Now that Twitter has delisted, there are alternatives for investors who still believe in the power of social media. Here are three social media platform stocks, META, MSFT, and DWAC, that are investable right now and could thrive as Twitter flounders under its new ownership.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Meta Platforms (NASDAQ: META)

Meta Platforms is a social media and metaverse platform that owns Facebook and Instagram. Like Twitter, Meta is undergoing workforce reductions and has a somewhat controversial leader.

However, CEO Mark Zuckerberg has a vision that Musk doesn’t seem to have. Specifically, Zuckerberg is transitioning Meta Platforms into a metaverse-focused company, so it’s not entirely dependent on Facebook and Instagram’s revenue.

That said, it’s encouraging to know that Meta still has Facebook, which is popular among older social media users, as well as Instagram, which appeals strongly to the Millennial and Zoomer age demographics.

Frankly, these two platforms aren’t associated with the Musk-Twitter controversy now, and that’s good news for investors seeking stability. Plus, you’ll get great value with META stock, as the company has a trailing 12-month P/E ratio of just 10.6x, suggesting a bargain that’s hard to resist.

What is the Price Target for META Stock?

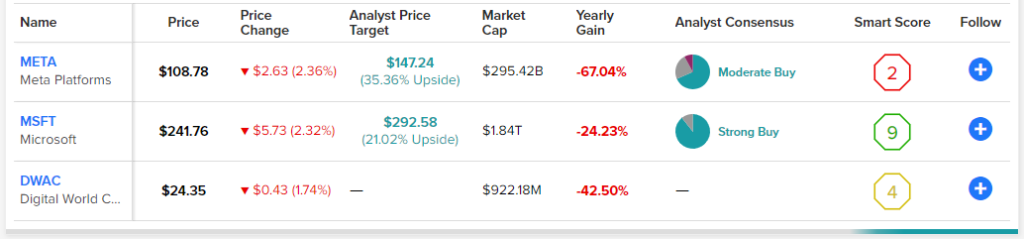

META has a Moderate Buy consensus rating based on 26 Buys, nine Holds, and three Sell ratings assigned in the past three months. The average Meta Platforms stock price target of $147.24 implies 35.4% upside potential.

Microsoft (NASDAQ: MSFT)

Microsoft is a well-known software and cloud computing company that also happens to own the social media site LinkedIn. Unlike Twitter, Microsoft has little to no controversy associated with the company.

There’s much more to Microsoft than LinkedIn, so you’ll want to research the company thoroughly before buying MSFT stock. Still, a stake in LinkedIn could prove to be profitable as this social media site is quite popular among professionals in various industries.

Believe it or not, LinkedIn had 875 million global users as of October 2022. Moreover, LinkedIn users tend to be loyal to the platform, so there’s no reason to expect userbase attrition in 2023 and 2024.

MSFT stock slid throughout the year, but it may be poised for a swift comeback. Indeed, LinkedIn could help Microsoft and its shareholders thrive with steady multi-year growth.

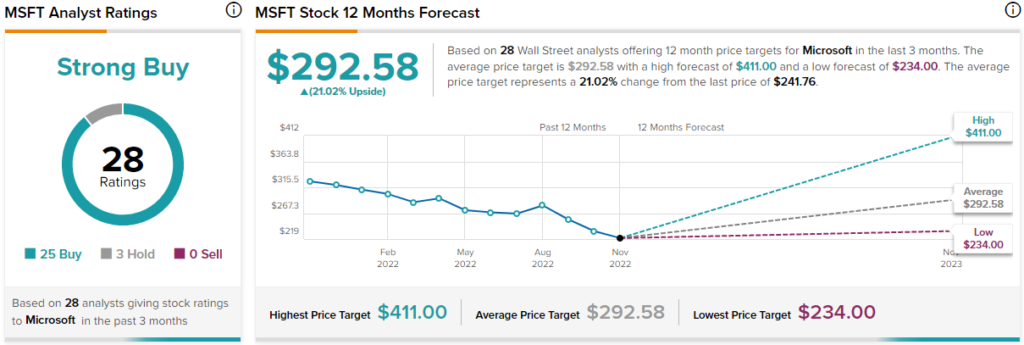

What is the Price Target for MSFT Stock?

MSFT has a Strong Buy consensus rating based on 25 Buys and three Hold ratings assigned in the past three months. The average Microsoft stock price target of $292.58 implies 21% upside potential.

Digital World Acquisition (NASDAQ: DWAC)

Digital World Acquisition is a blank-check company, also known as a special purpose acquisition company or SPAC. It plans to merge with Trump Media & Technology Group (TMTG), which is run by former U.S. President Donald Trump. TMTG operates a social media app called Truth Social.

A bit of positive news just happened with Digital World Acquisition, as the shareholders voted to give the company until September 2023 to finalize its merger plans with TMTG. Bear in mind that this merger needs to happen in order for TMTG to be directly tradable without Digital World Acquisition.

TMTG stands to gain $1.3 billion in cash if and when the merger is finalized. These funds could conceivably be spent on expanding Truth Social and attracting well-known content creators. Furthermore, Truth Social could get a boost of popularity as Trump recently announced his intent to run for president in 2024.

If you’re anticipating a “red wave” of conservative sentiment in the world of politics, Truth Social could become very popular in the coming years. If that happens – and if the Digital World Acquisition-Truth Social merger finally takes place – DWAC stock should have lots of room to run.

Regarding analyst price targets, however, DWAC currently doesn’t have one.

Conclusion: META, MSFT, and DWAC Look Interesting

Twitter and Musk may prove to be unpredictable in 2023. However, there are other social media platforms to consider buying now. Consider META, MSFT, and DWAC shares – one, two, or all three if you’d like – as the social media revolution can move forward with or without Twitter.