Apple (NASDAQ:AAPL) might not be flavor of the month right now, but the tech giant still has plenty going for it.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Roughly 1.4 billion people now own an iPhone, forming the backbone of Apple’s business. The ecosystem is highly sticky – once someone buys an iPhone, they are far more likely to pick up other Apple products. That said, this number has stopped growing, with device sales flat to slightly declining over the past three years. The business still follows cyclical patterns tied to refresh cycles, but these have been stretching out longer over time.

That said, as Seaport analyst Jay Goldberg points out, Apple has gotten “much better at monetizing its user base.” Those 1.4 billion iPhones are connected to another billion Apple devices, and services have become the company’s second-largest segment, powered by offerings like Music and AppleCare.

And in the near term, Goldberg thinks the company will do well. “We expect Apple to have a good year on this year’s product line-up, with Apple Air trending well and boding a stronger future for further price increases as an affordable phone (maybe) comes out next year,” the analyst explained.

But over the next five years, says Goldberg, there will be “two big swing factors” that will shape the company’s future.

One revolves around China and geopolitics. Apple’s success has been deeply tied to China’s manufacturing base – but that base itself was built in large part by Apple’s hundreds of billions of dollars of investment over the past two decades. The company now faces the challenge of diversifying production beyond China while still maintaining access to the Chinese consumer market.

Although Apple has started this shift, it will be a lengthy process. For now, the company remains caught in the middle of the U.S.–China trade tensions. “Our checks in PRC consistently show Apple is working with existing partners to move some components and some product lines elsewhere, but no major shifts on the horizon,” Goldberg said on the matter.

The other big factor is naturally AI. Apple’s approach to AI remains unfocused – it has “too many AI strategies” – and missteps here could pose an “existential threat” to the company. If users discover a stronger AI experience on rival platforms – particularly Android – it could undermine Apple’s core user base. On the other hand, getting it right could unleash a “super cycle of upgrades.”

So far, Apple has shown it cannot successfully build its own AI models, and Goldberg thinks that is unlikely to change anytime soon. “But when (if) they get it right, they could cement their position,” the analyst went on to add. Goldberg believes Apple’s most effective strategy is to make the iPhone the best platform for running third-party AI tools. That means no need for large acquisitions – just diversifying partnerships and “let everyone onboard.”

Goldberg thinks that over the next year, the strategy will become clearer. “AI models at the edge are not ready yet,” he summed up, “Apple has time.”

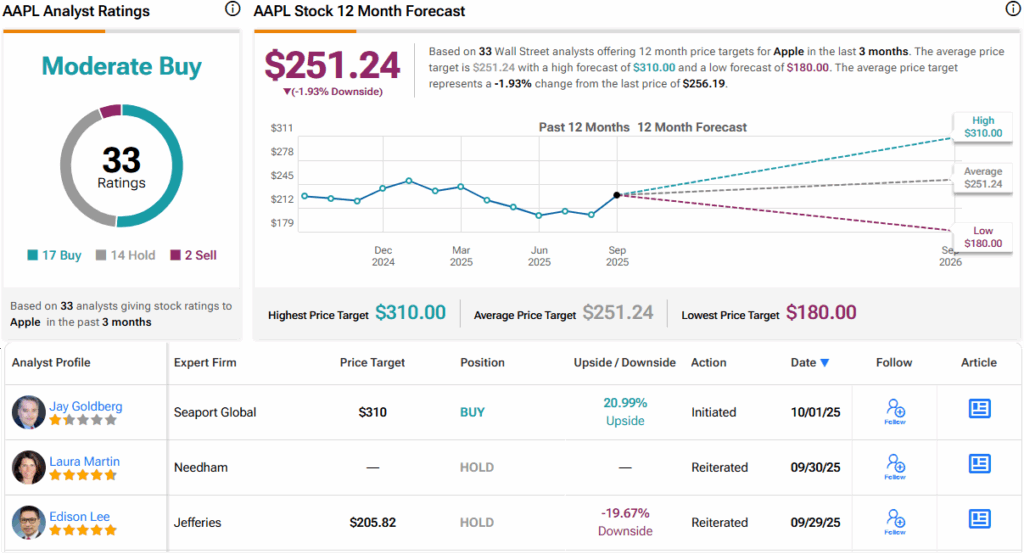

So, what does all this mean for investors? Goldberg initiated coverage of AAPL stock with a Buy rating and joint Street-high $310 price target, implying the shares will post growth of 21% in the months ahead. (To watch Goldberg’s track record, click here)

Of the 33 AAPL reviews posted over the past 3 months, 17 say Buy, 14 recommend to Hold, while 2 implore to Sell, all adding up to a Moderate Buy consensus rating. However, the average target stands at $251.24, suggesting the shares will stay rangebound for the time being. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.