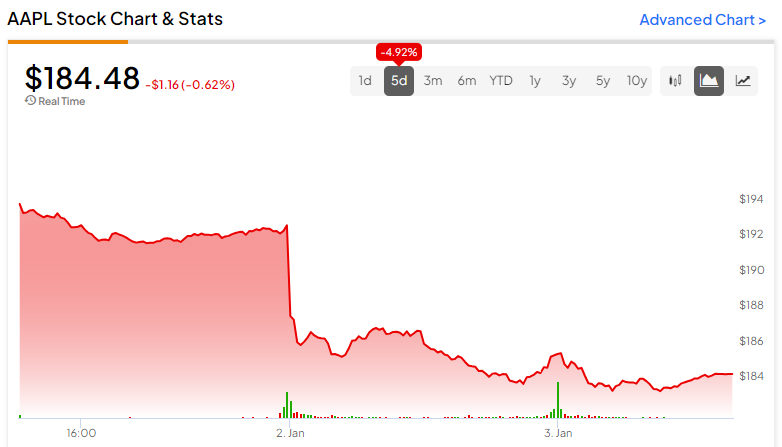

Yesterday was not quite the way Apple (NASDAQ:AAPL) stockholders wanted to kick off the new year, with shares suffering one of the worst single-day plunges in months. Apple stock got battered, falling 3.6% on the first trading day of 2024 due to the notable downgrade from Barclays (NYSE:BCS) to Sell from Hold.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, Sell ratings are few and far between on Wall Street these days. So, the downgrade was enough to send shivers down the spines of investors of the iPhone maker and Magnificent Seven holding, whose magnificence is sure to be tested (and perhaps questioned) throughout the year.

Indeed, Apple isn’t a $3 trillion company anymore after more than $100 billion in market cap was wiped out in a day.

Though five-star-rated Barclays analyst Tim Long had his fair share of reasons for the downgrade (“lackluster” iPhone 15 sales in China, for one) and a price target of $160.00 — which entails more than 13% in downside from here — I think investors should view any such dip to such levels as more of a buying opportunity than a sign that it’s curtains for the Cupertino-based tech titan.

The iPhone 15 Underwhelms. The iPhone 16 May Not Be Much Better, Says Barclays

Besides weak iPhone 15 sales expectations, Long doesn’t see the next iPhone as a catalyst that could help Apple make up for lost time.

“We see no features of upgrades that are likely to make the iPhone 16 more compelling,” Long said.

That downbeat note on the next iPhone is incredibly discouraging for investors. However, it’s quite a stretch to shoot down the next iPhone when we don’t know what the next device could feature.

Indeed, it seems like Apple stock seems to be heavily impacted by bearish notes than bullish ones. In a way, it’s the most unloved of the Magnificent Seven. For example, recently, Wedbush’s Daniel Ives touted Apple as a “golden opportunity” with a $4 trillion market cap in sight. Still, the stock didn’t surge 4% on that news. So, why the overweighting on the negatives? I guess it’s easier to be bearish on Apple stock than peers, who seem more than willing to serve investors what they want: AI announcements.

All considered, I believe the negativity surrounding Apple is overdone, and I am staying bullish, just like Mr. Ives, a bull whose call is being drowned out by excess negativity and a more recent Barclays downgrade.

Why It Could Be a Mistake to Discount the iPhone 16’s Potential

For now, iPhone 16 features are surrounding items rotating in the rumor mill. As such, I don’t think it’s justified to dismiss the next iPhone as uncompelling. The iPhone 16 may not feature a game-changing design. That said, I do believe that hardware innovations could make the next iteration of the iPhone a pretty substantial upgrade, perhaps the largest upgrade in a few cycles.

The iPhone 16 is rumored to have the A18 chip, which could feature even more impressive graphical capabilities. Indeed, the current A17 Pro chip featured in iPhone 15 Pro and Pro Max models can already run some impressive triple-A game titles. Capcom’s Resident Evil 4 Remake and Resident Evil Village are ambitious titles that show the graphical firepower of Apple’s latest chip. Undoubtedly, the latest iPhone shows potential in the handheld gaming device market.

There’s one big problem, however. There simply aren’t enough triple-A titles for gamers to view the latest iPhone as a suitable alternative to the many PC-based handheld devices out there that can run a slew of titles. This could change once Apple is ready to pull the curtain on its latest iPhone 16 later this year.

Apple Entering a “New Era of Gaming,” Says Video Game Industry Visionary

For the iPhone 15 reveal, there was quite an emphasis on gaming. However, I believe that’s just an appetizer ahead of a main course. This year will see the launch of Apple Vision Pro, a device that could be propelled to the forefront by gaming announcements. Indeed, gaming continues to be a main attraction to the medium of spatial computing and the Metaverse.

If Apple can acquire a major gaming studio (something I suggested in a prior piece) or pick up the pace of its gaming-related partnerships like the ones it made with Capcom and legendary game creator Hideo Kojima, I do not doubt that Apple could tap video games as a means to jolt Vision Pro, iPhone, and even Services sales growth.

Last year, Hideo Kojima made a bold statement, saying that Apple is entering a “new era of gaming.” As one of the brightest and most innovative minds in gaming, investors and gamers should not take such a statement lightly.

Is Apple Stock a Buy, According to Analysts?

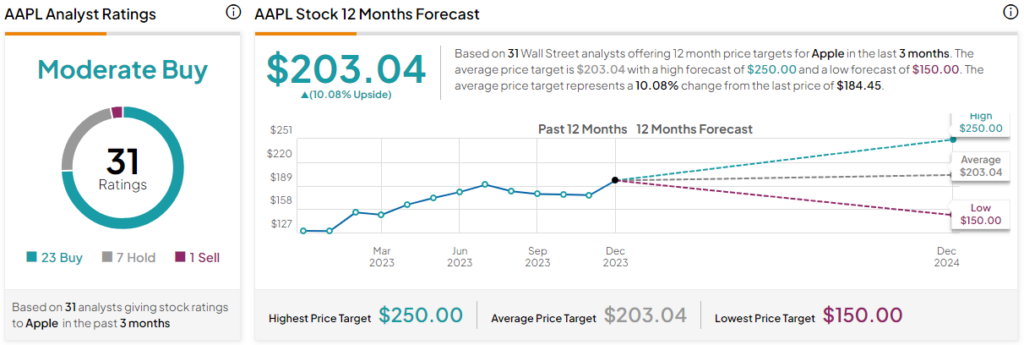

On TipRanks, AAPL stock comes in as a Moderate Buy. Out of 31 analyst ratings, there are 23 Buys, seven Holds, and one Sell recommendation. The average AAPL stock price target is $203.04, implying upside potential of 10.1%. Analyst price targets range from a low of $150.00 per share to a high of $250.00 per share.

The Takeaway

It’s all too easy to be bearish on Apple stock right now and believe Barclays’ Tim Long over the likes of Wedbush’s Daniel Ives.

After Apple’s awful start to 2024, I believe the odds favor the bulls over the bears. Apple’s iPhone 15 may be running out of steam, but there are a lot of new devices (and perhaps some services) coming in 2024. I wouldn’t overlook them.