The launch of Apple’s (AAPL) iPhone 15 hasn’t generated too much excitement, with other concerns – reports of China banning government workers from using iPhones, competition from Huawei – appearing to weigh on investors’ minds. However, tracking the iPhone 15 fulfillment times on the tech giant’s website offers reason to be upbeat, says Goldman Sachs analyst Michael Ng.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It shows that the lead times for all models are “extending further,” with the most significant uptick in lead time displayed by the iPhone 15 base model. “We view the extending lead times for the iPhone 15 base models as incrementally positive (relative to the extended lead times observed in the Pro Max last week on 9/15) given that supply constraints should be less of an issue for the base model,” Ng commented.

Compared to last Friday (9/15) and the past weekend, both the iPhone 15 and iPhone 15 Plus are seeing significant increases in lead times. Delivery lead times for the iPhone 15 have grown to more than 2 weeks (vs. launch day fulfillment at the end of day on Friday), and iPhone 15 Plus’ lead times have increased too, although to a lesser extent.

Even better, given all the China worries, the region has seen the most notable rise in lead times (compared to last Friday when pre-orders kicked off), having increased to about 3 weeks from first being available on launch day. It’s been a similar story for the iPhone 15 Plus. While lead times were one week following launch day if ordered this past Friday, these have now extended to around 3 weeks.

The early indications of demand are a pleasing development, says Ng, even if not too much should be made of it just yet. “Although we recognize that there are caveats to extrapolating delivery lead times to consumer demand,” Ng summed up, “we’re encouraged by what appears to be strong demand for all iPhone 15 models, particularly against the backdrop of heightened competition from Huawei.”

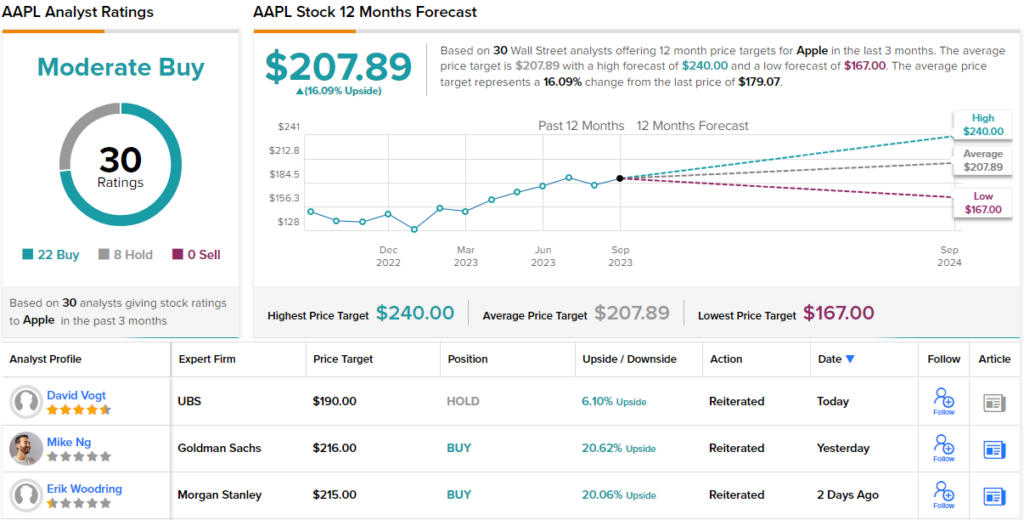

All told, Ng reiterated a Buy rating on the shares to go alongside a $216 price target. There’s potential upside of 21% from current levels. (To watch Ng’s track record, click here)

Elsewhere on the Street, the stock garners an additional 21 Buys and 8 Holds, all coalescing to a Moderate Buy consensus rating. The analysts see shares climbing 16% higher in the months ahead, considering the average target stands at $207.89. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.