Investors can breathe a sigh of relief, as Apple’s (NASDAQ:AAPL) results were good this earnings season. I won’t go so far as to say that Apple’s earnings report was perfect in every way. However, I am bullish on AAPL stock as the company sold plenty of smartphones during a tough time for the economy. Additionally, Apple is capturing the hearts of analysts and is making headway in India.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple is famous for providing the latest and greatest in tech gadgets, including the always-popular iPhone. An argument could be made that Apple’s quarterly earnings reports are the most important ones, inside and outside of the technology sector.

In other words, if Apple is doing well, there are larger implications for the U.S. economy as a whole. While some days you’ll find a red Apple, today the Apple is green and delicious, and it’s likely not too late for investors to take a bite.

Slowing Sales is a Sticking Point for Apple

To be completely fair and balanced, I’ll start off with the bearish argument concerning AAPL stock. The skeptics might claim that the stock is too close to its 52-week high to be buyable. However, as we’ll discuss, Apple stock could continue to move higher if the company is growing. On the other hand, investors might wonder whether Apple actually is growing, since the company’s recently reported sales indicated a year-over-year slowdown.

Here’s the breakdown. Apple’s second-quarter 2023 total net sales amounted to $94.836 billion, which is less than the $97.278 billion from the comparable year-earlier quarter. This isn’t a horrendous slowdown, mind you. Still, some financial traders are spoiled nowadays and they expect Apple to knock it out of the park every time, which isn’t realistic.

Before you get bent out of shape because Apple’s earnings report wasn’t 100% perfect, consider why Apple’s total sales declined slightly. It certainly wasn’t because of the iPhone. In actuality, Apple’s iPhone sales increased moderately on a year-over-year basis, to $51.334 billion — not too shabby, as this took place during a time of economic uncertainty.

The culprits, it seems, were Apple’s old-school gadgets that Zoomers probably don’t use much nowadays. Mac sales were down substantially, while iPad sales fell moderately. Since young people use their smartphones for practically everything nowadays, it’s understandable that these legacy technologies would fall by the wayside.

India Could be Apple’s Next Frontier Market

What will prompt the next leg up for Apple? Global iPhone sales will be pivotal, of course, but investors should look to India to see where Apple might expand the fastest over the coming quarters.

Apple’s Q2-2023 EPS came in at $1.52, beating analysts’ consensus estimate of $1.43 per share. It might be tempting to assume that Apple’s excellent quarter should be attributed to the iPhone’s popularity in the U.S. and other wealthy markets. Emerging markets also played a role, though, and investors should expect India to take a front seat in Apple’s growth story. Apple’s CEO Tim Cook explained, “There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there.”

This ongoing story is really only getting started, as Apple opened two retail stores in India in April and Cook assured that the company plans to expand its operations in the country. Investors should be patient, though. While D.A. Davidson analyst Tom Forte expects Apple to “mirror its strategy for China for India (from a supply chain and consumer sales standpoint),” he believes “it will take a long time” for Apple “to generate 5%-10% of its sales from the country.”

Is AAPL Stock a Buy, According to Analysts?

There’s no doubt about it: Apple is still a darling of the analyst community. AAPL has a Strong Buy consensus rating based on 24 Buys, three Holds, and one Sell rating. The average Apple stock price target is $181.51, implying 4.5% upside potential.

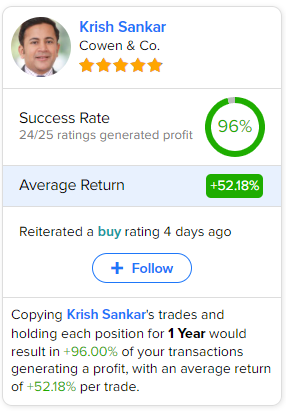

If you’re wondering which analyst you should follow if you want to buy and sell AAPL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Krish Sankar of Cowen & Co., with an average return of 52.18% per rating. See below.

Conclusion: Should You Consider Apple Stock?

At the very least, keep an eye on Apple as there’s a vast market in the nation of India for the company to capture. Also, I wouldn’t worry too much about Apple’s slowing sales; this shouldn’t overshadow the company’s excellent EPS result.

All in all, the bullish thesis for AAPL stock is strong, and analysts are generally optimistic. So, unless the recent rally in the stock really bothers you, I believe it’s a great time to consider a position in Apple stock.