Asana (NYSE:ASAN) is set to report its third-quarter Fiscal 2023 results on December 1. Though not untouched by macroeconomic challenges, the work management platform provider appears to have attracted new customers (according to website traffic trends), boding well for the business in Fiscal Q3.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Asana expects its adjusted net loss to be 33-32 cents per share, which matches the Wall Street consensus estimate. Additionally, the company’s outlook for quarterly revenues is in the range of $138.5 million – $139.5 million, whereas Wall Street expects $139.37 million.

Ever since it went public in September 2020, the company hasn’t missed bottom-line estimates. Let’s take a look at how it stands this time around.

Factors Likely to Have Impacted Q3

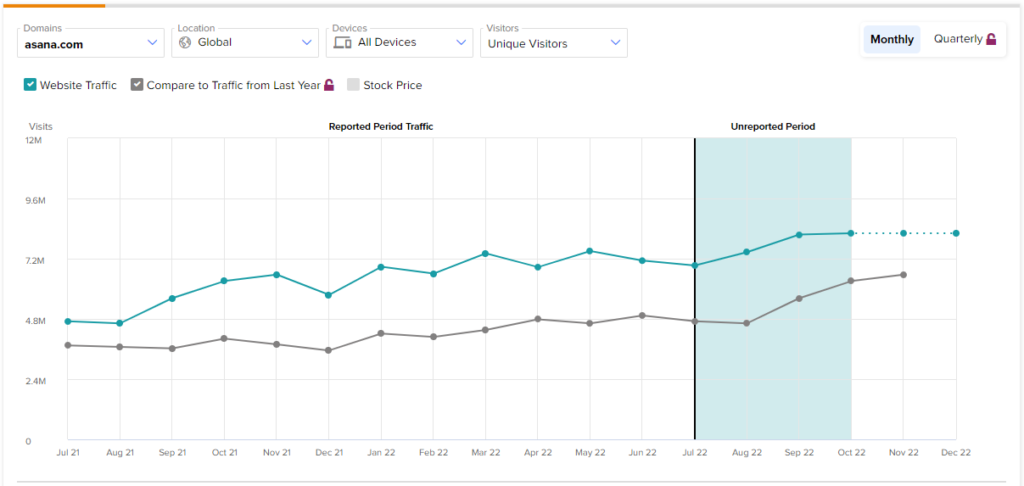

The company has been investing heavily in its enterprise solutions. Particularly, its focus on brand-awareness programs has been pulling solid traffic to its website, which resulted in meaningful customer growth during fiscal Q2. This trend is likely to have sustained into the third quarter as well.

At least, that’s what TipRanks’ Website Traffic Tool suggests. According to the tool, unique website visits to Asana’s website were up from that of Q2 by nearly 11%. Some of this might have converted to sign-ups, boosting the top line during the quarter.

Nonetheless, one must also be aware that macroeconomic instability has wreaked havoc on the foreign exchange market. This could have been a bottom-line headwind for Asana in Q3.

JPMorgan (NYSE:JPM) analyst Pinjalim Bora is also concerned that the high level of cash burn might have dented the already-pressed profitability of the company.

Is ASAN a Good Stock to Buy, According to Analysts?

Wall Street is cautiously optimistic ahead of the results, with a Moderate Buy rating based on six Buys, five Holds, and two Sells. The average ASAN price target of $26.15 indicates 55.1% upside potential.

Final Thoughts

While currency headwinds and cash burn seem to have kept margins under pressure, strong trends in the product side of the business are likely to have led to a relatively solid quarter.