There have been reports that iPhone 15 sales are not quite as strong as Apple (NASDAQ:AAPL) would have liked, particularly in key markets such as China.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, according to Evercore analyst Amit Daryanani, the picture is not conclusively negative. Although in some region, lead times have been falling, Evercore’s iPhone tracking endeavors show the data points to “stable demand for the iPhone 15 Pro and Pro Max models vs. a year ago across most geographies.” That said, the past week has seen lower-end models’ lead times display “big contractions.”

Overall, according to Daryanani, USA lead times are “tracking in-line vs. a year ago while China is slightly weaker.”

Specifically, in the US, deliveries for the iPhone 15 Pro Max and Pro are expected between November 13th – 28th and November 6th – Nov 13th, respectively. This represents time to first delivery of 28 days for the Pro Max and 21 days for the Pro.

The estimated delivery window for the iPhone 15 Plus and 15 is from October 23rd to November 6th and from October 23rd to November 1st, respectively, with both models having a time to first delivery of just 3 days.

As for China, the iPhone 15 Pro Max and Pro are expected to be delivered in 3-5 and 2-3 weeks, respectively, which translates to a time to first delivery of 21 days for the Pro Max and 18 days for the Pro. On the other hand, the iPhone 15 and 15 Plus have delivery estimates for October 22nd, with a time to first delivery of just 2 days.

Daryanani also notes that, on average, over the past week, the Pro Max model’s lead times in the UK and Germany have been lower.

However, summing up, Daryanani’s last thoughts on the data are reassuring. “Finally, we would also caveat that delivery times could be a reflection of strong demand or weak supply – though we suspect given the variation in wait times that this data set more likely suggests higher demand,” he opined.

All told, Daryanani reiterated an Outperform (i.e., Buy) rating on AAPL, backed by a $210 price target, suggesting shares will climb 21% higher in the year ahead. (To watch Daryanani’s track record, click here)

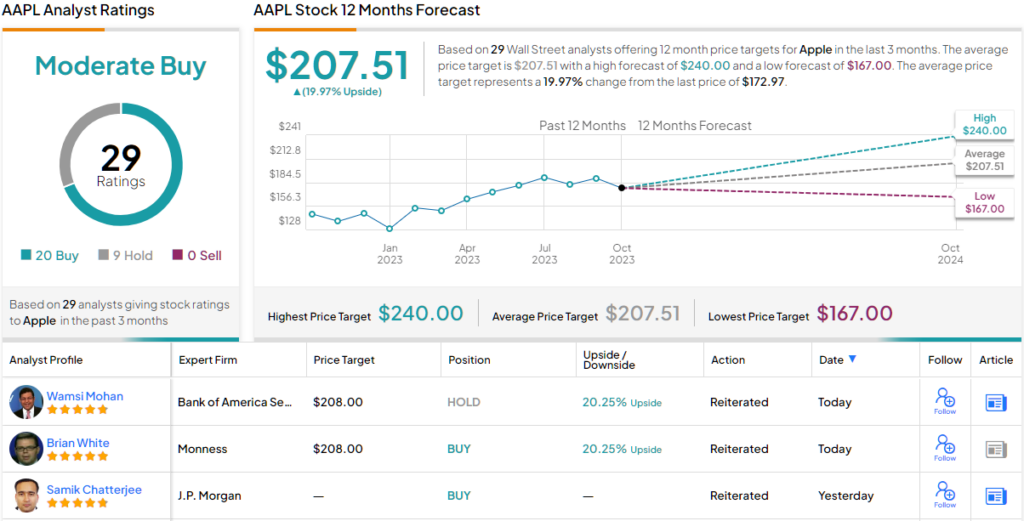

Elsewhere on the Street, with an additional 19 Buys and 9 Holds, the stock claims a Moderate Buy consensus rating. The average target is only slightly lower than Daryanani’s objective, and at $207.51, represents 12-month upside of 20%. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.