Arista Networks (NYSE:ANET) is a computer networking company achieving consistently high revenue growth by offering data centers affordable network switching hardware. Although the stock maintains a relatively high forward P/E ratio of around 45x, the company has staked out a solid market niche in a high-growth industry via innovation. Its ability to generate revenue draws attention as a potential investment, leading me to adopt a bullish outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As data centers increasingly demand substantial cloud computing power, both enterprises and hyperscalers are leaning towards more cost-effective options for their ethernet switching technologies. However, network hardware is only one segment of Arista’s business strategy. Earlier this month, Arista introduced new network observability software designed to reduce human error and accelerate problem resolution of network events. They’re intent on meeting a diversity of customer requirements.

Usually, a high P/E ratio that significantly exceeds the industry’s average (the industry average is a forward P/E ratio of around 19x) might raise concerns among investors. However, the business demand for AI-enabled computing challenges this traditional perspective. This evolving market dynamic will likely benefit Arista significantly.

Accordingly, analysts predict an 11.4% annual revenue growth rate for Arista over the next three years. While the forecast is below the CAGR of 17.85% for the data center network market, Arista is aggressively innovating to expand its market reach, making ANET stock highly attractive. I think the stock will rise due to its niche market leadership, the growing demand for AI-powered computing, and its track record of growth.

An Emerging Player in Network Innovation

Arista Network’s surge in market growth is a byproduct of increasing cloud computing and AI workloads. This growth trajectory has enabled the company to capture market share from established switch vendors such as Cisco (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR). ANET’s strategy hinges on providing scalable and cost-effective hardware and its unique Extensible Operating System (EOS).

Arista seeks to be the top choice for data center operators by offering more affordable solutions than its higher-priced competitors. It plans to accomplish this by effectively combining its EOS with cost-effective network solutions. Arista’s strategic approach closely matches the growing needs of data centers, especially in providing efficient ethernet switching solutions. As a result, it is gradually solidifying its market position in the data center space.

Arista is also intensifying its presence in the competitive network switching sector. The company is aggressively pushing into the 800-gigabyte switching market, with trials set for FY 2024 and production for FY 2025. Analysts expect this industry segment to see rapid customer adoption and a significant surge in annual shipments because of AI networking needs.

Beyond hardware, Arista offers a suite of services, including artificial intelligence for IT operations (AIOps), observability, security, and data analytics. The recent launch of its network observability software highlights Arista’s focus on expanding its reach. Finally, its strong presence in the campus networking market, which accounts for about 19% of its revenue, showcases its dedication to diversifying its operations.

Competition-wise, Arista faces challenges from emerging contemporaries like Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO) in the AI networking domain. For example, Nvidia’s Spectrum-4, a high-capacity ethernet switch aimed at AI computing, represents the advanced competition Arista must compete against.

ANET Exhibits Strong Financials

Arista Networks has been demonstrating remarkable growth and profitability. The company completed FY 2023 with substantial growth, reporting 33.8% revenue growth and 54.3% net income growth. These figures reveal an expanding market presence, increasing profitability, and efficient management of operational costs.

Arista’s Q4-2023 financial results also reflect this trend. The company reported 20.8% revenue growth and 47.8% operating income growth. Additionally, it achieved a record free cash flow of $2 billion, indicating strong liquidity and financial health. Most of this cash was reinvested into the business, emphasizing Arista’s focus on long-term growth. However, Arista used $112 million for share repurchases during FY 2023.

For Q1 2024, Arista anticipates revenue growth of approximately 14%. The company forecasts quarterly revenue to be between $1.52 and $1.56 billion, with impressive non-GAAP operating and gross margins of 42% and 62%, respectively.

An essential component of Arista’s financial performance is its margin expansion. In FY 2023, the company achieved a 42.4% adjusted operating margin, a notable rise from 37.7% in FY 2020. The increase is primarily the result of gross revenue growth and operational efficiency, indicating effective cost management and profitable business operations.

Analysts are highly optimistic about Arista’s future. They expect a 10.4% earnings growth rate over the medium term, signaling potential for robust cash flows. Furthermore, Arista Networks has demonstrated a consistently strong performance in its returns on capital employed, achieving an impressive 28.1% return for FY 2023, complemented by a solid 17.7% average return on capital employed over the past three years.

This consistent performance showcases Arista’s efficiency in using its capital to generate profits. It also underscores investor’s faith in the company’s long-term viability and financial health.

Is ANET Stock a Buy, According to Analysts?

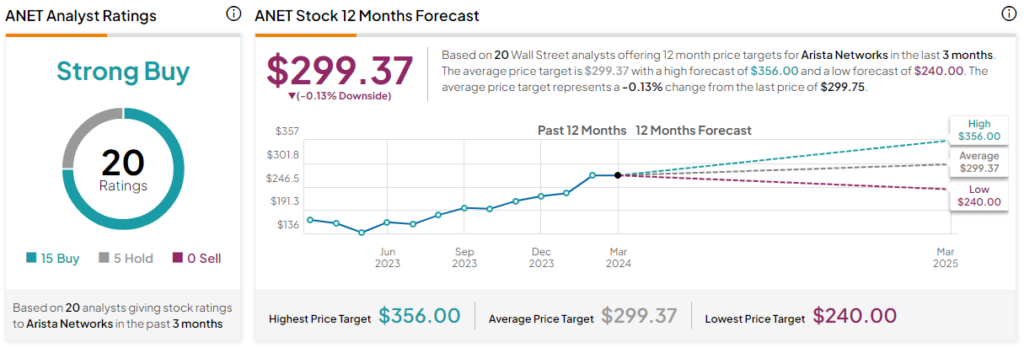

According to TipRanks, ANET is currently rated as a Strong Buy based on 15 Buys, five Holds, and no Sell ratings from financial analysts over the past three months. The average ANET stock price target is set at $299.37, implying that the stock is fairly valued. These analyst price targets vary, ranging from a low of $240.00 per share to a high of $356.00 per share.

Final Insight on ANET

Arista’s high stock price surge reflects investors’ positive sentiment about its future revenue growth. The decision to counter Cisco and Juniper Network as a more affordable, flexible alternative is a shrewd strategy. Arista Networks is also well-positioned to capitalize on the demand for AI computing. However, the high-performance ethernet switching market for AI applications could see them in more direct competition with Nvidia, particularly for specialized solutions.

Nonetheless, despite a high forward P/E ratio, look for the company’s penchant for innovation to give it a competitive edge.