Shares of semiconductor design firm Arm Holdings (ARM) got clobbered amid the recent summer sell-off, shedding close to 43% of its value from peak to trough. Indeed, the faster they rise, the harder they stand to fall as the market turns its back on the biggest near-term winners. Though the recent valuation reset may signal the glory days are over, I’d argue that the wide-moat firm is just getting started. The stock may be broken, but its growth story will improve with time. As Arm gets a hand in building its own chips, perhaps dominant AI chip giant Nvidia (NVDA) will have met its match.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though still pricy after the vicious pullback, I’m staying bullish on ARM stock as it’s one of those full-on growth stocks whose potential may still be underestimated by investors overly focused on the still-extended valuation metrics.

Arm stock Is Down But Not Defeated

Despite the significant drop, I remain optimistic about Arm stock. As it stands today, Arm stock remains down just north of 27% from its all-time highs hit at the start of July. Understandably, it’s hard to reach for such a falling knife when the stock has only been public for about a year. Furthermore, the stock could get cut in half multiple times and still be considered expensive by the traditional value crowd.

Nevertheless, this decline doesn’t diminish my bullish outlook. Today, shares of Arm trade at around 339 times trailing price-to-earnings (P/E) or 83.3 times forward P/E, both of which are miles ahead of the semiconductor industry average. Though far pricier than its peers, I’d argue that it makes little sense to conduct a comparative valuation on the name.

Why? Arm is really in a league of its own. The company’s architecture is coming into its own, with big-name tech titans like Apple (AAPL), Qualcomm (QCOM), and even Alphabet (GOOGL) leveraging Arm architecture for their custom silicon designs.

This unique position reinforces my bullish outlook. Whether we’re talking about Apple’s A- and M-series chips for its smartphones and personal computers or Qualcomm’s Snapdragon X Elite, which stands out as the PC’s answer to M3 and M4-powered Macbook Pros, it’s clear Arm has been pivotal in empowering tech titans to take complete control over their hardware. Most of Wall Street may still discount this empowerment, especially as the AI PC and Mac wars show off their AI-processing powers going into the new year.

Arm Is Being Embraced By Big Tech

In light of Arm’s growing influence, I remain optimistic about the stock’s potential. Arm’s expanding role in AI-focused ASICs (application-specific integrated circuits) strengthens my positive outlook. Although GPUs currently set the standard for AI accelerators and Nvidia continues to lead, Arm’s innovations in ASICs could disrupt this status quo.

Indeed, this potential to challenge Nvidia’s dominance reinforces why I believe Arm’s long-term prospects are bright. The company’s upcoming Blackwell line of chips, scheduled for release in 2025, has the potential to significantly outperform the current generation. While demand for AI chips is likely to remain robust, I believe that ASICs could gradually capture a substantial share of this demand from GPUs over time.

Google Is Betting Big on the Future of Arm

Turning to Google’s perspective, their sixth-generation TPUs (Tensor Processing Units) called Trillium leverage the Arm architecture in an intriguing way. Indeed, Trillium’s performance is impressive, with 4.7x better performance versus its last-gen chip. However, the biggest breakthrough (especially versus GPUs for AI-related compute) seems to lie in energy efficiency. Reportedly, Trillium is 67% more power-efficient than its predecessor.

In an era where there are growing concerns about the power demands of next-generation AI data centers, power efficiency is key. Today, AI already reportedly uses as much energy as a small country. And with energy needs expected to rise 100% by 2026, tapping into clean and nuclear energy isn’t enough. As various localities get serious about sustainability, ASICs may finally gain more momentum over the power-hungry GPUs. And that could be a huge shot in the arm of Arm Holdings.

Of course, it costs a great deal for firms to design their own optimized ASIC chips based on the Arm architecture. However, for firms like Google, such big bets could entail massive growth, especially as more firms opt to use its TPUs over Nvidia GPUs. Undoubtedly, Apple is a titan that’s leveraging Google’s TPUs to power its AI Private Cloud Compute.

Given Apple tends to be thinking miles ahead of rivals, I’d argue that Apple’s embracing of TPUs could be a sign that Arm-based ASICs could be where the puck is headed next in the AI chip scene.

Apart from server-side AI chips, Google is also looking to pull forward in the Arm-based CPU race, with its Axion product. The chip, which is under development, also stands to make massive strides on the front of energy-efficiency and performance. Though only time will tell how the Arm-based CPU and GPU combo can stack up against Nvidia’s offerings.

What Is the Future Price of Arm Holdings Stock?

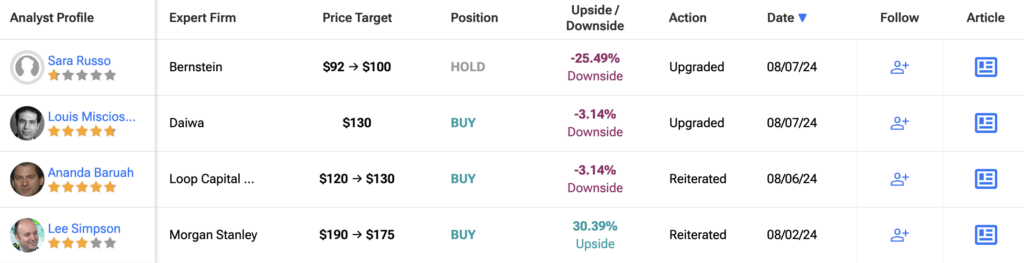

On TipRanks, ARM stock comes in as a Moderate Buy. Out of 18 analyst ratings, there are 13 Buys, four Holds, and one Sell recommendation. The average ARM stock price target is $141.60, implying an upside potential of 4.4%. Analyst price targets range from a low of $82.00 per share to a high of $180.00 per share.

The Bottom Line on ARM Shares

I view Arm as a key player capable of helping the tech industry close the gap with Nvidia in the AI race. This potential justifies a substantial premium, which may still not be fully reflected in the current valuation. While the stock remains pricey following its recent pullback, its broad adoption by major tech giants supports the notion that its growth prospects could justify the high price.

Given these factors, I remain strongly bullish on ARM stock from a long-term perspective.