solar and wind farms, while seven projects are dedicated to transmission and transport. Additionally, three projects focus on efficient natural gas utilization; another three revolve around water-related initiatives.

What sets Atlantica apart is not only the diversity of its asset base in terms of different types of projects but also its global reach. While a significant portion of its cash flows, roughly 40%, originates from North America, the company’s revenue sources are far from confined to a single region. Europe and South America contribute 34% and 18% of its cash flow mix, respectively, while the remaining 8% is spread across the globe, with notable contributions from countries like South Africa and Algeria.

Multi-Year Contracts, Quality Off-Takers Support Resilient Results

In addition to its diverse portfolio of assets, Atlantica has consistently achieved resilient results thanks to its long-term agreements known as power purchase agreements (PPAs), which enjoy the support of reputable off-takers (customers). These PPAs provide exceptional clarity on cash flows and mitigate risks.

With an average remaining contract term of roughly 14 years, Atlantica’s future revenues are highly secure, enabling the management to strategically plan for future investments and dividend growth. However, the benefits go beyond that. An impressive 47% of the company’s assets are tied to inflation-based formulas or indexed to specified increments over time. As a result, Atlantica’s assets have thrived despite the highly-inflationary environment experienced in the past year.

To grasp the strength of Atlantica’s long-term PPEs, mentioning the company’s high-quality off-takers is critical. In particular, Atlantica’s off-takers boast exceptional creditworthiness, effectively mitigating counter-party risks for the company. Most of them are government-affiliated entities such as The Government of Peru and The Kingdom of Spain or renowned players in the energy sector such as Enel Generacion Chile (NYSE:ENIC), making the likelihood of default on their contractual obligations quite low.

Furthermore, despite Atlantica’s significant overseas footprint and dependence on foreign off-takers, 90% of the company’s contracted revenues are sourced in USD or hedged to the dollar. This prudent approach provides an additional layer of protection, ensuring the company’s cash flows remain stable during currency fluctuations and other risks associated with foreign exchange exposure.

Strong Start to Fiscal 2023 Showcases Atlantica’s Portfolio Qualities

As previously discussed, Atlantica’s impressive portfolio of environmentally friendly assets possesses remarkable qualities that enable the company to generate resilient cash flows even in uncertain times. This was again exemplified in its first-quarter results, marking a positive start to Fiscal 2023. Atlantica achieved an adjusted EBITDA of $174.2 million during this particular quarter, representing a notable 4.0% increase compared to the first quarter of 2022.

Additionally, Atlantica achieved a 12.1% growth in cash available for distribution (CAFD) versus Q1 2022, amounting to $61.0 million, or an 8.9% increase to $0.53 per share. The disparity between the overall CAFD and the per-share metric can be attributed to Atlantica’s issuance of common shares to finance its investments and acquisitions over the past year. Still, given the underlying growth on a per-share basis, it is evident that these acquisitions boosted profitability and were accretive for shareholders.

The 7.5%-Yielding Dividend Remains Secure

Now that we have thoroughly highlighted Atlantica’s strengths and demonstrated their capacity to deliver strong results, you can understand why the company’s hefty 7.5% yield is highly attractive and quite secure. Precisely, Atlantica’s Q1 results came in line with expectations. Thus, management didn’t revise its prior guidance, which had been issued back in March, targeting CAFD between $235 million and $260 million for Fiscal 2023.

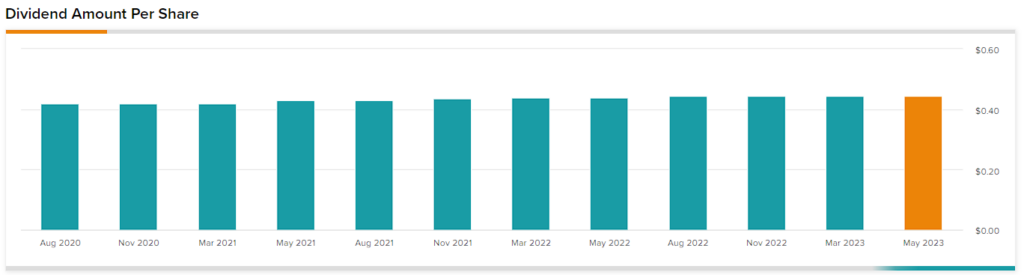

Assuming the company achieves the midpoint of this range and modestly dilutes shareholders, I would expect CAFD/share for the year to land close to $2.07, in line with last year’s performance. CAFD/share is likely to be higher if the higher end of this range is achieved, but let’s be prudent. Therefore, Atlantica’s current annualized dividend per share rate of $1.78 and the stock’s 7.5% dividend yield remain well-covered.

Is AY Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment on the stock, Atlantica Sustainable Infrastructure has a Moderate Buy consensus rating based on two Buys and three Hold ratings assigned in the past three months. At $31.40, the average Atlantica Infrastructure stock forecast implies 34% upside potential.

The Takeaway

In conclusion, Atlantica Sustainable Infrastructure presents a compelling investment opportunity if you seek green energy stocks offering consistent income and sustainability. The company’s unique qualities, including its diverse asset base, long-term PPAs, and strong off-takers, provide a high level of predictability for future cash flows.

Further, despite recent declines in share price attributed to macroeconomic headwinds and rising interest rates, Atlantica remains resilient. Its robust portfolio and inflation-protected assets position the company well for long-term success, with its most recent Q1 results demonstrating this strength. Finally, Atlantica’s 7.5% dividend yield remains well-covered and should provide investors a relatively hefty capital return while widening the investment case’s overall margin of safety.