Apple’s (NASDAQ:AAPL) virtual reality and augmented reality headset, the Vision Pro, took most of the headlines at last week’s WWDC, but the bigger story lies elsewhere.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That at least is the opinion of Wedbush analyst Daniel Ives, who ultimately expects to see a new app store that will be “built around this new form factor.”

“We continue to strongly believe this is the first step in a broader strategy for Apple to build out a generative AI driven app ecosystem for its golden customer base that will have thousands of use cases across fitness, health, sports/movies via Apple and partner (e.g. Disney) content, and a myriad of other areas just starting to take shape with developers,” the 5-star analyst went on to say.

The Vision Pro will launch early next year at the not inconsiderable price of $3,499 but as the price points start to “come down markedly in FY25,” Ives expects more consumers will come onboard, thereby adding “another tailwind” to Services revenue by then.

That is still a while away, though. Closer to the here and now, in FY24, the Services segment is on track to post double-digit growth and reach $100 billion of annual services revenue. That is a “jaw dropping trajectory,” considering that in FY20 Apple was generating roughly $50 billion+ of services revenue.

Apple also has another big event coming up – the iPhone 15 is anticipated to launch this fall. According to Ives’ analysis, over the last 4 years, around 250 million iPhones have not been upgraded. As such, this next “mini super cycle” could pave the way for “another trophy case moment.”

As many appear to be opting for the Pro offering (especially in China), for the iPhone 15 cycle, Ives thinks ASPs (average selling price) could approach the ~$925 level, amounting to approximately a $100 increase in the last 18 months. This will provide “another key tailwind” that Ives believes the Street is still underestimating.

Bottom-line, all of these developments merit a price target hike. Ives’ objective moves from $205 to a Street-high $220, suggesting the shares will gain an additional 22% over the next 12 months. (To watch Ives’ track record, click here)

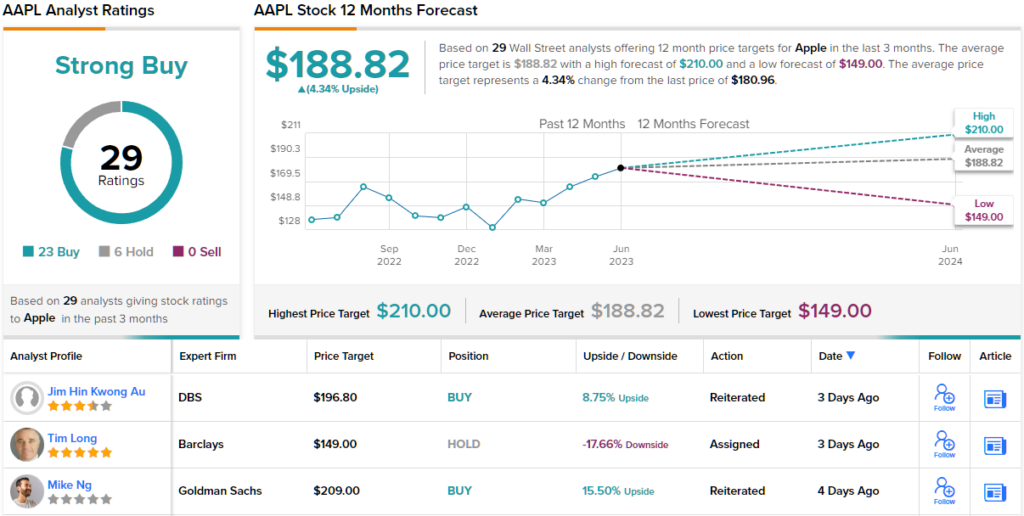

Elsewhere on the Street, AAPL receives an additional 22 Buys and 6 Holds, all culminating in a Strong Buy consensus rating. However, with shares trading at $180.96, the $188.82 average price target suggests room for just 4% upside. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.