In the coming week, brace yourself for a flurry of quarterly reports from major tech giants, with the spotlight shining brightest on the biggest of them all, Apple (NASDAQ:AAPL). The tech titan is scheduled to release its June quarter (F3Q23) results on Thursday, August 3, after the markets close.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Taking a glimpse at what’s ahead, Goldman Sachs analyst Michael Ng expresses confidence that Apple’s bottom-line display will surprise the prognosticators. Boosted by outperformance in Mac and Services, Ng expects Apple will deliver EPS of $1.21, above consensus at $1.19.

There’s a big discrepancy between Ng’s Mac expectations and the Street’s. While the FactSet consensus figure assumes Mac revenue declining by 15% year-over-year to $6.3 billion, on account of easy comps given last year’s supply chain issues and supported by the most recent industry research estimates (IDC estimates show Mac units up by 10% y/y), Ng is now calling for Mac revenue of $9.4 billion, just a touch above the prior $9.3 billion forecast.

Ng also expects higher Services revenue, forecasting it will reach $21.8 billion, up 11% y/y, compared to the consensus at $20.7 billion. “‘”Upside to our Services forecast reflects the inflection in App Store spending, per Sensor Tower, strong growth in advertising, continued content investments in AppleTV, and a more benign forex headwind (GSe: -2% YoY) relative to company guidance of -400 bps,” the analyst explained.

Like other Big Tech luminaries, AAPL shares are up by a significant amount this year (57%), although the surge has been “driven entirely by multiple expansion.” While acknowledging the worries investors may have regarding valuation and potential risks, Ng maintains confidence in Apple’s prospects, believing the expanding iPhone user base will lead to increased monetization per user through higher average selling prices (ASPs) and a larger number of Apple devices, particularly iPhones, in use. Additionally, he sees positive trends in the industry and opportunities for Apple to gain more market share in various Services categories.

“Accordingly,” Ng summed up, “we view AAPL as a long-term earnings & free cash flow compounder with strong visibility into that growth that supports a premium valuation.”

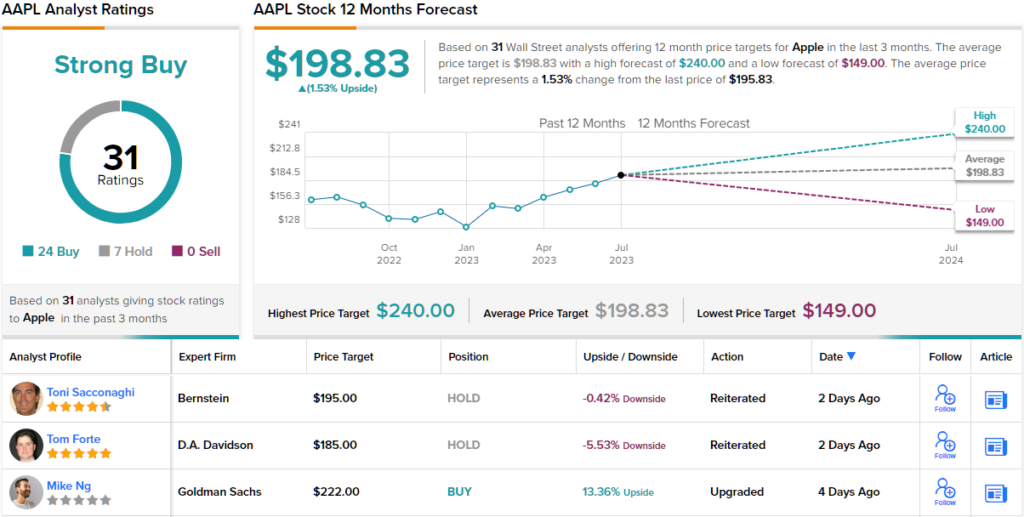

All told, Ng sticks with a Buy rating and $222 price target, a figure that represents a 13% jump from current levels. (To watch Ng’s track record, click here)

While the stock receives a Strong Buy consensus rating based on a mix of 24 Buys and 7 Holds, the upside appears capped for now; the $198.83 suggests the shares stay rangebound for the foreseeable future. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.