Nvidia has lost nearly half of its market value since its peak, subsequently leaving many investors wondering whether the stock provides an attractive entry point. The U.S.-based technology firm seems under-appreciated by the bulk of market participants. Thus, I’m bullish on the stock; here’s why.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent Performance Explained

Nvidia stock’s recent weakness is multifactorial. First of all, the company faced a trying semiconductor supply-chain, which has added inflationary pressure to its business model. The semiconductor days to delivery ratio recently reached 26.6, meaning that Nvidia’s operational efficiency is doubted by many investors.

Furthermore, Nvidia stock has faced stock market factor pressure, which has caused a significant drawdown in some of the big technology names as a consequence of a growth to value rotation, with inflation being the catalyst of it all.

Nonetheless, investors have likely overreacted to the various systemic and idiosyncratic headwinds, leaving Nvidia stock undervalued, and attractive.

Nvidia’s Market Overview

A large part of Nvidia’s recent success is tied to the rise in artificial intelligence’s use cases for enterprise and gaming solutions.

GPUs are integral for artificial intelligence applications pertaining to image recognition. Thus, Nvidia’s flagship A100 Tensor Core GPU has made significant strides over the past few years. Although the company’s competitors, such as Advanced Micro Devices (AMD) and Intel (INTC), provide GPUs at competitive prices, Nvidia is often seen as the “best-in-class” GPU supplier, thus providing the firm with product differentiation advantages.

Furthermore, CPUs have grown in stature over the past decade as the proliferation of time-series methods has stimulated demand for the concept. Nvidia’s GeForce RTX 3080 is considered a viable option for enterprise solutions, which is a key driver for the company.

Previous Earnings & What To Expect

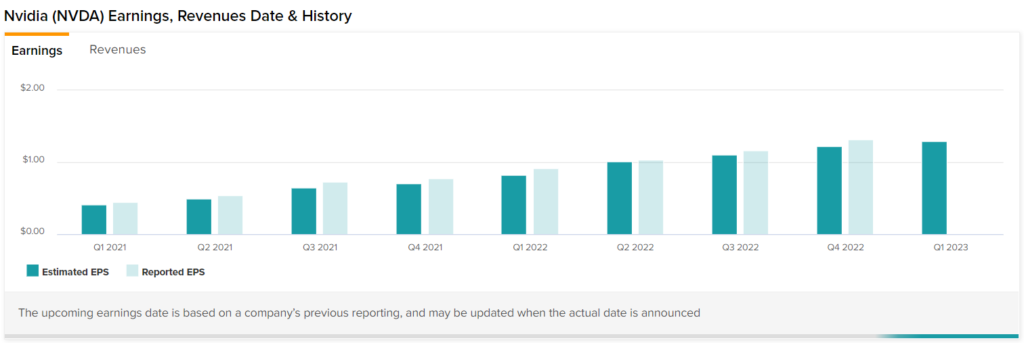

The firm’s fourth-quarter earnings report produced an earnings-per-share amount of $1.32, translating to a 70.32% year-over-year increase. Looking forward, the company’s first-quarter results will be released on May 25, in which a strong print is anticipated.

Additionally, Nvidia’s Beneish M-score of -1.75 is reasonably placed, suggesting that there aren’t any signs of aggressive financial reporting on an ex-post basis. Lastly, Nvidia has a reputation of beating earnings as it’s done so for fifteen out of its previous sixteen reported periods.

Hedge Fund Sentiment

Hedge funds are bullish on Nvidia stock. By observing TipRanks’ 13-F tracker, it’s clear that hedge funds have turned a corner on their Nvidia sentiment. After an abrupt sell-off during the earlier stages of the year, hedge fund managers added a cumulative of 1.3 million shares to their portfolios in the past quarter.

Notable names among the buyers include Ray Dalio, Charles Clough, and Cory Whitaker.

Hedge fund holdings provide a solid overview of a stock’s near-term prospects, as they have short-term mandates that incorporate active trading to maximize their profits. Thus, Nvidia stock’s prospects are considered lucrative among some of the Wall Street’s whales.

