Covid-19 is once again affecting Apple’s (AAPL) supply chain. A recent press release highlighted the impact the Covid restrictions are having at Hon Hai’s assembly facility in Zhengzhou, China, where the iPhone 14 Pro and iPhone 14 Pro Max are put together.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The facility is currently operating at “significantly reduced capacity,” the result of which will be longer waiting times with the company expecting to ship lesser units over the near term.

How this will ultimately affect sales in the holiday rich December quarter (F1Q23) is hard to quantify yet, says J.P. Morgan’s Samik Chatterjee, but the tech giant is not prone to making too many statements, so when it does, it is a signal something is up and implies to Chatterjee that the headwinds to the quarter’s revenue and earnings estimates are “likely to be substantial.”

Other EMS facilities will be able to pick up some of the slack in assembling other models, but with no real alternatives for the iPhone 14 Pro/Pro Max devices, Chatterjee has reduced his expectations for the quarter. The analyst has now lowered the iPhone 14 (Pro & Pro Max) shipment forecast in the quarter by 5 million and Other iPhones by 3 million.

That said, the overall effect on FY23 should be rather benign, as Chatterjee notes that overall demand remains healthy, while going by historical precedent, delays and extended delivery times have done little to dampen consumer demand. Therefore, the 5-star analyst expects the shipment shortfall in the December quarter to be made up in the “typically lower production” March quarter.

And while Chatterjee thinks the lack of further visibility into the current quarter’s shortfall means investor sentiment around the stock will “remain challenged in the near term,” the chance to rectify the situation in the next quarter could provide long-term investors with “several attractive buying opportunities into the shares through to the year-end.”

All told, then, Chatterjee sticks with an Overweight (i.e., Buy) rating backed by a $200 price target. The implication for investors? Upside of 35% from current levels. (To watch Chatterjee’s track record, click here)

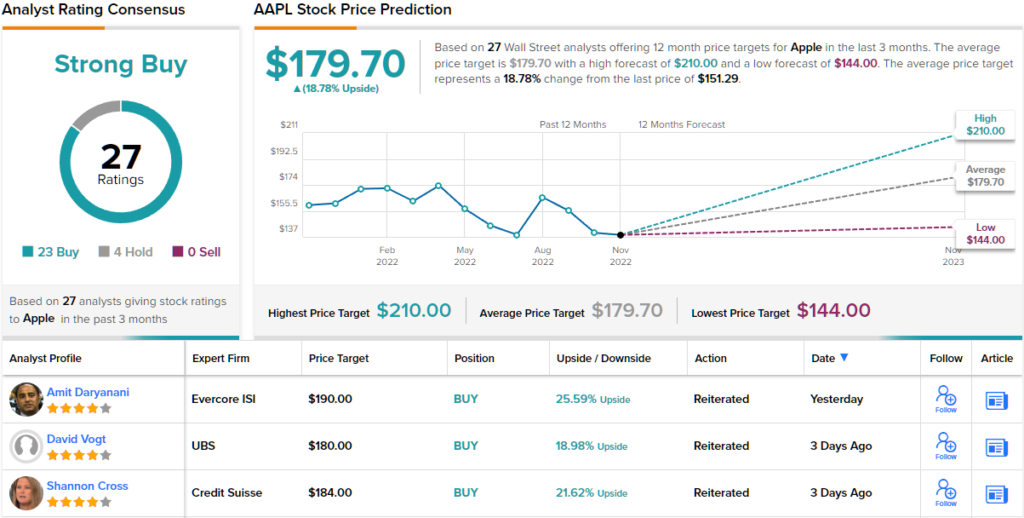

Most analysts agree with JPM’s stance; with 23 Buys outgunning 4 Holds, the stock claims a Strong Buy consensus rating. The forecast calls for 12-month gains of ~19%, considering the average target stands at $179.70. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.