AstraZeneca Plc (GB:AZN) became a household name during the pandemic due to its groundbreaking vaccine – and is a well-diversified pharmaceutical company with a strong portfolio of drugs across three segments: oncology, biopharma, and rare disease.

Here’s why it could be a great addition to your portfolio.

The company also has its product line spread across various geographic locations.

The company’s shares have surpassed market returns in the last few years. The stock has generated returns of a whopping 53% in the last three years. Pharma companies are largely immune to the inflationary pressures in the economy.

However, the company’s shares have fallen by around 15% since August 2022, creating a great buy opportunity for investors.

Let’s see what’s working in favour of the company.

Solid pipeline

Over the year, AstraZeneca has developed a strong pipeline of products at different stages of development. Overall, the company has 184 projects in its pipeline, including its own developments and acquisitions. It has around 17 molecular entities in the late-stage pipeline. This could provide strong growth opportunities from 2025 and beyond.

The company also expands its base through acquisitions. The company’s acquisition of Alexion in 2021 opened new opportunities for medicine in rare diseases.

Most recently, the company agreed to buy genomic medicine company, LogicBio Therapeutics, which will further enhance the company’s position in genomics and rare diseases.

AstraZeneca also benefits from geographic diversification which gives a measure of stability. The company has developed a strong presence in emerging markets which gives a hedge against any slowdown in a particular region.

Analyst’s view

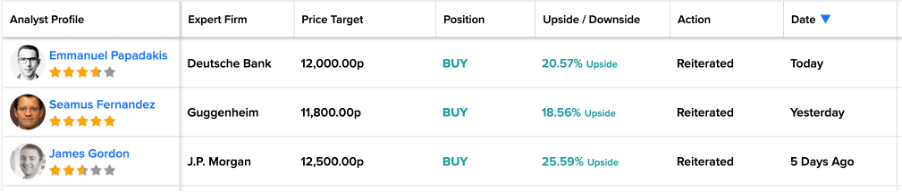

AstraZeneca enjoys wide coverage from analysts who are bullish on the stock and have reiterated their rating after the shares went down.

- Deutsche Bank’s four-star-rated analyst Emmanuel Papadakis reiterated his Buy rating on the stock today. He sees an almost 21% upside potential on the current stock price. Papadakis has a 74% success rate on the stock with an average return of 13.6%.

- Five-star-rated analyst Seamus Fernandez from Guggenheim also has a Buy rating on AZN stock and recently reiterated his rating. Even though he lowered his target price from 12,000p to 11,800p, it is still 18.5% higher than the current price. His average return on the stock is 18% per rating.

- J.P.Morgan analyst James Gordon is another on the list who believes the stock is a Buy. Gordon mainly covers healthcare stocks in the UK, the U.S., and German markets. He has a 71% success rate on the stock, with 24 out of 34 ratings being profitable. Overall, his average return on the stock is 11.14%.

Is AstraZeneca stock a buy or sell?

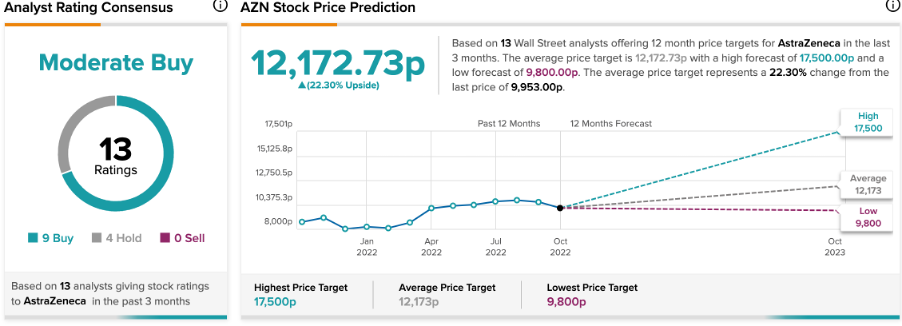

According to TipRanks’ analyst consensus, AstraZeneca stock has a Moderate Buy rating, based on a total of 13 analysts’ recommendations.

The AZN target price is 12,172.7p, which represents a 22.3% change in the price from the current level.

Conclusion

With a hedge against inflation, the pharma sector remains attractive. Overall, the prospects for the stock are bullish, and the current dip presents a good opportunity for investors.

The strong support from a group of analysts just makes the investment case more compelling.