Qantas Airways (ASX:QAN) shares took off on Thursday, after the airline issued a much better than expected profit forecast. Travel is one of a number of sectors hit hard by the COVID-19 downturn, but now rebounding since the global reopening from pandemic shutdowns.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the travel sector has seen recent gains, analysts believe the gaming space is also likely to see an uplift, with promising ‘reopening stocks’ including, Aristocrat Leisure Limited (ASX:ALL) and Tabcorp Holdings Limited (ASX:TAH).

As pandemic-hit sectors bounce back, opportunities arise for investors

Wilsons Advisory analysts have identified Aristocrat Leisure and Tabcorp as two pandemic recovery stocks worth watching. These companies are in the business of providing gambling content and technology, with customers including casinos and betting apps.

The pandemic dealt a heavy blow to gambling companies, but business is picking up, as sports and casinos get back into full swing.

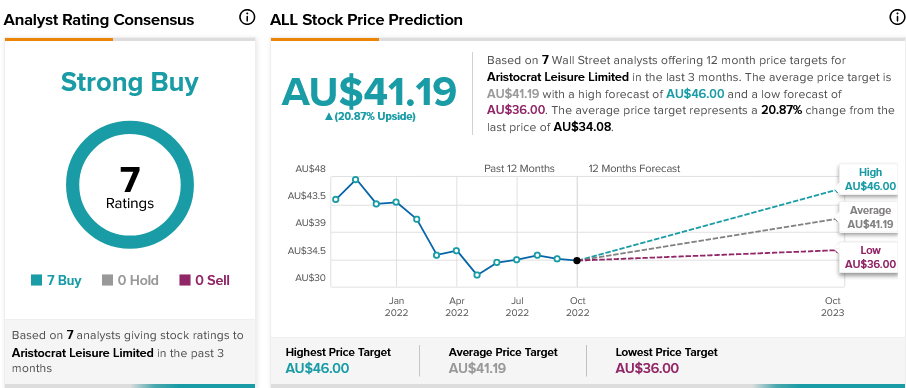

Aristocrat Leisure share price forecast

Founded in 1953 and headquartered in Sydney, Aristocrat has a presence across America, Asia, Europe, and Africa. The company launched a AU$500 million share repurchase program this year, as it seeks to both return money to investors and reduce its share volume.

According to TipRanks’ analyst rating consensus, Aristocrat stock is a Strong Buy. The average Aristocrat share price forecast of AU$41.19 implies over 20% upside potential.

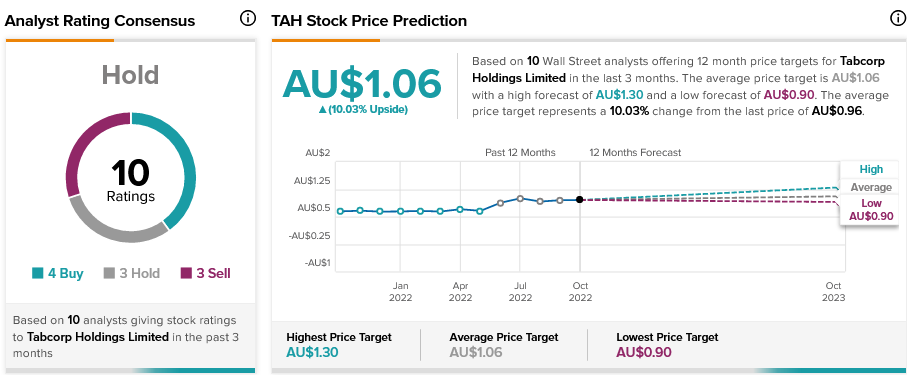

Tabcorp share price prediction

Melbourne-based Tabcorp has been in business since 1994 and has a presence in several international markets. In a business expansion and diversification effort, Tabcorp has secured a strategic deal with Dabble Sports. It will invest AU$33 million for a stake of 20% in the fast-growing, youth-oriented social betting provider.

According to TipRanks’ analyst rating consensus, Tabcorp stock is a Hold. Jefferies analyst Simon Thackray recently reiterated a Buy rating on Tabcorp, with AU$1.10 price target. The average Tabcorp share price prediction of AU$1.06 indicates 10% upside potential.

Tabcorp insiders, such as directors and executives, are big believers in their stock. TipRanks’ Insider Trading Activity shows that Insider Confidence Signal is currently Very Positive on Tabcorp. The company’s insiders have purchased AU$258,400 worth of shares in the past three months.

Concluding remarks

As casinos reopen in the post-pandemic recovery and online betting uptake continues to grow around the world, the future looks much more promising for Aristocrat Leisure and Tabcorp. In Aristocrat’s case, the share buyback program could make the stock even more valuable over time. As for Tabcorp, the Dabble investment deal has many potential benefits.