Apple (NASDAQ:AAPL) stock has been rising steadily — more than a month after its Vision Pro reveal. Apple’s headset (or spatial computer) is poised to go toe to toe with that of Meta Platforms’ (NASDAQ:META). Indeed, Meta has been investing billions into the Metaverse for over a year now. Still, the company has yet to convince most of us to purchase a headset and stay plugged in long enough for Meta to monetize meaningfully.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, it could take years before Meta’s metaverse makes a meaningful impact on overall earnings, which are dominated by ads from the social media family of apps. However, just because Meta and its Quest headset are off to a slow start does not mean Meta won’t eventually be able to make a significant mark on the field of spatial computing.

It’s unclear how spatial computing will take off at this juncture. As it always does, Apple’s going the “premium” route with mind-blowing, top-of-the-line technologies. As you’d imagine, the inclusion of the absolute best hardware comes at the cost of a hefty price tag — $3,500. Indeed, many people were shocked when the sticker price was announced.

Though it’s far too early to tell if the spatial computer is worth the price of admission, given that only a limited number of people have actually tried the headset, I do think it’s hard not to give Apple the edge when it comes to the headset battle with Meta.

Nevertheless, let’s use TipRanks’ Comparison Tool to have a closer look at Apple and Meta as they duke it out over the coming years.

Meta Platforms Has Its Bases Well-Covered as the Metaverse Race Kicks Off

Undoubtedly, Meta currently sports the more affordable option with its baseline Quest headset, with the latest (Quest 3) iteration going for $500. Indeed, Meta has the low-to-mid-end of the market pretty well-covered. Still, there are a lot of competitors in that corner of the market.

Though we may be entering an era where headset tech is in a place to take off with the average tech-savvy consumer, I do believe Apple is right to start at the high end first while opening the door to a cheaper, low-to-mid-end device at some point down the road when costs of such technologies begin to come down.

Over the medium term, it may take a genuinely high-end device to offer the type of immersive experience that gets the rest of us excited to buy a headset and plug into the VR/AR experiences. Most notably, high-end devices stand to better tackle the biggest hurdle stopping consumers from making the jump to VR — motion sickness.

Though Meta also has the Quest Pro on the high end, the $1,000 price tag doesn’t come close to that of the Apple Vision Pro. Indeed, there’s a lot of premium placed on the Apple brand. That said, given the innovation packed into its Pro headset, an argument can be made that the headset isn’t exactly as expensive as it could be when you consider the massive sums poured into the project over the years (you have to consider more than just the cost of the parts).

For now, Meta seems to have hit the ground running, while Apple is less than a year away from storming out of the gate.

The High End of the Market May be What Determines Who Wins the Metaverse Race

The price to get a headset can be quite excessive, especially with a recession potentially looming. Low-to-mid-end headsets seem to offer the perfect mix of tech and affordability. Still, I do believe that the high end of the market is where most of the money will be made, at least in the early days of the Metaverse’s rise. Meta recently made the move to Pro, while Apple is kicking things off with its Pro.

Indeed, it’s hard to tell which Pro headset will end up packing the most punch. The sticker price suggests Apple could take the high end of the market by a long shot. In any case, I would not count future Meta Pro iterations out of the game quite yet. It’s also possible that taking a margin hit by offering a lower price could be the better call in the early days of the Metaverse.

In any case, it’ll take more than competitively-priced Pro-level hardware to entice users. At the end of the day, a metaverse headset can only be genuinely immersive if the software behind it rises up to the test.

Apple’s a company that’s perfected bringing out the best in hardware and software. As such, I think it will be hard to top Apple’s visionOS operating system on the software side. Gestures used to control the Vision Pro headset looked so intuitive that it seemed almost magical.

Can Meta make software play as well with its hardware as Apple can? Only time will tell.

Is AAPL Stock a Buy, According to Analysts?

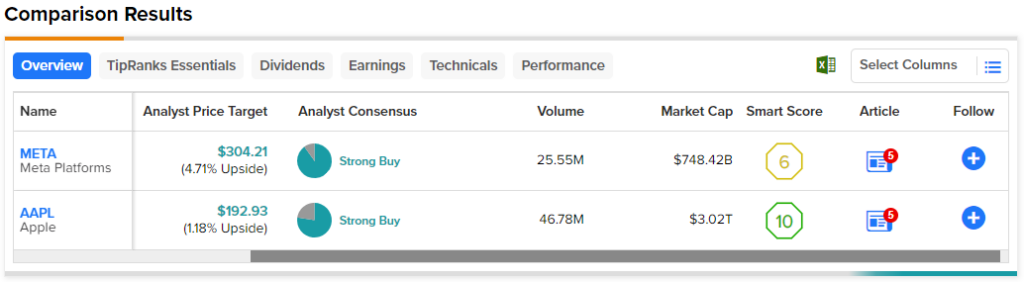

Apple comes in as a Strong Buy on TipRanks, with 24 Buys and seven Holds given in the past three months by Wall Street analysts. Still, the average AAPL stock price target of $192.93 implies just 1.2% upside potential.

Is META Stock a Buy, According to Analysts?

Meta’s a Strong Buy as well, with 36 Buys and four Holds ratings. The average META stock price target of $302.37 implies 4.1% upside potential.

Conclusion

It’ll be fun to see how the headset race pans out. Undoubtedly, the two bitter rivals are sure to give consumers plenty of options as a new dimension of entertainment comes to be, but I believe Apple may be right to start on the Pro end while working its way down to more affordable options. Currently, analysts seem just a tad more bullish on Meta, with more Buys per Hold rating and slightly higher upside potential.