Valuation Metrics & Price Level

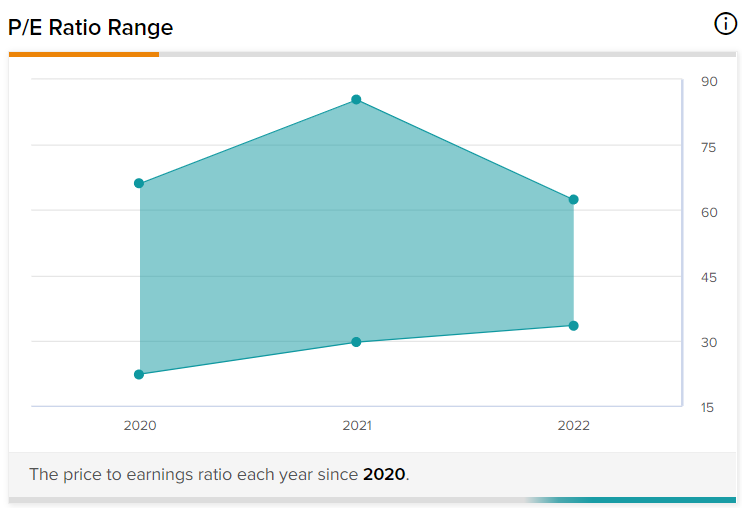

Nvidia’s recent sell-off has dragged the stock back into undervalued territory. According to TipRanks’ valuation algorithm, Nvidia’s price-to-earnings ratio (40.89x) is in mid-territory, and its forward price-to-earnings ratio (32.20x) is at the lower end of the spectrum, suggesting that the stock might be undervalued.

Furthermore, Nvidia’s PEG ratio of 0.39x suggests that the company’s earnings-per-share growth is robust and undervalued by market participants.

Lastly, Nvidia’s 1-year relative strength of 39.14 conveys that the stock is borderline oversold, meaning that it provides a lucrative entry point for investors who’re willing to take on the risk.

Wall Street’s Take

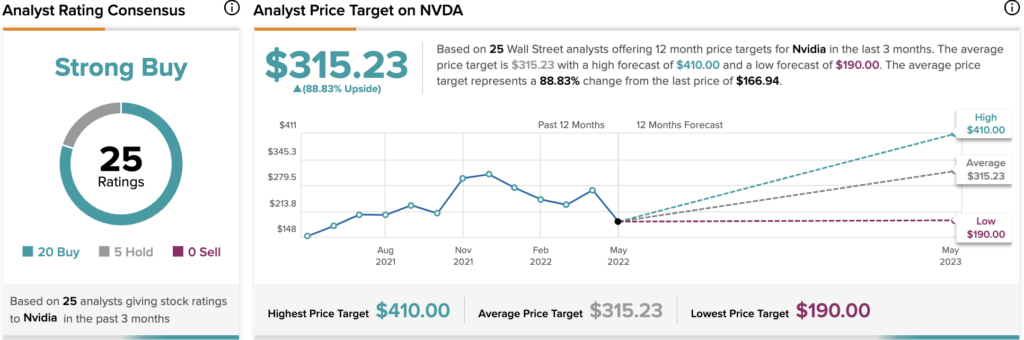

Morgan Stanley (MS) is one of the big Nvidia optimists on Wall Street. According to analyst Joseph Moore, “The stock is a core holding; our approach is to at least maintain a market weighting in the stock, and look for spots for an overweight.”

Turning to the rest of Wall Street, Nvidia earns a Strong Buy consensus rating based on 20 Buy and 4 Hold ratings assigned in the past three months. The average NVDA stock price target of $315.23 implies 88.83% upside potential.

The Bottom Line

Nvidia’s recent stock capitulation suggests that investors are worried about the general economy, which has led to a selloff of high-beta stocks, such as Nvidia. However, matters have been blown out of proportion, and market participants could realize that Nvidia is a robust company with “best-in-class” product offerings.

Furthermore, key metrics, hedge fund buying, and Wall Street’s price targets suggest that Nvidia is an undervalued stock that currently provides a lucrative entry point.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure