Apple’s (NASDAQ:AAPL) revenue has declined for two consecutive quarters, as macro pressures continue to weigh on consumer spending on discretionary items. Nonetheless, AAPL shares have rallied about 55% so far this year amid optimism around generative artificial intelligence (AI) and confidence in the tech giant’s ability to continue to grow in the long term. While most Wall Street analysts remain bullish on Apple, the upside in the stock could be limited in the near term due to ongoing macro pressures.

Analysts Stay Bullish on AAPL Stock

Apple’s overall revenue declined 3% year-over-year to about $95 billion in the fiscal second quarter (ended April 1, 2023), following a 5% fall in the prior quarter. High inflation and macro pressures have impacted consumers’ wallets, with discretionary spending taking a backseat. Apple expects its June quarter revenue decline rate to be similar to the March quarter.

Despite the ongoing challenges, Apple’s iPhone business and its Services segment remain resilient. It is worth noting that iPhone revenue increased 1.5% during Q2 FY23, even as the broader smartphone industry sales plunged as per IDC estimates. Revenue from the company’s higher-margin Services business increased 5.5% in Q2 FY23.

On Tuesday, KeyBanc analyst Brandon Nispel increased his price target for Apple stock to $200 from $180 and reiterated a Buy rating on the stock. While the analyst’s long-term view is bullish, he told investors that he is neutral on the stock in the near term due to his below-consensus hardware revenue estimates for Q3 FY23.

The analyst explained that the excitement around Apple’s new product launches and investors’ preference for safer bets “is resulting in an elevated multiple” for the stock.

Last week, Bank of America analyst Wamsi Mohan noted that as per SensorTower data, App Store revenues in Q3 FY23 increased 5.9% year-over-year to $6.6 billion, with total downloads on iPhone and iPad increasing 4.3%. Also, App Store dollars per download grew 1.5% in the fiscal third quarter. Overall Mohan highlighted that App Store trends improved marginally in the June quarter from the March quarter.

However, Mohan continues to have a Hold rating on the stock with a price target of $190 based on risk-reward balance, as positive catalysts related to new product launches (AR/VR headset) and stable iPhone sales are offset by a potentially weaker consumer spending backdrop in the second half of the year.

Is Apple a Buy, Sell, or Hold?

Wall Street’s Strong Buy consensus rating on AAPL is based on 24 Buys and seven Holds. The average price target of $193.57 implies only 3% upside potential.

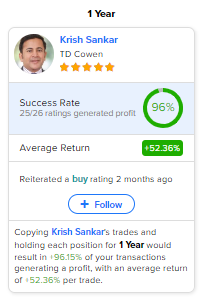

Investors looking for AAPL’s most accurate and profitable analyst could follow TD Cowen analyst Krish Sankar. Copying the analyst’s trades on this stock and holding each position for one year could result in 96% of your transactions generating a profit, with an average return of 52.4% per trade.

Conclusion

While most Wall Street analysts remain bullish on Apple due to its long-term growth potential backed by production innovation, brand value, and high-margin Services business, the average price target indicates limited upside due to the impact of macro pressures on the tech giant’s business.