Chipotle Mexican Grill (NYSE:CMG) owns and operates over 3,400 Mexican restaurants across five different countries. Investors have bid up its shares to 67x earnings, touting the company’s growth, drive-throughs, recession-resistant demand, and balance sheet. However, at current interest rates, Chipotle’s valuation is a market anomaly. The yield on government bonds far exceeds Chipotle’s earnings yield, even into the distant future. Therefore, I’m bearish on Chipotle stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why Chipotle’s Valuation Doesn’t Make Sense

Warren Buffett once said, “Interest rates are to asset prices… like gravity is to the apple. They power everything in the economic universe.”

So what did Buffett mean? Well, in finance, there’s something called the “risk-free rate.” The premise is simple: if you can get 5% on a risk-free asset like a U.S. government bond, that should be the minimum required rate of return for a riskier, less certain asset like a stock. Additionally, you should have a “risk premium” that makes up for the extra risk.

Over the past 150 years, the 10-year treasury has yielded an average of approximately 5%, which is slightly above where we are now. In the same time frame, the median S&P 500 P/E ratio was 15x, providing a 6.66% earnings yield plus growth. This resulted in compound annual returns of around 9.2% for the S&P 500 (over 150 years), meaning that the average equity risk premium over that time was about 4.2%.

The problem is that Chipotle has the opposite of a risk premium, making it look extremely overvalued. For example, on analyst earnings estimates, Chipotle has forward P/E ratios of 57x in 2024, 48x in 2025, 40x in 2026, 33x in 2027, and 28x in 2028. This translates to earnings yields of 1.75%, 2.08%, 2.50%, 3.03%, and 3.57%. These earnings yields are nowhere near the 5.21% you can get on a one-year treasury or the 4.59% you can get on a five-year treasury.

Even if Chipotle lives up to analysts’ lofty growth expectations (and I don’t believe it will) and then trades at a P/E ratio of 30x on its 2028 earnings, you would get a total return of less than 2% per annum, which translates to a negative equity risk premium. This is a market anomaly. But, like Buffett said, gravity should eventually take hold.

If the market decides to re-rate Chipotle at a lower P/E ratio, say 35x on current earnings (providing a 2.86% earnings yield plus growth), the stock price would fall by nearly 50%. A 35x P/E ratio may seem low now, but it is still significantly above where Starbucks (NYSE:SBUX) and McDonald’s (NYSE:MCD) currently trade. Chipotle traded at a P/E ratio of around 25x from 2008-2010, when it had a much larger growth opportunity ahead.

Chipotle’s Growth Will Slow

Chipotle’s earnings have grown at a blistering pace over the past five years. From 2018 to 2023, the company’s EPS grew at a compound annual rate of 47.7%. This was partially the result of the company improving its return on assets. In other words, Chipotle was underearning back in 2018, with just a 7.79% return on assets.

Meanwhile, companies with similar business models, like McDonald’s and Starbucks, were earning an 18% return on assets in 2018 (more than double the returns at Chipotle). Chipotle’s weak returns from 2016 to 2020 were likely due to foodborne illness problems and legal issues that tarnished its reputation and hurt its bottom line. However, Chipotle’s customers have come back in a big way, and the company has improved returns through its loyalty program, expansion, and drive-throughs.

If we fast-forward to 2023, Chipotle doubled its return on assets to 15.41%, in line with other owner-operated chains. For example, Starbucks and McDonald’s also have returns on assets in the 14-16% range, which is high versus the industry’s historical average.

All this means that growth will likely slow at Chipotle. For example, Chipotle’s 10-year average EPS CAGR was much lower at 15.5%. I expect that the company’s growth could be even less than this rate, going forward. Last year, Chipotle grew its restaurant count by just 8%. The company also relies on buybacks, which will be ineffective at 67x earnings. Additionally, there’s the risk that management fails to deliver.

Is CMG Stock a Buy, According to Analysts?

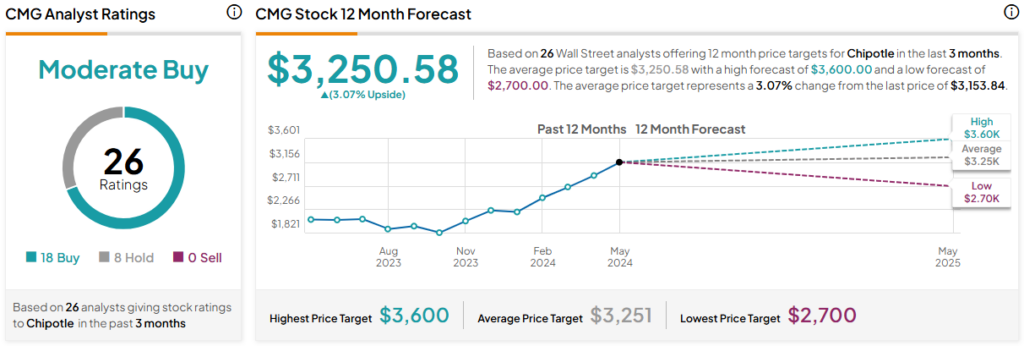

Currently, 18 out of 26 analysts covering CMG give it a Buy rating; eight rate it a Hold, and zero analysts rate it a Sell, resulting in a Moderate Buy consensus rating. The average Chipotle Mexican Grill stock price target is $3,250.58, implying upside potential of 3.1%. Analyst price targets range from a low of $2,700 per share to a high of $3,600 per share.

The Bottom Line on CMG Stock

Interest rates would likely need to move closer to 0% for Chipotle’s valuation to make sense. The stock appears to have a deeply negative equity risk premium. Should Chipotle’s P/E ratio fall from 67x to a more appropriate multiple of 35x on current earnings, the stock could crash by nearly 50%.

Meanwhile, I think Chipotle’s earnings growth rate will slow in the years ahead to be less than its 10-year average of 15.5%. It grew at a blistering pace over the past five years, partially due to its return on assets doubling. Now on par with McDonald’s and Starbucks on this metric (and on the high end historically), I think this tailwind is gone. Further, buybacks are likely to be ineffective at these levels, and the company’s store count grew by just 8% last year.