Believe it or not, Argentine stocks have quietly been one of the best trades of 2023. The Global X MSCI Argentina ETF (NYSEARCA:ARGT) is up a torrid 53.5% year-to-date, and it picked up even more momentum since Javier Milei was elected Prime Minister on November 19th. The ETF is up roughly 20% since Milei’s victory because investors are excited that the pro-free-market candidate will be able to bring much-needed reform to Argentina’s troubled economy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I believe ARGT is the best way to invest in the Argentine market as a whole. Even after this massive rally, I’m bullish on ARGT because there could still be plenty of upside ahead as the newly-elected Milei works to right the ship in Argentina. Let’s take a closer look at the market’s largest Argentina-focused ETF and the changes that Milei wants to bring about for the country.

What is the ARGT ETF’s Strategy?

According to Global X, ARGT “seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Argentina 25/50 Index.” Its investments include “the largest and most liquid securities with exposure to Argentina.”

Unexpectedly Strong Performance

While ARGT’s red-hot performance in 2023 has been eye-catching, the ETF has actually quietly put up a very respectable performance in recent years. The Argentine economy itself has suffered because of high inflation and other problems, but ARGT has managed to perform well in spite of this.

As of October 31, ARGT has generated an excellent annualized return of 19.6% over the past three years. This strong run means that ARGT has outperformed both the S&P 500 (SPX) and the Nasdaq (NDX) by a comfortable margin over the past three years. For comparison, the Vanguard S&P 500 ETF (NYSEARCA:VOO) has an annualized return of 10.3% over the same timeframe, while the Invesco QQQ ETF (NASDAQ:QQQ) (a good proxy for the Nasdaq) has returned an annualized 9.9%.

Further out, ARGT hasn’t outperformed these U.S. indices like it has over the past three, but it still has a strong annualized five-year return of 10.3% and a decent 10-year annualized return of 7.6% as of October 31.

That said, while ARGT has performed decently, the broader Argentine economy has been a shambles, leaving Milei with his work cut out for him but plenty of opportunity to turn things around.

A Breath of Fresh Air

The always-colorful, chainsaw-wielding Milei, who describes himself as an “anarcho-capitalist,” ran on the promise of radical economic change. If nothing else, he’s certain to shake things up, which is probably not a bad thing in a country where triple-digit inflation has been rampant, the peso (the local currency) has lost about 90% of its value against the dollar on the black market, and an increasing number of people are struggling to get by on a day-to-day basis.

Milei is an economist and free market capitalist whose ideas stand in stark contrast to those of the predecessors he will be replacing. Argentina’s government has long spent more on social spending than it has brought in, which is one of the reasons that the economy is in the state that it is in today, and Milei has clearly identified this as a problem that needs to be solved.

While many politicians talk about cutting government spending, Milei famously says he will take a chainsaw to it (often brandishing an actual chainsaw at rallies), meaning that he plans on making dramatic cuts, not just trimming at the margins.

He also plans to cut the size of the government, sell state-owned companies, and get rid of the country’s central bank. He has also spoken of dollarizing the economy, and he is an outspoken proponent of Bitcoin (BTC-USD). Dollarization refers to the practice where the U.S. dollar is utilized alongside or as a replacement for the local currency of a different country.

Time will tell if Milei will be able to accomplish these changes and if they will be effective, but in an economy that badly needs a shakeup, his ideas for drastic change could be just what the doctor ordered.

If the government can go from being a hindrance to being a catalyst, Argentina’s economy actually has a lot going for it. It ranks second among Latin American countries in the Human Development Index, which measures factors like healthcare and education. It’s also a member of the economically powerful G20, a group of countries that represents approximately 85% of global GDP.

Furthermore, Argentina is blessed with rich natural resources such as fertile farmland and an abundance of energy and minerals. Argentina has significant lithium reserves, which could be lucrative amid a long-term shift towards electric vehicles. This agricultural powerhouse is also one of the world’s leading exporters of commodities, including beef, wheat, and soybeans, which are all crucial commodities for feeding the world’s growing population. Moreover, Argentina has significant oil and natural gas reserves.

What are ARGT’s Holdings?

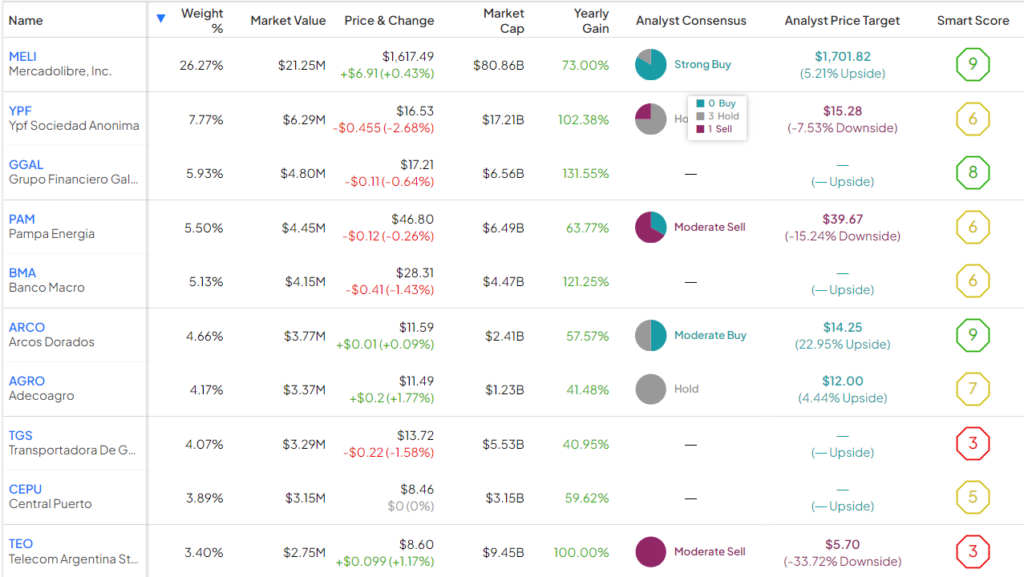

Diversification is not really one of ARGT’s strong points. It holds just 25 stocks, and its top 10 holdings make up 69.1% of the fund. Furthermore, top holding MercadoLibre (NASDAQ:MELI), the e-commerce and payments powerhouse that has been on fire in 2023, makes up a whopping 26.3% of the fund.

Below, you can check out ARGT’s top 10 holdings using TipRanks’ holdings tool.

That being said, ARGT is meant to be a targeted way to gain exposure to Argentina’s top stocks, so broad diversification isn’t really the primary goal of investors using this ETF.

What is ARGT’s Expense Ratio?

ARGT features an expense ratio of 0.59%. This means that an investor putting $10,000 into ARGT will have to pay $59 in fees over the course of a year. Assuming that the expense ratio remains at 0.59% and that the fund returns 5% per year going forward, this investor will pay $738 in fees over the course of a decade-long investment.

This certainly isn’t a bargain, but investing in international ETFs is typically more expensive than investing in broad-market U.S. ETFs, especially when they are focused on markets that are somewhat off the beaten path, like Argentina.

Investor Takeaway

ARGT has been a strong performer in recent years, despite the problems the Argentine economy has been grappling with. The ETF’s large run-up after Milei’s election is a vote of confidence from the market.

If nothing else, it’s refreshing to see a leader come in with ideas that will dramatically shake up a status quo that clearly isn’t working. In my mind, this makes ARGT a much more interesting long-term investment opportunity than it was before Milei’s election.

If Milei’s dramatic reforms can right the ship for the broader economy, ARGT’s recent rally could just be the beginning.