Apple’s (NASDAQ:AAPL) latest iPhone refresh cycle appears to be off to a good start, driven by a robust product lineup, especially in the premium segment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That is the conclusion reached by Evercore’s Amit Daryanani, an analyst ranked amongst the top 1% of Street stock experts, who points to the investment firm’s annual survey as reason to believe the cycle has kicked off in better-than-expected fashion.

The 2025 iPhone survey indicates a “solid upgrade environment,” with 59% of participants planning to buy an iPhone. While this is a slight dip from last year’s record 63%, it remains the second-highest result in Evercore’s survey’s history and comfortably above the survey average of 45%. Interest was strongest in the Pro and Pro Max models, cited by 56% of respondents versus the 50% survey average. Demand for the iPhone 17 ticked up modestly year-over-year (+2%), whereas the newly launched iPhone Air fell short compared to last year’s iPhone 16 Plus (9% vs. 12%). Notably, interest in a prior generation device rose meaningfully, with 14% of respondents planning to buy the discounted iPhone 16 – well above the 5% who said the same about the previous generation iPhone SE in last year’s survey. This year’s survey highlighted a shift in iPhone purchase drivers, with more respondents pointing to standard hardware upgrades like camera, battery, and display, while interest in AI features declined, down 6 points YoY.

As for the pricing and storage mix, ASPs rose to about $1,072, up nearly 7% YoY and well above the long-term survey average, driven more by mix and storage choices than broad price increases. Key factors Daryanani cites include the removal of the 128GB Pro model, which lifted the iPhone 17 Pro’s entry price by $100, the higher pricing of the new iPhone Air versus last year’s iPhone 16 Plus, “stronger adoption” of higher-performance, higher-capacity models, and the introduction of a 2TB Pro Max, priced $400 above last year’s 1TB version. Average storage per device jumped to roughly 430GB from 318GB, a meaningful “structural shift” supporting higher ASPs.

Daryanani does point out that the survey is U.S.-focused and does not capture international trends. “That said,” the 5-star analyst went on to say, “we think this may be the start of a strong iPhone refresh cycle, with positive trends across the portfolio, including reports of strong first week sales (T-Mobile citing DD y/y growth and reports of strong China sales). We think Apple’s core strength remains concentrated in the Pro tiers, while the iPhone 17 appears to have exceeded initial expectations.”

As such, Daryanani maintained an Outperform (i.e., Buy) rating on the shares and raised his price target from $260 to $290, suggesting the stock will gain 13.5% in the months ahead. (To watch Daryanani’s track record, click here)

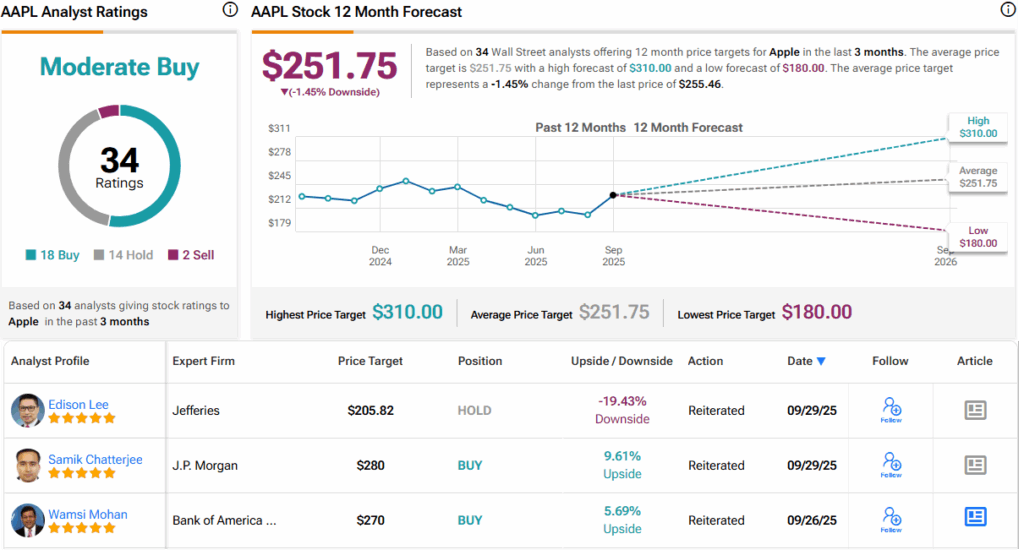

Amongst Daryanani’s colleagues, 17 join him in the bull camp and with an additional 14 Holds and 2 Sells, the stock claims a Moderate Buy consensus rating. However, going by the $251.75 average target, shares will stay rangebound for the time being. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.