Apple (NASDAQ:AAPL) is a darling of the markets and a member of the “Magnificent Seven.” Yet, investors are starting to see the reality of the situation on 2024’s first trading day. I am neutral on AAPL stock, and I would send an urgent message to Apple’s perma-bulls: high-flying stocks generally need to correct or consolidate before the next leg up.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple is a world-famous manufacturer of smartphones and other tech gadgets. Apple is also known for various services, including streaming.

With a $2.88 trillion market capitalization, Apple is bigger than all other U.S. companies. This might sound bullish, but no company is unstoppable, and no stock can just keep going up without taking a break. This is even true for AAPL stock, which fell today in what might be a bad omen for 2024.

Apple Stock: This is What Exhaustion Looks Like

If you look up “exhaustion” in the dictionary, you might find a picture of Apple stock’s one-year price chart. I’m joking, of course, but the point is that investing in Apple right now involves serious downside risk.

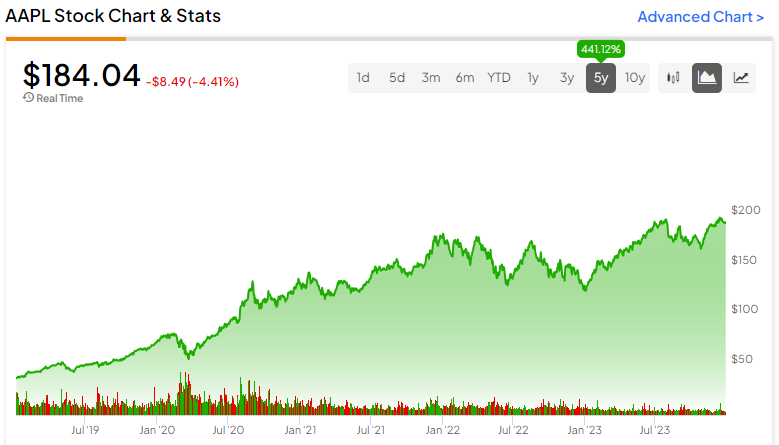

From a chart perspective, Apple hit major resistance at just below $200 in July and then again in December. In hindsight, AAPL stock really needed to take a breather after its relentless rally in 2023’s first half.

Furthermore, after gaining around 52% last year, Apple stock appears to have more room below than above. That air pocket below could easily get filled now that Apple’s market cap is so elevated.

Value-focused investors should be concerned, as Apple’s trailing 12-month price-to-sales (P/S) ratio was nearly 8x before today’s share-price drop. For comparison’s sake, the sector median P/S ratio is slightly above 3x.

I chose to cite Apple’s P/S ratio because the company’s sales are a topic of discussion today – but more on that in a moment. First, I wanted to be fair and balanced and acknowledge one analyst’s bullish perspective on Apple.

Soft iPhone Sales in China: Just a “Fictional Story”?

After AAPL stock’s “magnificent” rally last year, it shouldn’t be too surprising that some analysts are bullish on the stock. Among the most vocal Apple optimists on Wall Street is a well-known analyst, Dan Ives of Wedbush.

It’s no secret that Apple’s iPhone sales haven’t been stellar in China. There, customers are loyal to China-based smartphone brands, especially Huawei.

The market largely overlooked this problem for Apple, and Ives doesn’t seem very concerned about it. The Wedbush analyst seems dismissive of what he calls the “growing noise and Huawei competition in China” and the “iPhone China demise narrative,” which Ives called a “great fictional story” cooked up by the bears.

With that in mind, Ives reiterated his Outperform rating on AAPL stock and published a Street-high $250 price target on the shares. Only time will tell whether Apple can manage to live up to Ives’ confident vision, as the company’s issues in China won’t just go away tomorrow or next week.

Apple Stock: A Bear Emerges

In stark contrast to Ives and many other Apple bulls, one analyst dared to issue a warning about the company today. It’s a rare event since analysts usually heap praise upon Apple.

Specifically, Barclays (NYSE:BCS) analyst Tim Long downgraded AAPL stock from a Hold to a Sell rating and lowered his price target on the shares from $161 to $160. That’s not a huge price-target reduction, but the Sell rating is getting a lot of coverage in the financial media today.

Long cited the “lackluster” performance of Apple’s iPhone 15, stating, “Our checks remain negative on volumes and mix for iPhone 15, and we see no features or upgrades that are likely to make the iPhone 16 more compelling.” That’s a powerful warning, as Apple’s smartphones are the company’s bread and butter.

Don’t expect Apple’s Services business to rescue the company, either. On that topic, Long warned, “We also believe 2024 will bring more Services risk to light.”

Moreover – and here’s the part that I fully agree with – Long expressed concerns about Apple’s overextended valuation versus the company’s actual results. “The continued period of weak results coupled with multiple expansion is not sustainable,” Long cautioned.

Is Apple Stock a Buy, According to Analysts?

On TipRanks, AAPL comes in as a Moderate Buy based on 23 Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average Apple stock price target is $203.04, implying 10.2% upside potential.

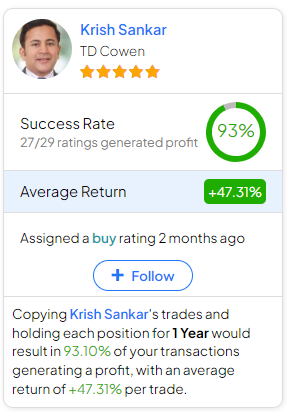

If you’re wondering which analyst you should follow if you want to buy and sell AAPL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Krish Sankar of TD Cowen, with an average return of 47.31% per rating and a 93% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Apple Stock?

I wouldn’t dare to short Apple shares, as the company is still a technology gadget juggernaut, and expensive stocks can always get more expensive. On the other hand, I’m not prepared to dismiss Apple’s China concerns like Ives seems to be doing.

Plus, eager investors should take a long, hard look at Apple’s valuation while also heeding Long’s warnings. When all is said and done, Apple is still an important company with strong long-term growth prospects. However, much of Apple’s anticipated growth is probably already priced into AAPL stock, so I’m neutral on it and am not considering a share position now.